UAE based Phoenix Group has sold 10% of its company shares to Abu Dhabi conglomerate International Holding Company’s subsidiary.

IHC’s wholly owned unit, International Tech Group, has entered into a definitive agreement to buy 10% stake in Phoenix Group, according to a disclosure on the Abu Dhabi Securities Exchange (ADX).

The company is currently completing all required procedures and obtaining regulatory approvals to complete the transaction, the disclosure noted.

This announcement comes at the heels of an agreement between Muscat-based Green Data City and Phoenix Group to develop a $300 million crypto-mining farm in Oman. The 150-megawatt farm, which will be one of the largest crypto-mining data centers in the region, will be installed in Green Data City, the entities said in a joint statement. The farm is expected to be fully operational by the second quarter of next year.

Pheonix Group had announced on several occasions that it was seeking to have an IPO ( Initial Public Offering). With the 10% acquisition by IHC this could well put the IPO on hold.

Phoenix provides crypto-mining equipment distribution and hosting services. The company has a portfolio of mining facilities in the Middle East, Europe, the US, and Canada.

In the first half (H1) of 2023, IHC generated net profits valued at AED 10.39 billion, up from AED 10.35 billion during the same period a year earlier.

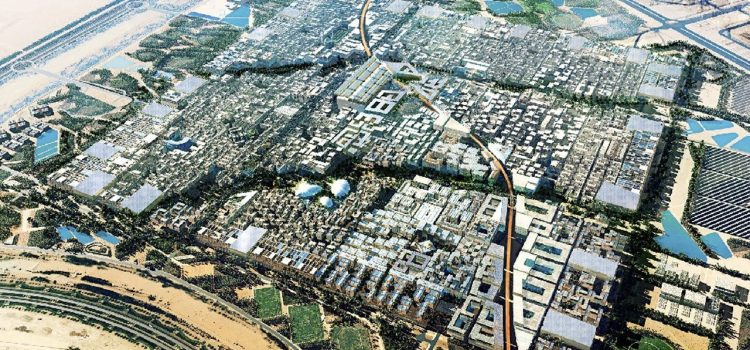

This is a reflection of Abu Dhabi’s government interest in crypto mining. Prior to this Marathon Digital a digital asset mining entity announced in January 27th 2022, that it had entered into a shareholder’s agreement with FSI ( FS Innovation), the BTC mining subsidiary of UAE ADQ a sovereign fund, to form an Abu Dhabi, ( ADGM (Abu Dhabi Global Markets) based company.

Marathong Digital will use fossil fule offset or nuclear to power bitcoin mining operation.