Saudi Arabian NTDP ( National Technology Development Program), an entity aimed to transform Saudi Arabia into a tech leader by fostering sustainable development and innovation has invested along with Outlier Ventures, Smart IT Frame, Sensei Capital as well as angel investors Murali Kulala (CEO, Smart IT Frame), Salman Butt (Co-founder, Salla), and Christopher, a seasoned fintech investor, along with several other prominent angel backers, a sum of $1 million in UAE based Byzanlink, a Blockchain enabled real-world asset (RWA) tokenization platform bridging traditional finance and decentralized finance (DeFi), in a private funding round.

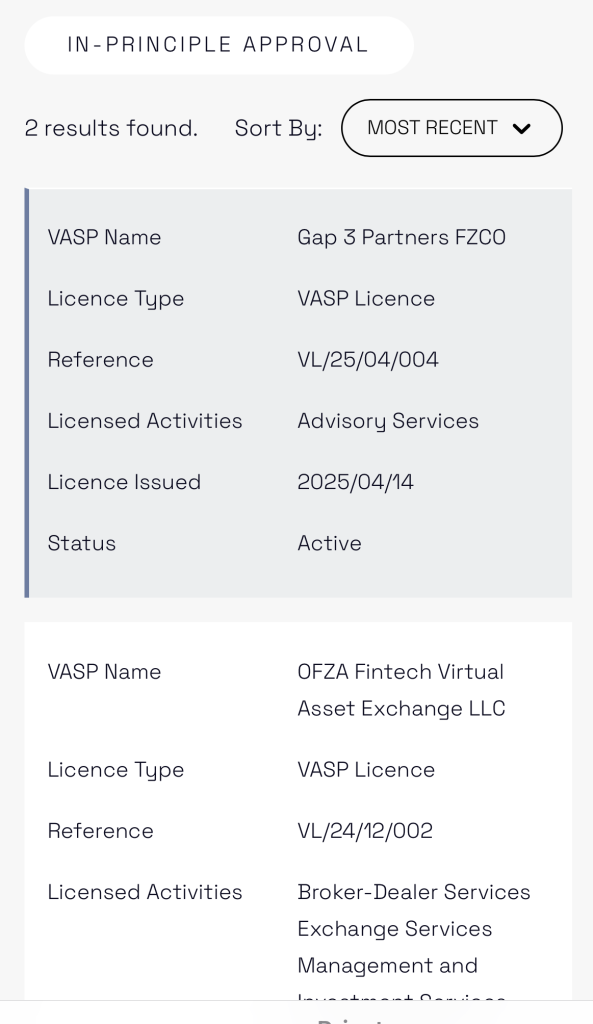

Byzanlink, operating our of Dubai DMCC is building an infrastructure to modernize access to institutional grade investment opportunities using blockchain tokenization.

The platform is designed to bring greater transparency, operational efficiency, and broader accessibility to financial assets that have traditionally remained out of reach for many investors.

“Support from such a diverse and forward-thinking group of partners is a strong signal for what we’re building,” said Anbu Kannappan, Founder and CEO of Byzanlink. “We believe the next generation of financial infrastructure will be powered by transparency, automation, and access. We’re committed to building that foundation.”

As per the press release, the recent funding will be used to accelerate product development, deepen ecosystem integration and strengthen the operational frameworks to support regulatory alignment and institutional adoption.

The platform aims to align traditional investment structures with modern financial rails, creating a foundation where capital moves faster, more openly, and with greater programmability. The company is positioning itself as a core infrastructure layer supporting compliant, yield-bearing financial products for institutions, fintech, and digital-native treasuries.

This comes as both Saudi Arabia and UAE develop tokenization solutions in both countries. Recently DroppRWA, a sister company of Web3 technology provider DroppGroup, partnered with Saudi Arabia’s real estate developer RAFAL Real Estate Co, to execute a Saudi Arabian pilot that would (RWA) tokenization real estate transaction. The pilot will serve as a national feasibility benchmark for the future of tokenized property markets in KSA.

Additionally in the UAE EmCoin, recently regulated by UAE’s Securities and Commodities Authority, will launch an investment platform that brings together digital assets and traditional finance all within a single, seamless mobile experience. Users will be able to trade Virtual Assets, invest in UAE and global equities, buy commodities, and access expert-managed portfolios with full transparency and trust.