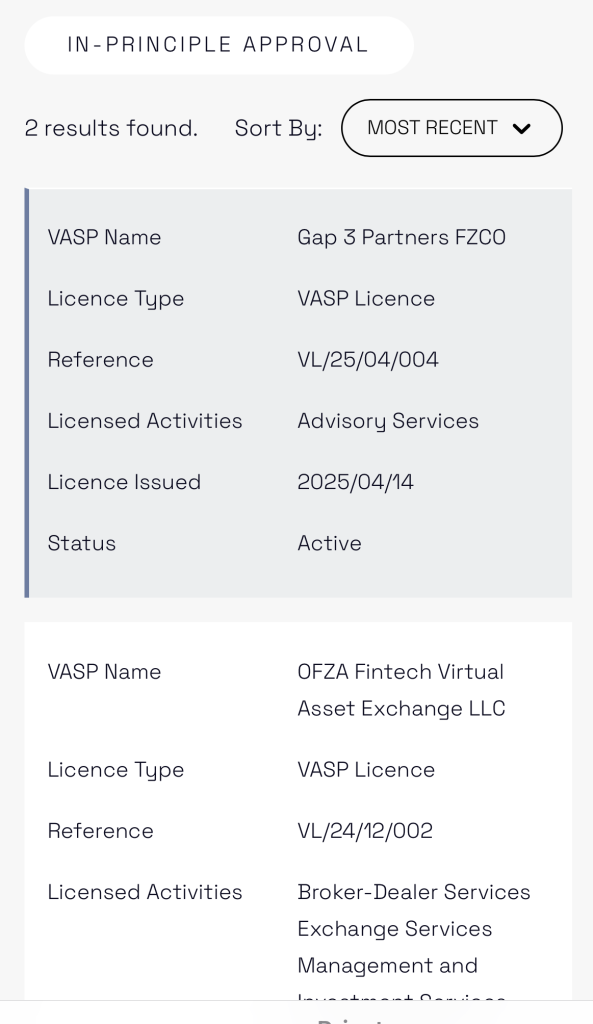

GAP 3 Partners (“G3”), a Dubai-based institutional virtual asset advisory firm, has been granted an Operational License by the Dubai Virtual Assets Regulatory Authority (VARA). With this advisory license, G3 becomes becomes a regulated Virtual Asset Investment Advisor authorized to provide its full range of services to institutional clients across the Emirate.

Founded by industry veterans Robin Janaway (Outlier Ventures), Chris Donovan (NEAR Foundation), and Adib Tohme, G3 offers advisory services covering token strategy, investment, structuring, licensing, treasury management, and token-market execution. The firm provides end-to-end virtual asset advisory services under a unified mandate, covering strategy, structuring, licensing, treasury management, and token-market execution.

G3 will support family offices, corporations, and investment institutions seeking secure and compliant access to the digital asset space, including emerging opportunities in real-world asset (RWA) tokenization and blockchain-based financial infrastructure.

“Dubai’s regulatory leadership together with accelerating institutional interest in digital assets create a unique environment for growth,” said the founding team in a joint statement. “We are building G3 to be the region’s premier Virtual Asset Investment Advisor, trusted by institutions to navigate complexity, unlock value, and lead in the next era of finance.”

G3 is leveraging Dubai’s progressive regulatory framework to help clients future-proof their operations and investments. As real-world asset tokenization and institutional digital asset strategies accelerate, G3 offers the structure, insight, and regulatory clarity needed to support high-trust adoption at scale.