Qatar Financial Centre (QFC) recently published that it witnessed record growth in 2024, welcoming 836 new firms to its platform, a 156 percent growth compared to 2023 as well as 29 firms into its Qatar Digital Assets Lab.

The upsurge brought the total number of QFC firms to 2,489 and the combined assets under management to over USD 33 billion. It also enlarged the QFC community to over 11,700 employees, representing 153 nationalities.

The firms registered in 2024 represent 90 countries, with the largest number of firms coming from the United Kingdom, India, the United States, Jordan, Turkiye, France, Lebanon, and Qatar. These firms span a wide range of activities and industries, including fintech, consulting services, media, IT, and wealth management.

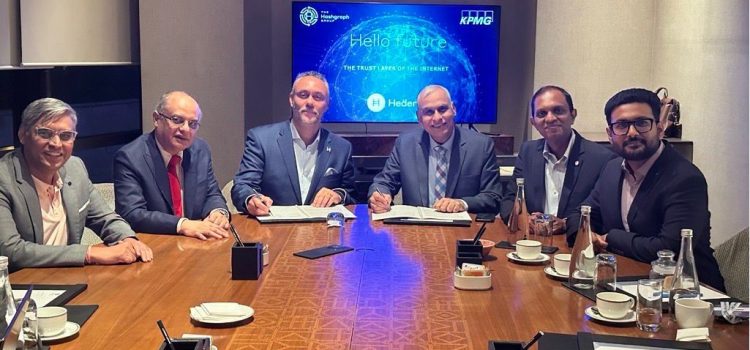

QFC also signed 24 memoranda of understanding in 2024, including agreements with prestigious financial institutions such as Qatar Islamic Bank (QIB), Masraf Al Rayan, Dukhan Bank, The Hashgraph Association, and the Chartered Institute for Securities and Investment. QFC established other significant partnerships during the year, including a memorandum of understanding with Qatar Media City and a collaboration agreement with Qatar Science and Technology Park (QSTP), aimed at facilitating business setup in the State of Qatar

The Digital Assets Lab, which commenced activities with 29 participants, developing unique digital solutions and services based on distributed ledger technology (DLT). To support the program, QFC issued the Digital Assets Framework to regulate digital assets, which includes comprehensive and clear legal guidelines for digital assets creation and regulation, including processes related to tokenization, legal recognition of ownership rights of encryptions and underlying assets, custody arrangements, and transfer and exchange transactions. These initiatives align with the Qatar FinTech Strategy and reinforce the country’s position as a regional leader in financial innovation.

Commenting on the QFC 2024 performance, CEO of QFC Yousuf Mohamed Al Jaida said, “The exceptional growth witnessed by the Qatar Financial Centre in 2024 reflects our commitment to provide a developed and attractive business environment for local and international companies. These achievements would not have been possible without the concerted efforts of all business units, along with close cooperation with our clients, key stakeholders in Qatar and our strategic local and global partners. Over the past year, we have continued to enhance innovation and support economic growth and diversification in Qatar, and we aim to achieve more successes in the coming years.”