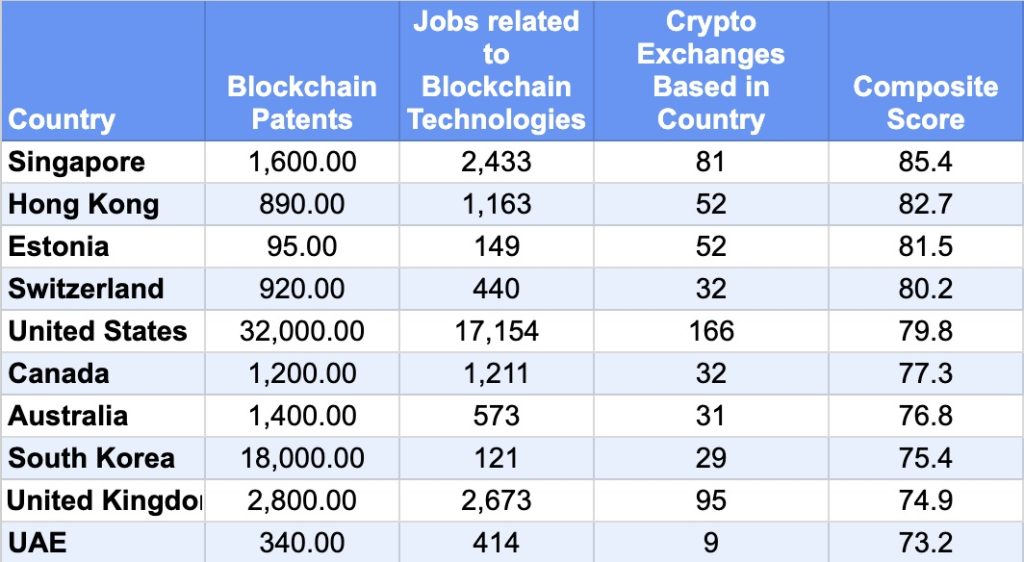

UAE based Sigma Capital, a Web3 early-stage venture firm, has launched a $100 million fund dedicated to accelerating the next wave of Web3 innovation in the Middle East and globally. As per the press release, the fund launch spotlights the UAE’s growing role as a global hub for the Web3 & Blockchain sector.

The fund will focus on early-stage venture investments in transformative areas such as DeFi, blockchain infrastructure, real-world asset tokenization, gaming and the metaverse.

Sigma Capital will actively manage a portfolio of liquid tokens, seizing market opportunities to generate consistent returns. The fund will also leverage high-yield DeFi strategies to optimize portfolio performance and invest in high growth crypto venture funds that broaden exposure to emerging innovations.

Vineet Budki,an expert in the Web3 space, and the former CEO and Managing Partner of Cypher Capital, also a Web3 VC based out of UAE, will lead the fund.

Vineet spearheaded over 300+ investments in high-profile projects, including Mysten Labs, Sei Network, Casper Labs, Web3Auth, Casper labs, Manta network, Mocaverse, Peak network and MyPetHooligan.

The Sigma Capital Team has years of experience in the Blockchain investing space and have been invested or partnered with multiple reputed players in the Blockchain space which include Polygon Technology, Morningstar Ventures, Blockchain Founders Fund, Woodstock Fund and many others.

Vineet Budki, CEO and Managing Partner of Sigma Capital, said, “We envision a digital economy that is more open, inclusive, and innovative. The UAE’s dynamic economy and forward-thinking regulatory environment provide the perfect backdrop for Web3 innovation. This fund empowers startups with capital, equips them with access to our extensive network and expertise, and enables them to thrive in a rapidly evolving landscape.”

Sandeep Naliwal, Founder Polygon Technology one of the leading players in the Blockchain space noted, “ Vineet’s track record as a visionary leader in Web3 speaks for itself. His deep understanding of market dynamics and foresight in nurturing high-impact projects have been pivotal in advancing the ecosystem. The launch of Sigma Capital’s $100 million fund is a testament to his expertise and the UAE’s emergence as a global hub for blockchain innovation. I have no doubt this fund will catalyze the next wave of groundbreaking startups and solidify the region’s role in the decentralized economy.”

Sigma Capital plans to deploy investments across 100 early-stage projects, 25 liquid tokens, and 10 fund-of-fund allocations over the next three years. The firm’s strategic edge lies in its proven expertise and global reach, leveraging its network to provide access to key exchanges, market makers, exchanges, launchpads and opinion leaders.

Danilo S. Carlucci, Founder & CEO at Morningstar Ventures, and a key partner in the fund sdded, “Since our establishment in Dubai in 2020, Morningstar Ventures has been committed to supporting transformative projects and bold founders that push the boundaries of blockchain innovation. Sigma Capital’s $100 million fund is a testament to the region’s growing influence in blockchain and financial technology. It will support the growth of Web3 startups and further solidify the region’s position as a leader in financial innovation.”

Sigma Capital collaborates with Web3 hubs across 10 global cities, providing portfolio companies with deep market insights and comprehensive support to enable success in a competitive market. By combining a diversified approach with deep market access, Sigma Capital aims to drive sustainable growth in both the Global and GCC Web3 ecosystem.

The firm’s dual presence in Dubai and Singapore, coupled with regulatory oversight from the Cayman Islands, ensures access to global opportunities while maintaining a strong compliance framework.

In December 2024, The Hashgraph Group (THG), the Swiss-based international business, technology, and investment firm that operates exclusively within the Hedera ecosystem, secured a fund management license through its subsidiary Hashgraph Ventures Manager Ltd in ADGM planned to launch a $100 million global venture fund (Hashgraph Venture Fund-I). The strategic Web3 venture fund would focus on generating attractive long-term returns by investing in proven early-stage and well-established companies utilizing deep technologies to build and commercialize enterprise-grade solutions and products for the Web3 economy.