Inveniam Capital Partners (“Inveniam”), a global leader in decentralized data infrastructure for private market assets, and MANTRA, a layer 1 blockchain focused on the tokenization of real-world assets (RWAs), announced a strategic technology and commercial partnership that includes a $20 million investment in MANTRA.

The partnership and investment will allow MANTRA to deliver private real-world assets (RWAs) packaged with real-time asset reporting and surveillance to DeFi and institutional capital allocators. It will enable institutional-grade private market assets with full data sovereignty, surveillance, and agentic solution sets to capitalize upon the rapidly expanding DeFi market with digitally-native smart financial instruments.

The Inveniam and MANTRA partnership will expand investment pathways to build the next generation of private market infrastructure, unlocking a $300 trillion opportunity. Inveniam and MANTRA’s strategic partnership will set a new standard for compliant tokenization, combining MANTRA’s blockchain infrastructure with Inveniam’s data and AI capabilities. Together, they aim to unlock institutional access to RWAs and accelerate the growth of decentralized finance globally.

The partnership will integrate Inveniam’s data operations management solutions and AI Agent Suite with MANTRA’s regulated Web3 infrastructure to scale private RWA solutions with, and for, asset owners, clients, and partners. It will significantly grow Total Value Locked (TVL) and transaction throughput on MANTRA Chain, aligning with Inveniam’s vision for the systematic trading of private market assets in an AI driven, agentic future.

As per the press release, the partnership underscores Inveniam’s conviction in the accelerating convergence of scalable AI, tokenization, and blockchain-powered financial infrastructure, at a time when real-world assets (RWAs) are expected to grow at a 75% CAGR, expanding from $275 billion today to $18.9 trillion by 2033.

“We have been in discussions with MANTRA for some time. As we watched third party bad actors prey upon excellent builders and founders, we leaned in. In our diligence, we have found MANTRA to be a fundamentally excellent chain with great management, regulatory clarity, institutional focus, and the right partners,” Patrick O’Meara, Chairman and CEO of Inveniam said.

He added, “This partnership provides MANTRA with the capital and throughput needed to focus upon and scale its ecosystem and further develop its position as a leading layer 1 blockchain for real-world assets. This foundational step enables trillions of dollars in private assets to operate in digital environments, thereby ushering in a new generation of products for global allocators, builders, and hyper-scalers.”

John Patrick Mullin, CEO and Founder of MANTRA noted, “We are incredibly excited about our partnership with Inveniam, and believe it will be a key driver in moving MANTRA to a significantly greater position in the global RWA marketplace. Inveniam’s investment and collaboration will allow us to better serve asset owners and capital allocators not just in the UAE, but in the United States and globally with leading decentralized infrastructure. Together, we will accelerate MANTRA’s development of a trusted, composable and scalable tokenized market for real-world assets, bringing tangible value to asset owners, investors and developers.”

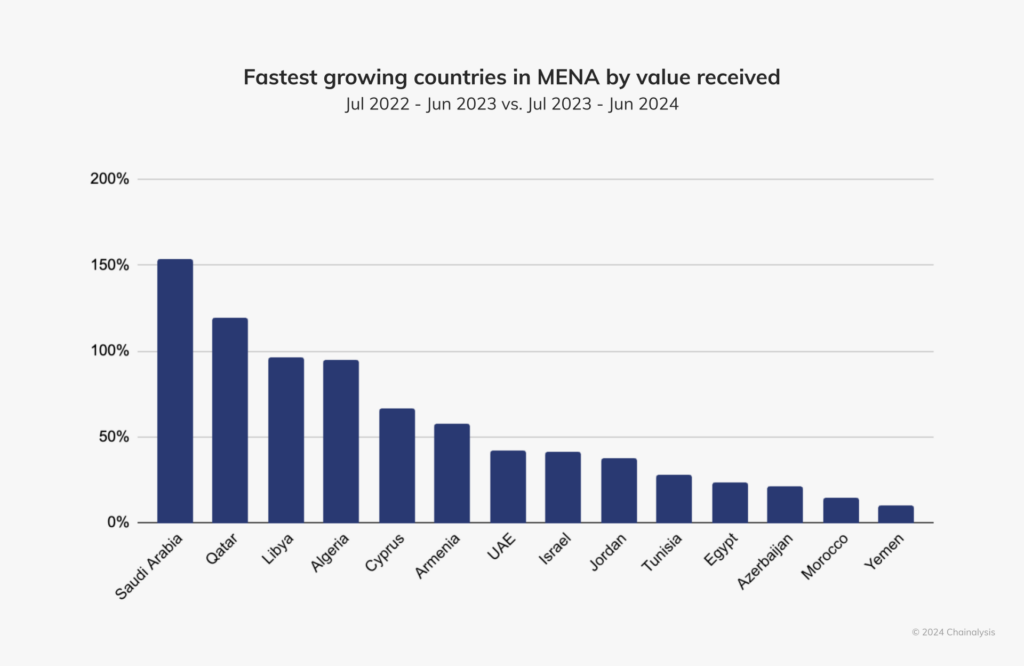

Inveniam’s long-term partnership with the United Arab Emirates continues to grow. In 2024, G42 became a strategic investor in Inveniam. Inveniam has since established a corporate presence in Abu Dhabi with offices in Al Khatem Tower. Its wholly-owned subsidiary, Inveniam Mid East, Ltd (إنفينيم الشرق الأوسط), is in the Abu Dhabi Global Market (ADGM).

MANTRA’s wholly-owned subsidiary, MANTRA Finance FZE, is licensed by Dubai’s Virtual Asset Regulatory Authority (VARA), which establishes a foundational framework for compliant, data-rich private market assets to be tokenized and integrated into the global DeFi ecosystem launching from the UAE. The VARA licensing includes digital asset exchange, broker-dealer, and investment services, and supports the end-to-end lifecycle of tokenized RWAs, from primary issuance to automated secondary market liquidity.

Integrated Market Infrastructure

This joint effort will leverage ADGM’s institutional framework, G42’s data and AI capabilities, and Dubai’s crypto liquidity infrastructure to deliver a complete market stack for RWAs in the UAE.

MANTRA has signed several tokenization deals after the OM Token debacle, reflecting the growth tokenization is witnessing not only in the UAE, MENA but also globally.