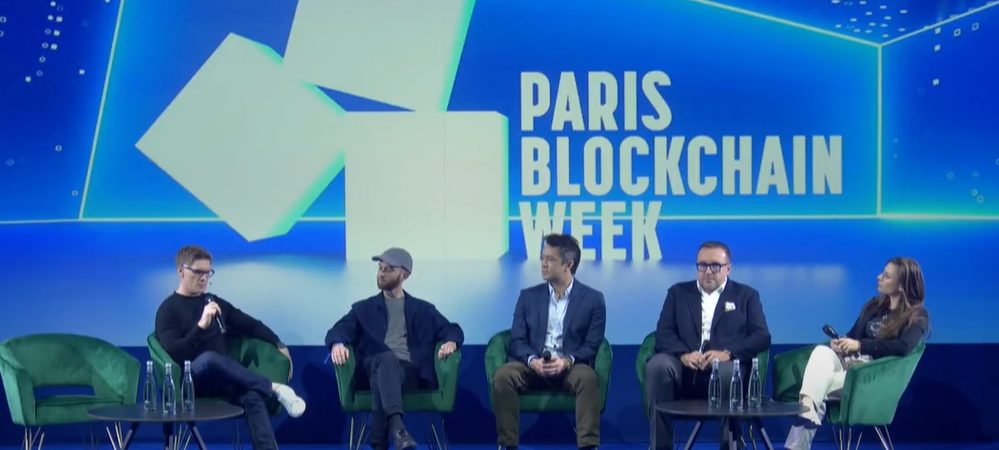

During the Paris Blockchain Week, at the Global regulatory Landscape Panel session, Mathew White, CEO of Dubai’s VARA (Virtual Asset Regulatory Authority) discussed the cost of compliance for smaller crypto and Blockchain firms and the solution he is proposing where big players sponsor the cost of compliance for smaller ones.

White in his contribution during the panel made several points with regards to how he views VARA’s regulatory standpoint.

Firstly, VARA wants to regulate without damaging the presence of nearly 2000 Web3 and crypto companies already present in Dubai UAE. He states, “We seek to set a regulation that we feel anybody can be part of and is not exclusive by nature. We engage with the industry, governments, and continue to do that. While it is still not perfect, there are a number of things we are looking into to make the regime fit for everybody, one of which is how we deal with cost of compliance for small entities.”

According to White, compliance is a costly exercise and not many players have the resources to go and get regulated. His proposal is “looking towards a structure where larger market participants host smaller ones, where the cost of compliance can be borne by the large players.” He adds, “We are on this journey of allowing innovation whilst being able to regulate it.”

White explains that two years ago when he was part of the team building VARA, the Dubai government decided as part of their economic diversification project to prioritize technology and in specific virtual assets.

VARA was established to be able to position Dubai as a hub with financial stability and investor protection in mind.

When the topic of self-regulation through technology came up White acknowledge that he believes that this will one day be possible. He also stated he would be looking into piloting this idea at VARA.

He stated, “No doubt some point in the future it will be available. For the short to medium there will be regulation and it will be significant.”

Earlier this week, Crypto.com became the first international crypto exchange to receive a full license from VARA, while OKX is still awaiting final requirements to receive its full VASP operational license.