UAE Cypher Capital, a multi-strategy crypto investment firm, participates in a $15 million seed funding round for Hemi Labs, a modular blockchain network unifying Bitcoin and Ethereum. Hemi Labs will use the funds to develop and launch the Hemi Network, utilizing funds from Cypher Capital to advance blockchain technology and enhance interoperability by developing a unified supernetwork.

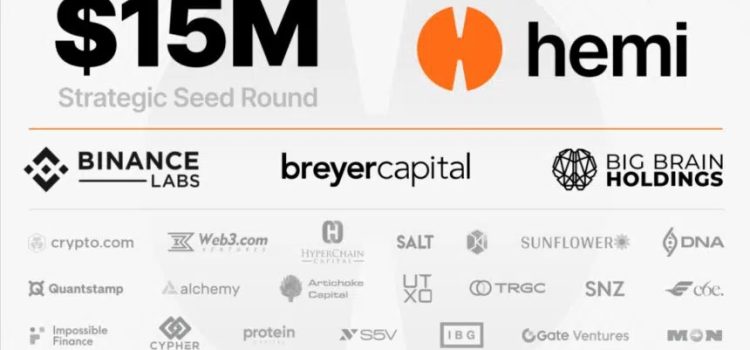

The round comes after Hemi’s recent incentivized testnet launch, and a mainnet launch targeted for Q4 2024. Participation from numerous investors includes Binance, Breyer Capital, Big Brain Holdings, Crypto.com, HyperChain Capital, Alchemy, SALT Fund, Kelly Capital, Sunflower Capital, DNA Fund, Web3 Ventures, Quantstamp, TRGC, UTXO, Artichoke Capital, SNZ Holding, Capital6, IBG Capital, Protein Capital, MON Ventures, SV5, Impossible Finance, Jihan Wu (Bitdeer), and George Burke (Portal), among others.

“Hemi Labs is at the forefront of blockchain interoperability,” said Vineet Budki, CEO of Cypher Capital. “Their approach to integrating Bitcoin and Ethereum into a cohesive supernetwork addresses key scalability and security challenges, and our investment aligns with their mission to transform blockchain infrastructure and unlock new possibilities for decentralized applications.”

Hemi Labs is developing a unified supernetwork. Hemi Network will include the Hemi Virtual Machine (hVM), integrating a full Bitcoin node within an Ethereum Virtual Machine (EVM), allowing developers to create cross-chain smart contracts with familiar tools while ensuring compatibility with existing EVM dApps and wallets. The Hemi Bitcoin Kit (hBK) facilitates direct smart contract access to granular Bitcoin state for advanced Bitcoin-native applications such as staking and lending markets.

The network also boasts Superfinality through Hemi’s Proof-of-Proof (PoP) consensus mechanism, ensuring Bitcoin-level security in a decentralized, permissionless manner and provides Bitcoin-security-as-a-Service to other blockchain networks. Hemi’s Tunnels will offer trustless cross-chain portability, improving upon traditional bridge methods. Additionally, Hemi will feature on-chain routing, time-lock, password protection, and gasless transfers for seamless asset movement without relying on native chain currencies.

“The quality and enthusiasm of our investors and partners reflect the groundbreaking nature of what we are building,” said Jeff Garzik, Co-founder of Hemi Labs. “We are well positioned to advance blockchain technology by creating a supernetwork that marries the capabilities of Bitcoin and Ethereum, and Cypher Capital’s support is crucial to that success as they share our vision for the ecosystem.”