UAE MBank, Al Maryah Community Bank the first fully integrated digital bank in the UAE, is offering AED secure and regulated AED dirham to crypto conversions and trades, AED Escrow Account Services, executed at UAE regulated Changer.ae platform, a global crypto custodian service provider.

The Central Bank of the United Arab Emirates (CBUAE) has officially approved Mbank to open an AED Escrow Account for Changer.ae. This approval enables secure and compliant holding of AED funds in escrow through Mbank’s digital infrastructure, while the conversion of virtual assets and stablecoins such as USDT and USDC into AED is carried out by Changer.ae.

As per the press release, the service is a significant step toward bridging the gap between traditional finance and the digital asset economy. Mbank provides AED Escrow Account Services to Changer.ae clients allowing them to safely utilize a Dirham escrow account powered by the bank, while all conversions between dirhams and crypto assets are executed by Changer.ae.

Mbank and Changer.ae announcement of the Dirham-based crypto conversion service, including a fully regulated fiat escrow account in AED for crypto transactions, was made during TOKEN2049 Dubai, with Mohammed Wassim Khayata, CEO of Mbank and Board Member of Changer.ae, and Wang Hao, Senior Executive Officer at Changer.ae.

For customers, this means they can confidently and immediately convert their digital assets into local currency within a fully regulated and secure environment, eliminating the uncertainty and delays often associated with fiat, in on-ramp and off-ramp transactions. The service is entirely online, providing fast, transparent, and seamless access to funds, and allows individuals and businesses to manage crypto-to-fiat flows with ease, backed by Mbank’s trusted digital banking platform.

The cooperation between Mbank and Changer.ae enables individuals to exchange supported cryptocurrencies and stablecoins into AED via Changer.ae, with the converted Dirham funds held securely in escrow by Mbank. It also provides businesses with the tools to operate transactions entirely within a regulated, blockchain-enabled system, with real-time access to fiat and crypto balances.

This escrow service supports Crypto to Dirham and Dirham to Crypto conversions executed by Changer.ae, while the customers’ Dirham funds and transactions are fully protected through a comprehensive regulatory compliance and by Mbank’s secure technology infrastructure. Furthermore, this service facilitates fast movement of customer’s AED funds, in and out, within the UAE banking system.

Mr. Mohammed Wassim Khayata, CEO of Mbank and Board Member of Changer.ae, stated, “We are excited to offer this unique service to our customers, providing a seamless way to integrate Dirhams and crypto-related transactions with confidence. By providing AED Escrow Account Services to Changer.ae, we ensure secure and regulated dirham to crypto conversions for Changer clients. This partnership with Changer.ae aligns with our mission to drive innovation in the UAE’s financial ecosystem by offering regulated and secure financial infrastructure. The launch of this escrow account demonstrates the UAE’s commitment to becoming a global crypto hub while maintaining the highest standards of security and regulatory compliance.”

Mr. Wang Hao, Senior Executive Officer at Changer.ae, said, “At Changer.ae, we are thrilled to bring this innovative product to the market in collaboration with Mbank. With the approval from CBUAE, we are enhancing our service offerings by providing a secure, reliable, and convenient way for customers to access crypto services. This product reflects our continued dedication to bridge the gap between traditional finance world and the rapidly growing world.”

Mr. Tarek Soubra, Chief Technology Officer at Mbank noted that the AED escrow account service was an exciting leap forward, as it was developed in house with the highest standards of security, reliability and compliance without relying on third-party crypto custody platform.

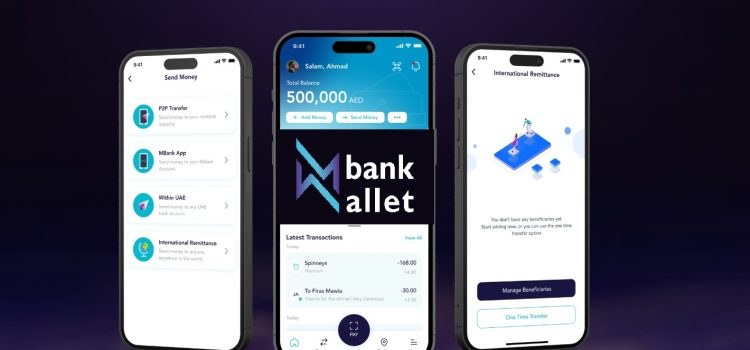

He added, “The seamless and straight forward integration between the systems of Mbank and Changer.ae,callow our customers to benefit from a safe, fast, and transparent crypto-to-fiat experience. Customers can now convert their cryptocurrencies into AED through Changer.ae and then use their converted AED funds immediately and seamlessly, with Mbank holding the AED funds in escrow. Alternatively, Mwallet customers can now receive their converted AED funds immediately into their wallets and use them for any supported transactions or for immediate cash withdrawal, using Jaywan ATM card.”

MBank received Payment Token Services approval from UAE Central Bank

Al Maryah Community Bank also received approval from the Central Bank of the UAE to provide Payment Token Services within the country. This new capability allows merchants to open accounts and accept payments through the AEC Wallet, further reinforcing Mbank’s role in supporting a regulated and innovative crypto payments ecosystem in the UAE.

Previously Mbank also launched the first regulated stablecoin AE Coin.