Ripple, provider of digital asset infrastructure, proudly has renewed its partnership with NYU Abu Dhabi through its University Blockchain Research Initiative (UBRI). As per the announcement, this extension solidifies Ripple’s commitment to advancing blockchain research by supporting innovative student initiatives in the region, bringing the total funding grant to over $1 million in support of NYU Abu Dhabi research projects and student initiatives.

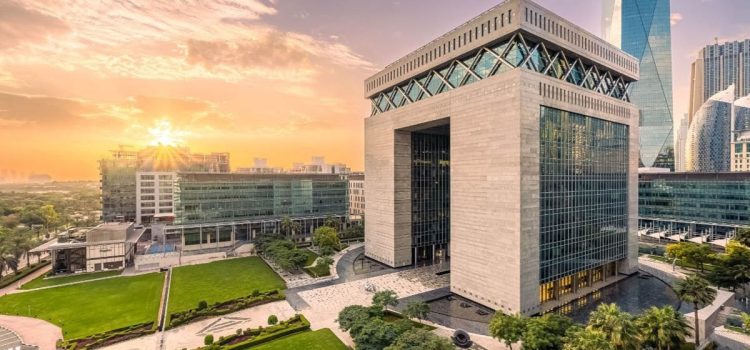

“Ripple and NYU Abu Dhabi share a vision of unlocking the full potential of blockchain research and innovation in the region,” said Reece Merrick, Ripple Managing Director, Middle East, and Africa. “The UBRI program plays a crucial role in supporting cutting-edge research and academic exploration, and this ongoing collaboration exemplifies Ripple’s dedication to driving transformative advancements in digital finance. Coupled with our recent partnership with the DIFC Innovation Hub to support blockchain innovation in the region, these initiatives highlight our broader strategy to integrate blockchain technology into startups and established institutions in the UAE.”

Ripple’s UBRI program is dedicated to fostering blockchain research and development at over 58 universities worldwide. The initiative aims to drive global adoption and interoperability of digital assets through strategic support, technical resources, and funding grants. UBRI’s global impact encompasses over $60 million in funding since its launch in 2018.

Lauren Weymouth, Director, University Partnerships at Ripple, added, “Ripple’s University Blockchain Research Initiative is dedicated to advancing blockchain research and education globally. In the past year alone, we’ve seen remarkable progress, funding over 313 scholarships and blockchain-related research projects and publishing over 150 research papers and technical projects. As we build on this momentum, we’re eager to further collaborate with NYU Abu Dhabi to cultivate innovation, foster fintech advancements, and contribute to the UAE’s growing leadership in the digital economy. By supporting UBRI-led research, we are investing in a region that leads in innovation and technological advancement, reinforcing our mission to foster transformative projects and support the UAE’s vision of becoming a global financial hub.”

Raša Karapandža, Visiting Professor of Economics at NYU Abu Dhabi, added, “NYU Abu Dhabi is thrilled to extend its partnership with Ripple, which has been instrumental in placing the university at the forefront of blockchain research and education in the region. The continued support from Ripple’s UBRI program strengthens our commitment to driving innovation and fostering a forward-thinking mindset within our academic community. As we extend this partnership, we aim to further empower our students and faculty by deepening their engagement with blockchain technology, advancing research in this transformative field, and equipping the next generation with the skills and knowledge needed to lead in the rapidly evolving digital economy.”

NYU Abu Dhabi was the first UAE university to join Ripple’s University Blockchain Research Initiative (UBRI). Since its inception in 2021, the Ripple Blockchain Collaboratory at NYU Abu Dhabi has successfully driven research and project-based courses in blockchain, cryptocurrency, cybersecurity, and fintech. Additionally, it has integrated with the Corporate Sprint Accelerator Program powered by startAD, helping fintech and blockchain startups launch and scale in the UAE through innovative pilot projects.

In its fourth year, this renewed partnership with NYU Abu Dhabi is part of Ripple’s broader strategy to deepen its engagement in the UAE and the wider Middle East region, underscoring its dedication to nurturing talent, fostering innovation, and advancing the adoption of digital assets.

As part of its commitment to its university partners, UBRI has played a pivotal role in this collaboration. NYU Abu Dhabi professors, including Raša Karapandža and Yaw Nyarko, are conducting world-class, UBRI-led research using blockchain and AI to create efficient markets in Africa, with a live crypto project in Ghana. The goal of their research is to leverage technology and markets to transform rural agricultural markets in developing countries, apply innovative blockchain technologies, digital currencies, and AI to benefit these markets, and improve the livelihoods and economic development of the poorest farmers in sub-Saharan Africa through technological innovations, enabling sustainable prosperity and growth.

Additionally, the university has been running an XRP Ledger (XEPL) validator and a new EVM side chain validator to enhance XRPL interoperability and support the broader adoption of innovative technologies in the region. Furthermore, the university has been offering fintech courses as well as courses on Technology and Economic Development that cover blockchain and AI technologies in great depth to prepare the next generation of leaders.