The Hashgraph Association, the non-profit organization accelerating the broad adoption of the Hedera network globally, has partnered with Dar Blockchain to nurture projects, facilitate growth, and profoundly shape the MENA technology landscape. The partnership focuses on the education and nurturing of Web3 talent within the region through facilitating meetups, hackathons, and university groups, as well as publishing a monthly podcast. Through their focus on Web3 talent, The Hashgraph Association and Dar Blockchain will strive to advance innovation within the region, furthering the expansion of Distributed Ledger Technology (DLT) and blockchain across the globe.

Together, Dar Blockchain and The Hashgraph Association will work to provide insight into blockchain ecosystems, as well as promote the Hedera network, the most innovative, sustainable, enterprise-grade public ledger for the decentralized economy. To foster curiosity and capabilities within the MENA region, Dar Blockchain and The Hashgraph Association are partnering to host four hackathons, starting in October 2023.

These events are part of a broader strategy that includes community-building activities and a sourcing phase for an upcoming incubation program tailored for the North African community. This incubation program, to be announced soon, will further support and nurture promising projects emerging from these hackathons. In addition to the hackathons, the collaboration will offer bespoke training sessions, fueling the growth of communities and enterprises, while showcasing the endless possibilities of Web3.

Mohamed Mnif and Jaafar Saied the Co-founders of Dar Blockchain, said: “At Dar Blockchain, our foundation is built on the belief that education is the cornerstone of innovation. We were established with a clear vision: to support and nurture local talents while forging a vital connection between our local Web3 ecosystem and the global blockchain landscape. By providing training sessions that dive into the Hedera Network, and setting up chapters in local universities to connect students from different backgrounds, Dar Blockchain and The Hashgraph Association will lay the foundation for the true realization of DLT. This partnership underscores our commitment to empowering the next generation of innovators across the MENA region, equipping them with the skills and knowledge to drive the widespread adoption of Web3 technologies on a global scale.”

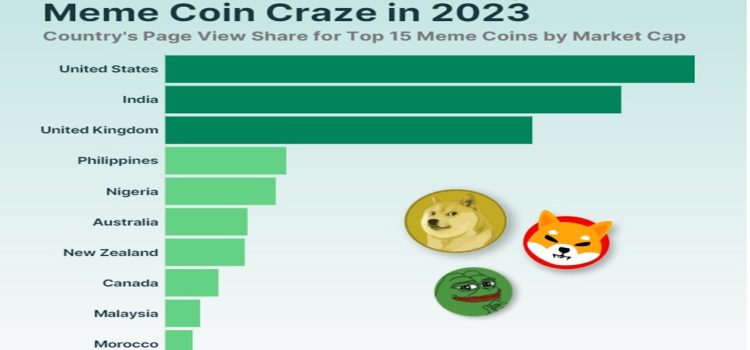

Recently, the MENA region has been a frontrunner for Web3 growth and innovation. In October 2022, it was announced that the region was home to the world’s fastest-growing cryptocurrency markets. In August 2023, the Dubai AI and Web 3.0 Campus committed to cutting license fees of Web3 and AI firms by 90% in an effort to encourage the move of companies and organizations to the city.

Kamal Youssefi, President of The Hashgraph Association, said: “The Hashgraph Association’s partnership with Dar Blockchain will accelerate the mass adoption of DLT in the MENA region. With the favorable outlook on crypto in the region, we wish to support this growth and ensure its continued upward momentum. It is a result of this openness to Web3 that we are partnering with Dar Blockchain and committing to advance the MENA Web3 industry.”

With each event and initiative, Dar Blockchain and The Hashgraph Association hope to provide a starting point for those interested in the world of Web3. By establishing ways to support Web3 talent in MENA, The Hashgraph Association and Dar Blockchain will further advance MENA’s blockchain boom and its position as a leader in the field. More details about the collaboration can be found at: Darblockchain.io