Bitget crypto exchange released some statistics on how MENA investors anticipate Bitcoin halving on its price as well as information from Bitget’s managing Director on crypto mining in the region as it courts MENA crypto traders, investors, and regulators.

As per the Bitget study 80% of MENA investors believe that bitcoin halving will lead to price fluctuations between $30,000 and $60,000 at the time of halving.

In addition, 82% of crypto investors residing in MENA who were surveyed intend to augment their investments in 2024 with merely 4% planning to reduce their crypto holdings.

Bitget Managing Director Gracy Chen has revealed that the MENA region bitcoin mining hashrate now exceeds 8 percent and is expected to grow as miners migrate from countries with regulatory instability towards low-cost reliable surplus of energy.

She notes that in Oman for example $1.1 billion of investment has gone into crypto mining, she expects as such the share of bitcoin mining in MENA to go over 15%.

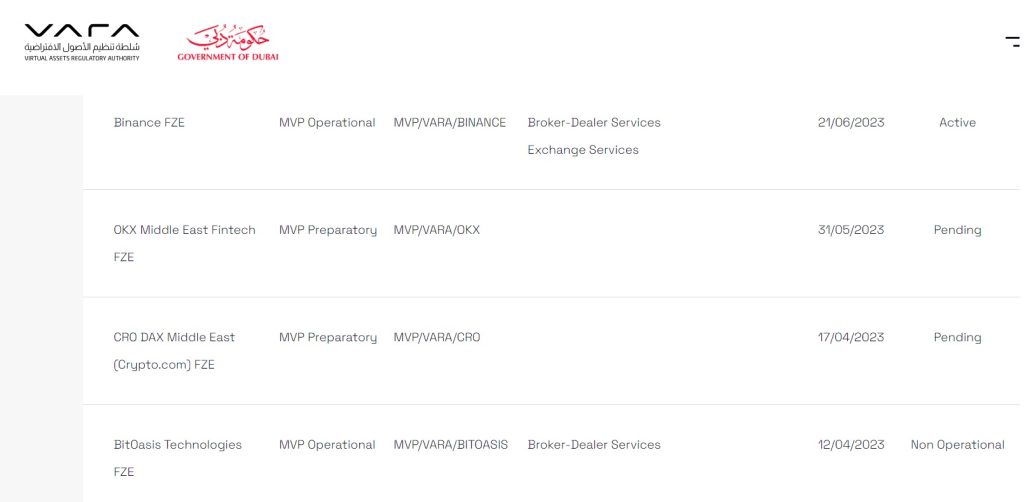

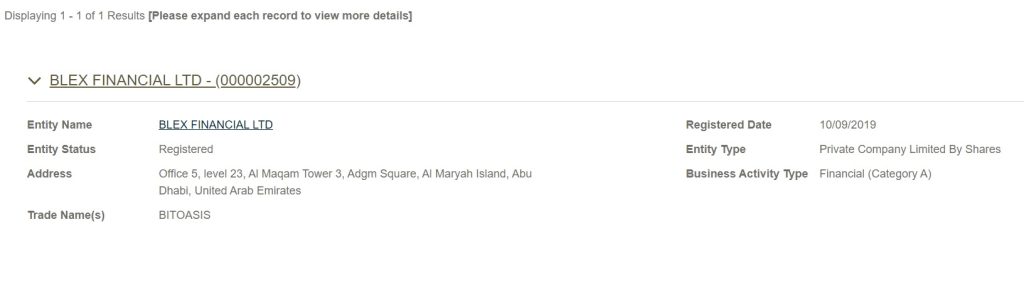

Crypto exchange Bitget, with roots in India has been courting the MENA region for some time. While the crypto exchange has yet to receive a license from any GCC or MENA regulator, it has launched a Ramadan campaign to celebrate the holy month with its Arabic speaking audience. The campaign includes daily token giveaways along with the chance to win airpods, headsets, laptop, smartwatch and more.

As per the release, to make this program inclusive, Bitget will be donating $1 towards charity for each winner during the campaign timeline. Users who follow Bitget MENA on Twitter can utilize #BitgetRamadanChallenge to get noticed and win exciting rewards. Giveaways will be settled every Saturday and requires users to complete a set of challenges to be eligible for the event.

“Middle east and North African regions have increased its crypto adoption drastically in recent times. At Bitget we plan to leverage our resources to strengthen this growth. With regional specific campaigns, language support, crypto conversion and trading choices, we’ve tailored our app for our MENA users. The region is bound to grow and increase its adoption, and we’re here to fuel it,” says Vugar Usi Zade, COO at Bitget.

Back in November 2023, Bitget, even expanded its support for fiat gateways in the Middle East region. The crypto exchange announced that users can now utilize the platform’s peer-to-peer trading for seven currencies: DZD (Algerian Dinars), BHD (Bahraini Dinars), TND (Tunisian Dinars), JOD (Jordanian Dinars), QAR (Qatari Rials), MRU (Mauritanian Ouguiyas), and OMR (Omani Rials).

With the newly added fiat support, Bitget users can start buying and selling crypto with zero fees on Bitget P2P. Users can purchase USDT with integrated local currencies using local payment methods from anywhere globally via Bitget P2P. The exchange also launched Arabic lingual support for its website and mobile application.

At the time Chen noted, “Our products are aligned with Bitget’s expansion plans in the Middle East. We want to enable our traders to trade in their preferred fiat currencies. With Bitget P2P we’re enabling a seamless and convenient trading experience for our valued users in the region. We’re focused on driving financial sovereignty as we make crypto accessible and user-friendly throughout the globe.”

Bitget confirmed that it had begun exploring license applications in order to operate in target Middle East markets. In the same press release it stated, gaining proper licenses and regulatory approval is a top priority to support expansion and allow the company to open regional offices. Bitget has been scaling its operational reach globally in recent months, including the registration as VASP (Virtual Asset Service Provider) in Poland and similar crypto registration in Lithuania. The new expansion plan in the Middle East region aligns with Bitget’s vision of spreading crypto’s mass adoption.

In 2023 Bitget announced opening of operations in Dubai UAE, and recruiting over 60 new staff members to fill back-office positions.

Bitget even has its own X channel for the MENA region where it is posting competitions and challenges.

Bitget is now rated as the number 12th crypto exchange in world, with more than $2 billion worth of trading as per CoinMarketCap.