CZ the Co-Founder of Binance has taken to twitter after word came out that the U.S. SEC ( Securities and Commodities Authority) has sued Binance US and its founder for providing trading for securities such as BNB, BUSD, SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI. The U.S. summarizes the case as a blatant disregard of the federal securities law and the investor and market protections these laws provide. The SEC states that Binance has enriched itself by billions of U.S. dollars while placing investors’ assets at significant risk.

The 13 charges come after the CFTC unveiled a similar complaint against Binance and Zhao earlier this year.

CZ on twitter stated, “4. Our team is all standing by; ensuring systems are stable, including withdrawals, and deposits. We will issue a response once we see the complaint. Haven’t seen it yet. Media gets the info before we do.”

Charles Hoskinson of IOHK, who had tweeted, “With respect to Binance, I’m reading through the SEC complaint. It’s over 130 pages, but seems like the next in a series of steps to implement chokepoint 2.0 in the United States. The end goal is an agenda based CBDC partnered with a handful of massive banks and end-to-end control.”

To that CZ replies, “a perfect opportunity for the entire industry to set aside it’s fragmented nature and unite for a common sense set of rules and guidelines”

Binance issued a statement expressing its disappointment with the U.S. Securities and Exchange Commission, stating that they have actively cooperated with SEC’s investigations and have worked hard to answer their questions and address their concerns.

The statement reads, “Most recently, we have engaged in extensive good-faith discussions to reach a negotiated settlement to resolve their investigations. But despite our efforts, with its complaint today the SEC abandoned that process and instead chose to act unilaterally and litigate. We are disheartened by that choice. “

They add, “We intend to defend our platform vigorously. Unfortunately, the SEC’s refusal to productively engage with us is just another example of the Commission’s misguided and conscious refusal to provide much-needed clarity and guidance to the digital asset industry.”

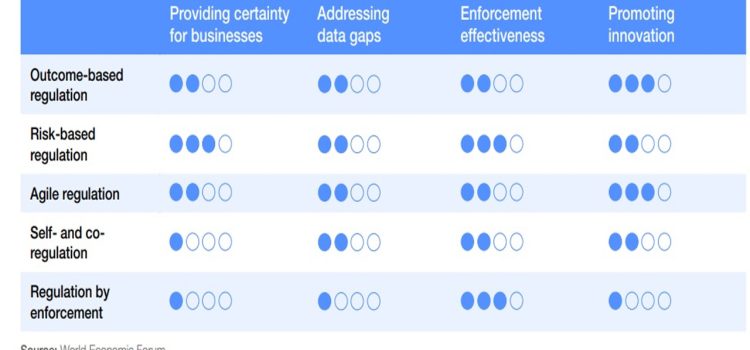

According to Binance, an effective regulatory framework demands collaborative, transparent, and thoughtful policy engagement, a path the SEC has abandoned. Because of our size and global name recognition, Binance is an easy target now caught in the middle of a U.S. regulatory tug-of-war.”

It also explains that because Binance is not a U.S. exchange, the SEC’s actions are limited in reach. Still, we stand with digital asset market participants in the U.S. in opposition to the SEC’s latest overreach, and we are prepared to fight it to the full extent of the law.

Talal Tabaa, Co-Founder of CoinMENA a crypto broker exchange, told LaraontheBlock, “Honestly, I am not surprised. The SEC has had Binance and CZ in their sights for a while now. Binance operations and ownership structure have always been opaque when compared to others. We will have to wait and see the extent of these charges because the SEC has been on a quite aggressive path with crypto and is pushing many onshore exchanges offshore.”

As for the bright side Tabaa adds, “Ethereum wasn’t listed as part of the assets that are centralized in nature which is a huge win.”

Waseem Mamlouk, Founder of NMB Fintech, believes that the USA is going after crypto and SEC is the working end of that very focused policy. the USA via the SEC sees alternative assets such as Bitcoin as a threat to fiat currencies especially the US dollar which is the most hegemonic currency, and used in trade deals taking place 24 hours a day.

He adds, “Maintaining that portion size of global market is really big deal for the USA. In absolute terms the USA is biggest money printer in the world, making its product highly diluted which makes them go after all alternative assets and shut them down.

He explains, If you look at late 2021 BTC had a I trillion dollar market cap while today the entire crypto market is under a trillion, so things have changed.

The positive thing according to Mamlouk is that companies are looking to set up in crypto friendly jurisdictions. He notes that a company he is acquainted with which has a 100 million dollar hedge fund that includes stablecoins, early venture startups, Web3 and crypto companies are interested in seeking regulation in markets such as Bahrain.

He finally explains that if the US were to diversify large transactions could be settled in alternative assets, this would be good for US economy. For him the world is changing and as such we have to change with it. This is the natural evolution of economic systems and financial markets.

In conclusion he believes that if you put more things on blockchain, you will achieve more transparency, and trace transactions. Gone are the days where banks such as HSBC can launder money for drug cartels in Mexico. Blockchain and crypto bring more accountability traceability and transparency so the banking structure needs to evolve into this world.

So despite the bad news with SEC versus Binance, there is always a bright side.