While the globe and MENA region have started to embrace cryptocurrencies and stablecoins, especially with regulations in the United States, UAE, Bahrain and others, Algeria has passed one of the world’s most comprehensive anti-crypto laws, officially criminalizing all cryptocurrency activities including exchanges and custody.

The law was enacted on July 24, 2025, Law No. 25 - 10 and prohibits the issuance, possession, purchase, sale, storage, mining, promotion, or use of digital assets. It also outlaws any services facilitating such activities, including crypto wallets and exchanges.

Algerian government has noted that this is part of a broader initiative to strengthen anti-money laundering ( AML) and counter terrorist financing (CTF) enforcement.

Under the new law, individuals convicted of crypto-related offenses face prison sentences ranging from two months to one year, and fines between 200,000 and 1,000,000 Algerian dinars (approximately $1,540 to $7,700 USD).

The law applies not only to active participants but also to passive holders and individuals who promote or disseminate information about cryptocurrencies. This includes influencers, advertisers, and content creators who may not be directly involved in trading or transacting.

Previously in 2018, Algeria’s Financial Law, banned crypto usage without clearly defining penalties or enforcement, Law No. 25 - 10 codifies specific criminal liabilities and grants authorities broad enforcement powers.

According to the Ministry of Finance, the primary motivation behind the ban is the need to protect the national economy from unregulated financial flows. Officials emphasized that cryptocurrencies are often used for fraud, tax evasion, money laundering, and terrorist financing, and pose a threat to financial stability and monetary sovereignty.

Supporters of the law argue it will safeguard consumers from the volatility and speculative nature of digital assets, which have caused substantial losses for retail investors globally. The government has expressed interest in exploring regulated fintech alternatives, but no timeline has been provided for potential frameworks.

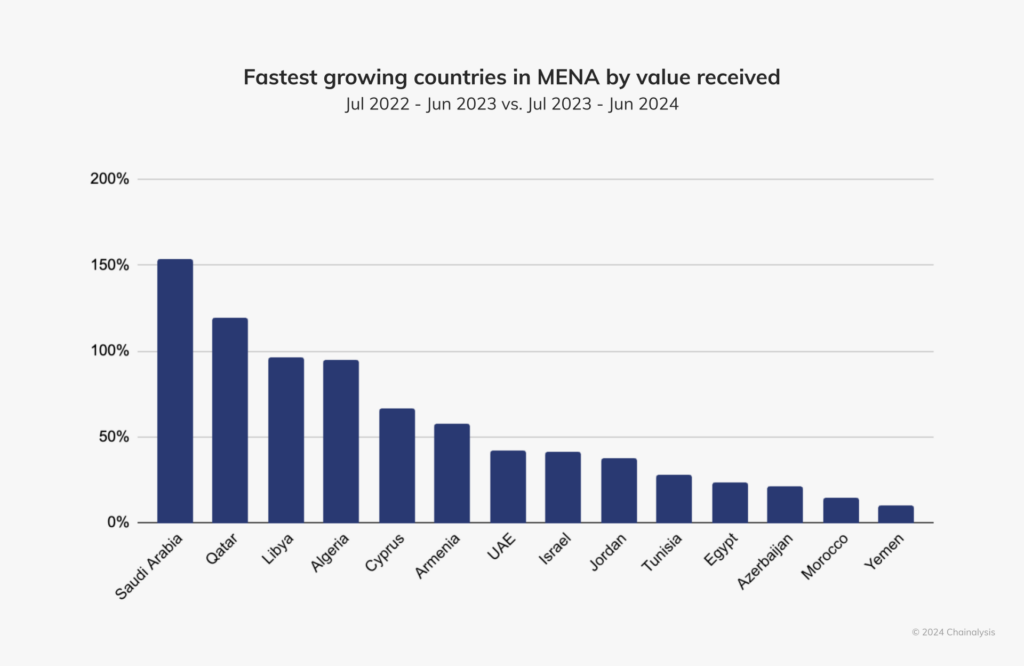

The Middle East & North Africa (MENA) region ranks as the seventh-largest crypto market globally in 2024, with an estimated $338.7 billion in on-chain value received between July 2023 and June 2024, accounting for 7.5% of the world’s total transaction volume. MENA includes two countries ranked in the top 30 of the global crypto adoption index: Türkiye (11th) and Morocco (27th), capturing $137 billion and $12.7 billion of value received, respectively. The majority of crypto activity in MENA is driven by institutional and professional-level activity, with 93% of value transferred consisting of transactions of $10,000 or above.

In the same report, Algeria was noted as being the fastest growing crypto country by assets after Saudi Arabia and Libya.

In May 2025, The Egyptian Financial Regulatory Authority issued a warning against dealing with unlicensed financial entities including those marketing crypto and virtual assets. As per the notice on their website, “Unlicensed entities and online platforms operating in the field of receiving & pooling funds for investment will face legal consequences. Do not participate in subscriptions for any securities (shares and bonds) unless the Authority has explicitly approved the public offering. Exercise extreme caution and avoid investing through companies lacking the necessary licenses to receive funds for investment or platforms offering financing without authorization.”

So both Egypt and Algeria, as well as Morocco who has been in the process of issuing its crypto legislation continue to fight the crypto adoption onslaught.