The visit of the National Bank of Kazakhstan to the UAE will lead to exploration of cross border initiatives, collaboration with ADGM and DIFC on digital assets, and learnings from Dubai’s Virtual Asset Regulatory Authority on developing bespoke regulations for digital assets. This comes as the UAE Central Bank launched its digital dirham CBDC which will be available for retail users at the end of 2025.

These comments were made by Binur Zhalenov, Chief Digital Officer of the National Bank of Kazakhstan in a LinkedIn post as he noted that the delegation’s visit was a productive one.

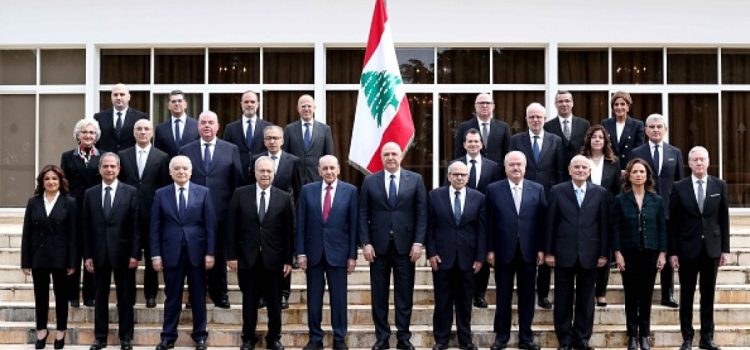

In an official press release, the National Bank of Kazakhstan noted that on March 26-27, the delegation of the National Bank of Kazakhstan and the Agency of Kazakhstan for Regulation and Development of Financial Market (ARDFM) made a visit to the United Arab Emirates (UAE).

During the visit, meetings were held with H.E. Khaled Mohamed Balama, Governor of the Central Bank of the UAE; H.E. Waleed Saeed Abdul Salam Al Awadhi, CEO of the UAE Securities and Commodities Authority; H.E. Ghannam Butti Al Mazrouei, Chairman of the Abu Dhabi Securities Exchange; management of the Mubadala sovereign investment fund, administration of the UAE international financial centers, banking and fintech companies.

In the course of the meeting with the Central Bank of the UAE parties exchanged views on macroeconomic conditions, as well as experiences in financial flows management and digital financial assets regulation. Following the meeting, a Memorandum of Understanding was signed aimed at exchanging best practices in the development of financial markets and FinTech, ensuring cybersecurity, and promoting CBDCs.

An exchange of experiences on the digital financial assets regulation and the development of blockchain technologies took place with the management of the Virtual Assets Regulatory Authority of the UAE.

In cooperation with the AIFC management, a meeting was held with the administrations of Abu Dhabi Global Market (ADGM) and Dubai Financial Centre Authority (DFSA) to discuss approaches to the regulation of the UAE’s international financial centers, as well as the conduct of transactions and mutual settlements within the jurisdictions of these centers.

Following the meeting with the Abu Dhabi Securities Exchange, the parties noted the importance of developing infrastructure in the capital markets and increasing the liquidity of trading products in the exchange market.

In addition, meetings were held with the Mubadala investment holding and First Abu Dhabi Bank on the prospects of expanding investment partnership with Kazakhstan, as well as with regional offices of leading international companies BCG and Microsoft on the creation of infrastructure for the proactive development of AI in the financial market of Kazakhstan.

Crypto Regulations in Kazakhstan

Kazakhstan currently mandates that all crypto transactions occur through the Astana International Financial Center (AIFC), where regulated platforms such as Binance and Bybit operate. However, many transactions still take place outside this framework. More recently Azat Peruaşev, leader of the minority Aq Jol party and member of the Majilis, the lower house of the Kazakhstan parliament, proposed that the country’s central bank and private banks collaborate to create a “crypto bank” to provide a legal platform for operations with cryptocurrencies. Another MP, Ekaterina Smyshlyaeva, proposed legislative reform of digital asset regulations at the same time.

Peruaşev said 90% of crypto operations in Kazakhstan are currently carried out in a legal gray zone. That enables scams, illicit activities, and tax evasion.

The country through the Kazakhstan’s Financial Monitoring Agency (FMA)also recently shut down 36 illegal crypto exchanges, seizing $4.8M in assets to combat money laundering. Authorities blocked 3,500 unlicensed platforms, returning $545K to victims and freezing $120K in assets. Additionally Kazakhstan plans to launch its Digital Tenge CBDC by 2025 integrating it with global payment platforms.

All this comes as Kazakhstan has put laws into place to encourage cryptocurrency miners to establish operations there. Kazakhstan currently produces around 6.17% of the world’s cryptocurrency mining, placing it among the top four nations in the world along with China, the US, and Russia.