UAE headquartered Fuze, a digital assets infrastructure provider, has raised a seed round of $14mn, the largest Seed investment in a digital assets startup in the history of the Middle East and North Africa region (MENA). The investment was led by Abu Dhabi-based Further Ventures, along with participation by US-based Liberty City Ventures.

Fuze will benefit from the strategic capital and network of these investors, acting as a catalyst for the business as it builds the digital asset infrastructure that will drive the future of finance.

A first-of-its-kind infrastructure provider in MENA, Fuze enables any bank, fintech or traditional enterprise to easily offer regulated digital assets products to their customers through their native apps.

Fuze was founded by an expert team of fintech, traditional finance (TradFi) and decentralized finance (DeFi) leaders, with its co-founders holding extensive knowledge from experience in global hypergrowth businesses.

CEO, Mohammed Ali Yusuf (Mo Ali Yusuf) has held prominent roles at Checkout.com and Visa; Arpit Mehta (COO) was previously in the leadership team at fintech leaders like Simpl and Clear; Srijan Shetty (CTO) built algorithmic trading systems at Goldman Sachs and worked at tech leader Microsoft.

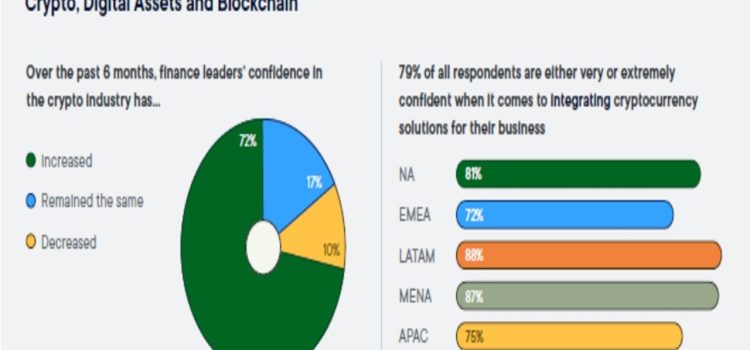

With a regional digital asset market worth $566bn, and growing at 48% YoY, Fuze co-founder and CEO, Mohammed Ali Yusuf believes the Middle East is the perfect home to establish a digital assets infrastructure business.

Yusuf states, “We are excited to build the future of regulated financial infrastructure and digital assets out of the UAE. Regulations have played a pivotal role in propelling the UAE into a central position within the global Digital Assets industry. To receive the backing of Abu Dhabi-headquartered Further Ventures combined with the deep expertise of US-based Liberty City Ventures, confirms the relevancy and potential of Fuze’s mission to rapidly expand our cutting-edge infrastructure across the region.”

Further Ventures commented, “This is an important strategic investment into digital assets, one of our core verticals. The team at Fuze is highly experienced and has a clear vision to develop a trusted, world-class digital assets proposition. Technology that enables a range of stakeholders is vital for the future of the financial ecosystem and Fuze is well placed to be a leader in digital assets across the MENA region and beyond.”

In September 2022, Abu Dhabi’s ADQ and Further Ventures, an investment firm back by ADQ launched a $200 million fund focused on Fintech, digital assets and supplychain.

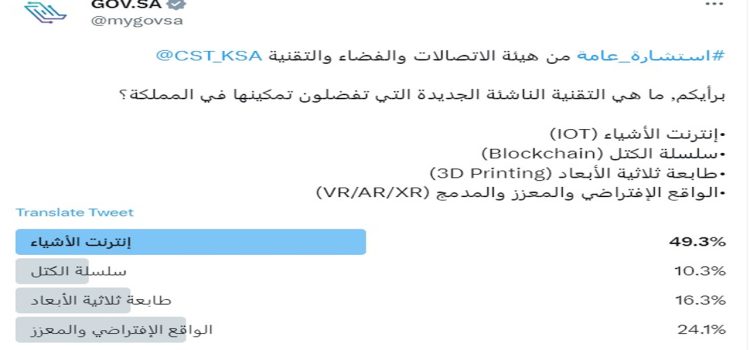

Fuze was founded in December 2022 and selected earlier this year to join Hub71, Abu Dhabi’s global tech ecosystem through its Company Building Program. Its white label solutions handle the complexities of blockchain and regulatory overheads for enterprises, enabling these organizations to readily offer digital assets such as stablecoins, cryptocurrencies, CBDCs and tokenized assets.

The funding will propel Fuze’s growth as it obtains regulatory licensing, adds strategic hires in key roles, continues to expand its technological capabilities, and accelerates its geographic expansion across the region. Its products, such as Fuze Trader and Fuze Loyalty, allow banks, brokerages and superapps to offer digital asset products in a simple, easy and trusted manner.

“We are building a suite of products that addresses the growing demand for regulated digital asset capabilities through trusted channels. Our technology first approach is a game-changer for the region and offers our customers a reliable bridge to the new era of investments and to the future of finance,” adds Yusuf.

In a recent report by Singaapore funded UnaFinancial, the group said that Fintech funding in UAE could reach $2.8 billion in 2028 from $1.8 billion in 2023. This is boosted by a strong economy and favourable environment.