In 2023 and earlier this year in January, the UAE licensed in total 13 crypto exchanges and crypto brokers. This came at the backdrop of a more robust virtual asset regulatory ecosystem both in Dubai and Abu Dhabi, as well as a heightened awareness and interest in investing in crypto tokens, virtual assets, and digital assets.

The most important question to many who are either already investing and trading in crypto or who are just getting started is which crypto exchange or broker can serve me best. The article will look into each crypto exchange and compare them to offer a more transparent mirror of the licensed and regulated crypto exchanges in the UAE.

OKX:

Starting with OKX is mainly because it is the first global exchange to receive a virtual asset license to operate their crypto exchange in the UAE. OKX received the license in January 2024, yet is still not fully operational as it finalizes certain requirements requested by Dubai’s virtual asset regulatory authority VARA.

However when it does start, it will offer more than 350 crypto tokens. So other than the basic offering of trading tokens or trade pairs on the spot, margin and derivatives markets, it also offers managing of DeFi portfolios, buying and selling NFTs, earn crypto in our mining pools, and take out crypto collateralized loans.

But wait all these products are not available to UAE retail and institutional clients. So far, OKX’s approved suite of duly regulated virtual assets activities includes spot services and spot-pairs, via the OKX App and OKX.com exchange.

The UAE VASP License also allows OKX to offer AED deposits and withdrawals.

OKX also announced that it has developed its Arabic website to meet the needs of users in the MENA region.

Finally OKX is active on all social media platforms so engaging with the community is available through many channels.

The crypto exchange boasts of over 50 million users in more than 100 countries. It is currently seeking a license in Hong Kong.

CoinMENA

Next in line is homegrown Crypto broker CoinMENA, which is not only now licensed in the UAE but was also one of the first to be licensed in Bahrain. CoinMENA offers the major cryptocurrencies on its platform, 52 in total.

It is fully operational and is authorized to serve Institutional Investors, qualified Investors and retail Investors. It offers spot trading of crypto assets.

CoinMENA already is fully operational and has been serving customers in the GCC and MENA region through its Bahrain licensed entity.

In addition customers can deposit money directly via bank transfer or credit/debit card to a customer’s CoinMENA Wallet, as well as withdraw money from CoinMENA Wallet directly to a client’s bank account.

CoinMENA currently serves over 900,000 users supporting seven countries.

Recently CoinMENA expanded its family office, investor and institutional offering through a partnership with Onramp Bitcoin. Onramp is an international Bitcoin asset management company built on multi institutional custody.

| Crypto Exchange | Regulatory Status | Presence in |

| OKX | Crypto Exchange | HongKong UAE |

| Fasset | crypto broker | UAE |

| CoinMENA | crypto broker | UAE Bahrain |

| GCEX | Institutional crypto Exchange | UAE Denmark UK |

| FUZE | Crypto broker | UAE |

| BackPack Exchange | crypto exchange | UAE |

| Toko | Crrypto exchange/broker | UAE |

| Laser Digital | Crypto Broker | UAE |

| RAIN | Crypto broker | UAE Bahrain |

| M2 | Crypto exchange | UAE |

| Glomex | Institutional crypto exchange | UAE |

| Matrix | Institutional crypto exchange | UAE |

| Midchains | Institutional crypto exchange | UAE |

| Venomex | Institutional crypto Exchange | UAE |

M2

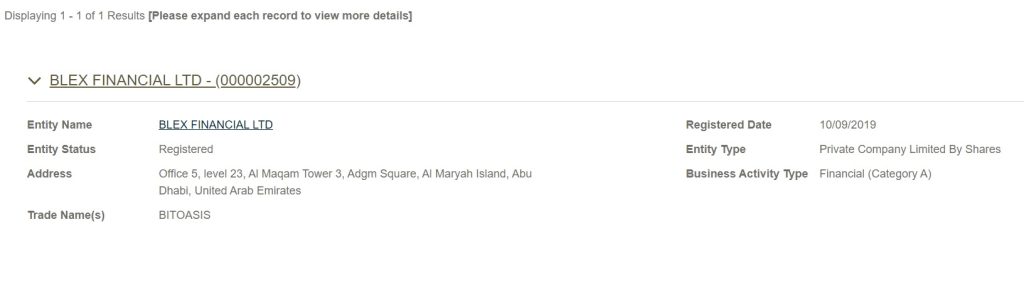

M2 is a UAE Abu Dhabi Homegrown crypto exchange. It received its license back in November 2023 from ADGM. It was recognized as a fully regulated Multilateral Trading Facility (MTF) and Custodian and is now able to on-board UAE residents and institutional clients.

M2 offers spot trading and currently has 50 crypto tokens to choose from.

It will also be able to offer AED Fiat On/Off-Ramp: Allow the on/off ramp of AED with ease through its partnership with a local bank in the near future.

One of the strengths of M2 is that it is backed by strong investors, one of which is a Bitcoin mining conglomerate, Phoenix Group that helps M2 to offer its Bitcoin Earn Product. The product was launched in partnership with Phoenix crypto mining group and offers yields that reach up to 10.5%.

M2 has an equity investment of $300 million as well.

RAIN

RAIN crypto broker and exchange was the first crypto broker to receive a license in the MENA region. Its operations started in Bahrain and it is now licensed in the UAE through ADGM in Abu Dhabi.

On the landing page of RAIN the first thing a user sees is the 0% trading fee. RAIN offers 70 crypto tokens to trade with. RAIN also offers crypto swaps.

It also is able to offer AED Fiat On/Off-Ramp: Allow the on/off ramp of AED with ease through its partnership with UAE local banks.

Like most of the major exchanges it has a mobile application, and is present on most social media channels.

Fasset

In November 2023, Fasset received its crypto broker license from Dubai’s regulator VARA. This license follows Fasset’s launch in Indonesia in August, where it partnered with Mastercard Indonesia and telco giant Indosat Ooredoo Hutchison.

Fasset offers five crypto tokens to trade with.

On its website, unlike other crypto exchanges, Fasset states that it offers gold investments using blockchain technology, crypto staking and other products. How much of this they can offer with their license in VARA is not clear. But it would be a surprise if they could offer these with their current license.

| Crypto Exchange | Maker Fee | Taker Fee | Currencies | Minimum deposit USD | Trade Limits |

| OKX | 0.08% | 0.10% | 320 | 10 | 100,000 USDT |

| Fasset | 0.10% | 1.00% | 5 | 35 | 1000 |

| CoinMENA | 0.75% | 0.75% | 52 | 10 | No limits |

| GCEX | No | No | 50 | 50,000 | No Limits |

| FUZE | NA | NA | NA | NA | NA |

| BackPack Exchange | 0.085% | 0.095% | NA | NA | NA |

| Toko | NA | NA | NA | NA | NA |

| Laser Digital | NA | NA | NA | NA | NA |

| RAIN | 0.15% | 0.30% | 70 | 20 | No Limits |

| M2 | 0.02% | 0.04% | 30 | 50 | NA |

| Glomex | NA | NA | NA | NA | NA |

| Matrix | 0.10% | 0.20% | 7 | 50,000 | No Limits |

| Midchains | 0% | 0.40% | 17 | NA | No limits |

| Venomex | NA | NA | NA | NA | NA |

Other crypto exchanges

As for the rest of the crypto exchanges and brokers that serve retail and institutional clients and are licensed in UAE, they are Fuze, BackPack exchange, Toko and Laser Digital. These four were licensed by Dubai’s virtual asset authority, but have yet to populate their websites with clear information on their product offering, fees and other information.

Fuze is preparing to launch and its CEO refrained from sharing information until they do.

As for purely institutional investors they can work with the following crypto exchanges who only deal with institutional customers. These are GCEX where the minimum deposit is $50,000 offering 50 tokens.

According to GCEX Managing Director, Mehtap Onder, the exchange doesn’t charge its clients maker and taker fees but just a trading fee.

Then there is Matrix, who also has a minimum deposit of $50,000 but offers just 7 crypto tokens to trade and invest in.

Interestingly Venomex has no information on its fees and offering, and just states on its website, that it will communicate its fees and charges via a notice.

Conclusion

In conclusion, the UAE definitely now has an array of crypto exchanges and crypto brokers that can offer safe and secure means to trade and invest in crypto tokens. It is left up to customers to choose which one they feel more comfortable with, which one offers competitive fees and which ones offer the crypto assets they want to trade.

Users can choose between local, regional and global exchanges to work with. But the future will bring even more. As VARA recently announced, while the regulator awarded 19 regulated VASP licenses in 2023, with 11 already operational, it will be adding 72 more in the coming months.

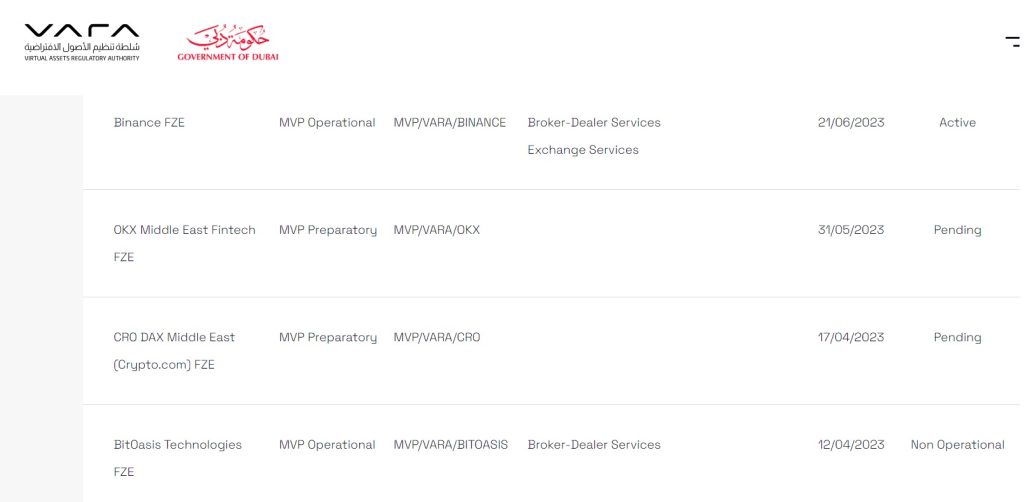

This could mean that Binance will soon have a license to operate in UAE, as will ByBit, and Crypto.com among others.

As more crypto exchanges enter the UAE as regulated entities, competition will surely increase and this is always a good thing for clients and users, so be prepared.