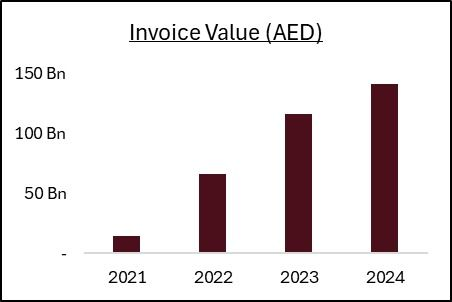

Haifin, previously known as UAE Trade Connect, an AI blockchain platform to combat trade finance fraud among the banking sector and non-banking sector, has announced a record-breaking year with nearly $40.8 billion of transactions (150 billion AED).

According to Zul Javaid, CEO of Haifin in a LinkedIn post, “ We identified and prevented hundreds of millions of Dirhams of duplicate financing and fraud for our member involved in lending.”

UAE Trade Connect (UTC), Launched in 2021, was co-created by e& enterprise and the UAE banking industry and offers a technology solution to detect suspicious transactions and prevent fraud and duplication in real time. It uses technologies such as AI, Blockchain and machine learning.

Juvaid added, “Big shout out to our steering committee and wider consortium for their trust and commitment to de-risking the lending environment and increasing accessibility to finance for the UAE economy.”

The members of Haifin platform include UAE Banks Federation, Al Masraf, Abu Dhabi Islamic Bank, Abu Dhabi Commercial Bank, Commercial Bank International, Commercial Bank of Dubai, Dubai Islamic Bank, First Abu Dhabi Bank (FAB), Habib Bank AG Zurich, Invest Bank, Mashreq Corporate & Investment Banking Group, National Bank of Fujairah, RAKBANK, Sharjah Islamic Bank, United Arab Bank, Beehive Fintech, CredibleX, DP World, and Finneva.

In December 2023, Beehive, a peer-to-peer lending platform, became the second non-banking entity to join Blockchain enabled UAE Trade Connect platform, Haifin. Priort to that, DP World Finance platform partnered with UAE trade Connect in November of the same year.

Zul Javaid expressed his interest in expanding Haifin offering to countries across the GCC and MENA regions, including KSA hiring Wissam Massud to lead their international expansion in 2023.