During the AIM Conference in Dubai, Brevan Howard a global hedge fund management fund which recently opened its offices in Abu Dhabi UAE noted that it does a significant amount of its crypto trading from the United Arab Emirates. Ryan Taylor, Group head of compliance at Brevan Howard stated that this was because of the country’s sensible regulations.

Taylor stated, “The regulators in the UAE are hard, but they want the industry to fly and so they write sensible regulations and they are prepared to talk to the industry in order to evolve those regulations.”

Taylor said that Brevan Howard’s crypto trading operations represented about $2 billion of the firm’s total strategies which he said were over $30 billion. Brevan Howard has become the first global hedge fund to have 100 employees in the United Arab Emirates.

The statements come soon after Brevan Howard became the first client for Standard Chartered regulated crypto custody service out of DIFC.

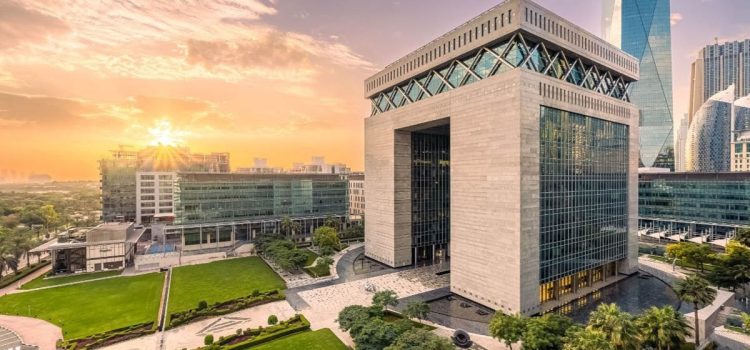

In May 2024, Standard Chartered announced that it had signed a memorandum of understanding (MoU) with Dubai International Financial Centre (DIFC) to collaborate on digital assets, including digital asset custody through its Zodia Custody entity. The now licensed service will allow clients to safekeep their Ethereum and Bitcoin cryptocurrencies as a start.

Brevan Howard Digital, the dedicated crypto and digital asset division of Brevan Howard, is confirmed as the inaugural client for the product.

During the announcement, Gautam Sharma, Chief Executive Officer of Brevan Howard Digital commented, “This is a significant win for the UAE and the wider digital asset industry. Standard Chartered’s global reputation and demonstrated commitment to this space adds a layer of credibility that is meaningful for institutional adoption. The development of the institutional infrastructure within the asset class and region supports our established business within the ADGM in its continued expansion and our ongoing efforts toward improving and reinforcing standards in the digital asset ecosystem.”

Brevan Howard, which manages $35bn in assets, opened its Abu Dhabi office in February 2023.