In the global race to harness computing power, energy has emerged as the defining factor. Nations and organizations alike are accelerating energy infrastructure development to meet the surging demand fueled by data-driven economies. Yet, the path to this energy transformation is fraught with complexities—from securing resources to deploying infrastructure, and finally, commercializing compute capacities for applications such as bitcoin mining and AI workloads. In this context, energy is not just the enabler but the ultimate determinant of success. This is why UAE’s XRG (xrg.com) could be a global game changer.

The Decentralization Dilemma

Can we achieve truly decentralized, sovereign digital economies with global reach when the game is so heavily reliant on power? While the technology exists to enable such an ambitious vision, the question remains whether capital can be directed toward achieving it at scale. With an estimated $1 trillion expected to be invested in energy innovation, there’s an opportunity to build global distributed energy infrastructure using modular and remote compute technologies.

By focusing on underdeveloped and marginalized regions, private capital can drive global connectivity while bypassing the bureaucratic barriers that often stifle innovation. This could foster wealth creation in areas historically disadvantaged by geopolitical agendas.

The UAE’s Digital Energy Vision

A shining example of forward-thinking energy strategy is the United Arab Emirates (UAE). Despite global economic turbulence, the UAE has proven its resilience, emerging stronger post-COVID and in the midst of regional turmoil in surrounding countries, taking a leadership position in the regional virtual asset ecosystem. From Web3 advancements to Bitcoin mining, and now AI, the UAE has embraced technology to fuel economic growth.

However, rapid technological progress also brings challenges—particularly the rising energy consumption associated with AI and deep tech. Addressing this requires bold and forward-looking investments. Enter XRG , a revolutionary international energy investment company launched by Dr. Sultan bin Ahmed Al Jaber, UAE Minister of Industry and Advanced Technology and Chairman of Masdar.

Global Energy Demand in the AI Era

As Dr. Al Jaber highlighted, global energy demand is set to rise dramatically, increasing from 9,000 GW to 15,000 GW by 2035 and potentially reaching 35,000 GW by 2050—a staggering 250% increase. The rise of AI applications like ChatGPT, which consumes ten times the energy of a single Google search, is accelerating this trajectory.

Without diversified energy solutions, meeting this demand sustainably will be nearly impossible. XRG addresses this by optimizing energy production and usage across the spectrum—from traditional fuels to low-carbon alternatives and advanced infrastructure.

The essence of this challenge lies in the economic implications of insufficient energy infrastructure to power AI deployments. Nations that fail to establish sovereign compute capabilities could face economic stagnation. In the next five years, such nations may struggle to compete globally, reinforcing the urgency of energy-centric national policies.

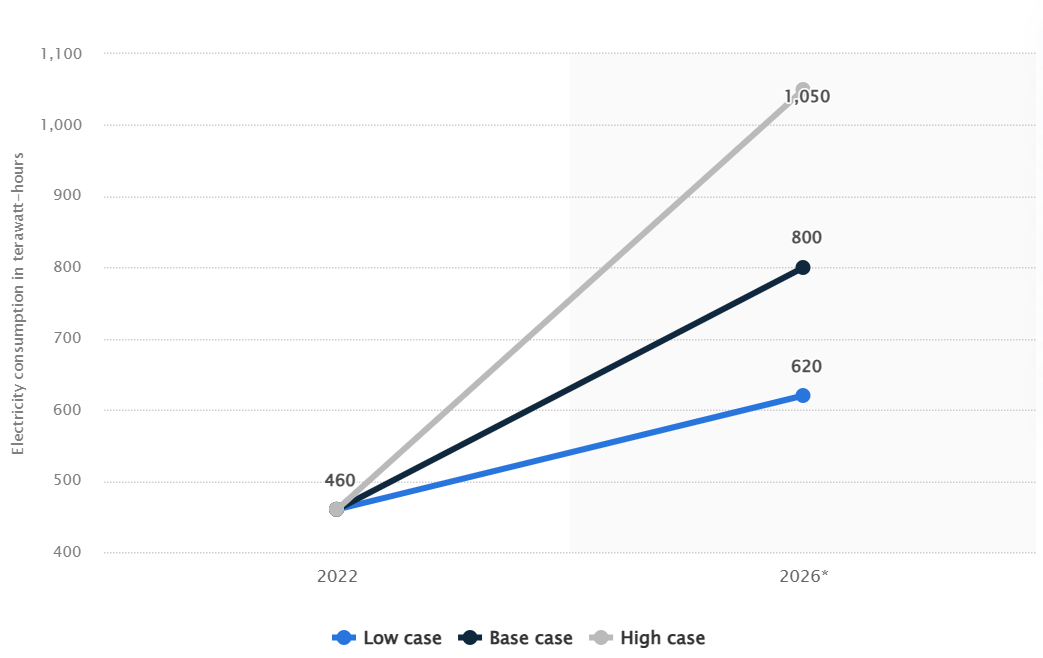

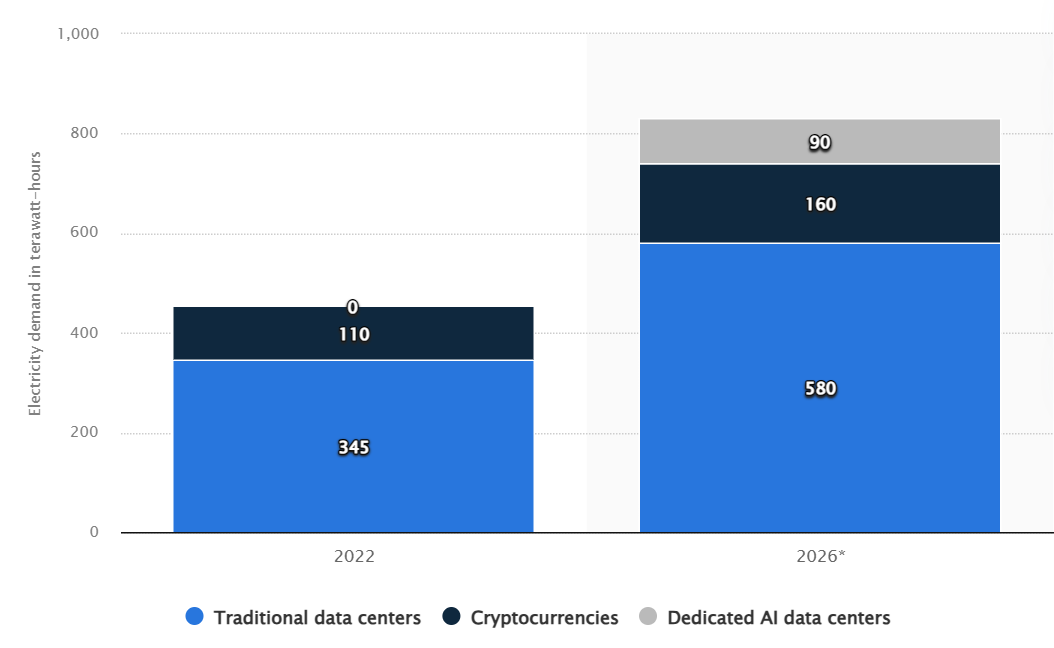

The following graphs illustrate electricity demand from data centers, artificial intelligence, and digital asset mining worldwide in 2022, with a forecast for 2026, by scenario.

XRG: A Blueprint for the Future

XRG’s innovative structure embodies efficiency and adaptability. Dr. Al Jaber’s vision is rooted in maximizing every energy unit, spark, and joule—a philosophy that aligns with PermianChain’s mantra of “creating wealth from every watt.” By investing in diverse energy technologies, XRG offers a scalable model for nations to secure economic prosperity in the digital age.

At PermianChain, similar principles drive our efforts. Through our global digital energy market, we’ve aggregated over 500 MW of distributed alternative energy projects to serve underserved markets. This approach exemplifies how modern energy investments can transform underdeveloped regions by accelerating digital transformation and fostering exponential growth.

The Role of Innovation in Efficiency

Innovation is not just about finding new energy sources but about optimizing existing systems. For instance, NEXGEN, one of our companies, aligns closely with EXERGY’s strategy by adopting cutting-edge technologies to maximize energy efficiency. As global energy demand rises, such approaches will be critical, particularly in energy-intensive sectors like AI computing.

Equity in Energy Access

Equity in energy access is essential for global progress. With over 1.7 billion people living off-grid or without reliable utility connectivity, vast populations are excluded from the potential of digital economies. Distributed energy solutions offer a pathway to bridge this gap, enabling marginalized communities to participate in and benefit from the global digital revolution.

The Path Forward

By embracing a diversified and efficiency-driven approach will require collaboration, innovation, and a relentless commitment to sustainability from industry stakeholders and global public and private capital markets.

As Dr. Al Jaber rightly emphasized, reliance on a single energy source is not a viable solution. Instead, a comprehensive strategy combining traditional and emerging technologies is imperative. Only by taking this holistic approach can we meet the demands of an increasingly interconnected and data-driven world while preserving the planet for future generations.

Conclusion

The launch of XRG is more than an investment in energy; it’s an investment in the future. By championing distributed, efficient, and inclusive energy systems, the UAE is leading the charge in creating a sustainable digital economy. As nations navigate the complexities of energy transformation, the new digital energy frontier offers a powerful blueprint for aligning innovation with equity and sustainability.

In a world where energy is the key to unlocking economic growth, it’s time for global leaders to prioritize bold and forward-thinking strategies. Only then can we truly harness the potential of the digital age while ensuring prosperity for all.

Written by Mohamed El Masri, Founder of PermianChain and originally published in his blog.

Tune in to my podcast at Drilling into Crypto to explore the world of finance, energy and modern technologies.