The Central Bank of the UAE (CBUAE) and the People’s Bank of China has signed an MOU (Memorandum of Understanding) to enhance technical and technological cooperation in the development of central bank digital currencies (CBDC), going beyond initial collaboration on mBridge CBDC project.

As per the UAE Central Bank press release, the signings will enhance the strategic partnership between the two friendly nations and expand the bilateral relations in the financial and economic fields.

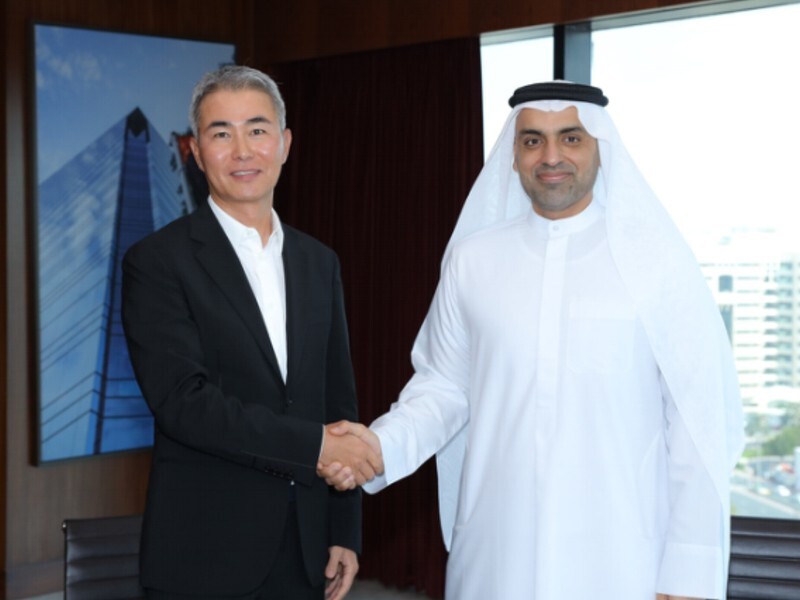

His Excellency Khaled Mohamed Balama, Governor of CBUAE, and His Excellency Pan Gongsheng, Governor of the People’s Bank of China, signed the MOU in Hong Kong in presence of the UAE Counsel General in Hong Kong, H.E. Shaikh Saoud Ali Almualla.

The CBDC MoU aims to enhance collaboration central bank digital currency development and strengthen cooperation between CBUAE and the Digital Currency Institute of the People’s Bank of China in the field of financial technology. The MoU will enable the exchange of information on best practices and regulations relating to digital currencies and support the implementation of joint initiatives and projects, including the “mBridge” project which is a multi central bank digital currencies platform in facilitating cross-border trade payments instantly and securely.

The MoU also includes cooperation in training and skills development for specialists on both sides and the exchange of bilateral visits to discuss matters of common interest.

Commenting on the signing, H.E Khaled Mohamed Balama, Governor of CBUAE, stated, “We look forward to strengthening cooperation with our partners on innovation and solutions in financial technology including central bank digital currency to support the growth of our economy and society.”

Earlier,according to a Chinese media article, the Bank of China announced during The 3rd “Belt and Road” Summit Forum a list of 369 practical cooperation projects of which was an MOU signed with FAB bank of cooperation in digital currency.

Concurrently Standard Chartered announced its participation in the pilot testing program of China’s central bank digital currency (CBDC) known as the digital Yuan (e-CNY or digital RMB). This move makes Standard Chartered the first foreign bank to engage with the country’s CBDC. According to the announcement, Standard Chartered, in collaboration with City Bank Clearing Services Co, will facilitate e-CNY transactions for its clients. It will allow them to purchase exchange and redeem e-CNY within their bank accounts.

It is noteworthy that Standard Chartered’s backed digital asset platform, Zodia markets, received an In-Principle Approval (IPA) fulfilling the pre-requisites to receive a Financial Services Permission (FSP) for OTC broker-dealer in virtual assets by Abu Dhabi Global Market (ADGM), Abu Dhabi’s international financial center.

Standard Chartered’s , venture arm SC Ventures, an innovation and fintech investment arm recently partnered with Japanese SBI Holdings to establish a Digital Asset Joint Venture investment company in UAE. The parties intend to capitalize the vehicle with $100 million. The company will invest in DeFi, tokenization, consumer payments and metaverse.