Marathon Digital Holding, a crypto mining entity has mined 18 Bitcoin out of the 1,202 Bitcoin produced in October 2023 from its UAE joint venture with 2.3 exahashes online in Abu Dhabi with 7 exahashes to be online by end of 2023. The figures were published in its unaudited Bitcoin BTC production and miner installation updates for October 2023.

Fried Thiel, Marathon Digital’s Chairman and CEO stated in their press release, “ “In October, we increased our energized hash rate 1% to 19.2 exahashes as the facility in Garden City, Texas, where we have 4.1 exahashes of miners installed, began to come online. Once this facility is fully operational later this month, we will have surpassed our 23 exahash target and solidified Marathon as the largest publicly traded Bitcoin miner in North America.”

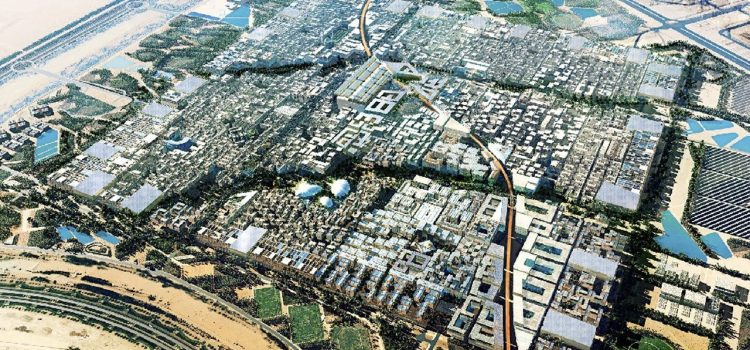

In terms of the operation in UAE, Thiel added, “By increasing our hash rate and continuing to improve our operations at the facility in McCamey, Texas and elsewhere, we earned 4.0% of the total Bitcoin network’s available miner rewards and produced 1,202 bitcoin in October. This total includes 18 bitcoin from our 20% share of the JV in Abu Dhabi. We now have 2.3 exahashes online in Abu Dhabi as our second, larger facility in Masdar City has begun powering up. We continue to expect the full 7.0 exahashes in the UAE to be online by year-end.

“We have also been exploring new methods of mining that we believe may allow us to further diversify our operations, reduce our energy costs, and increase our sustainable energy mix. We recently announced a pilot project in Utah that is exclusively powered by landfill methane gas. Naturally produced methane is often stranded, and Bitcoin miners like Marathon are uniquely positioned to help capture and convert this environmentally harmful gas into clean, renewable energy. We look forward to sharing more of the many innovative mining projects that we are exploring in the months ahead.”

Furthermore in November 8th Marathon Digital Holdings reported results for the third quarter 2023 including its operational results for the quarter ended September 30th 2023, Thiel made a statement showcasing how their international expansion in UAE has opened up new international opportunities such as Paraguay. He noted, “We made significant progress on our 2023 strategic priorities in the third quarter. First, we grew our energized hash rate 8% quarter-over-quarter to 19.1 exahashes. In addition, our new facility in Garden City started energizing last week and is expected to be fully operational later this month. Second, we experienced significantly higher uptime as optimization efforts helped increase our U.S. average operational hash rate 18% from last quarter to 14.2 exahashes. Third, we energized our first joint venture and our first international location in the UAE. This initial success has helped open new opportunities, and we recently entered into a new joint venture in Paraguay powered by hydroelectricity.

The Company recorded net income of $64.1 million, or $0.35 per diluted share, during the three months ended September 30, 2023, compared to a net loss of $72.5 million, or $0.62 loss per share, in the same period last year.

Marathon Digital officially inaugurated it 200 MW Bitcoin mining facility at Masdar City in Abu Dhabi UAE, under the joint venture Two Zero. In January 27th 2022, Marathon digital Holdings, announced that it had entered into a shareholder’s agreement with FSI (FS Innovation), the BTC mining subsidiary of UAE ADQ a sovereign fund, to form an Abu Dhabi, (Abu Dhabi Global Markets) based company.