The UAE National Team for Reviewing the Impact of Data Centers on the Energy Sector recently held its first meeting at the Dubai headquarters of the Ministry of Energy and Infrastructure (MoEI) to explore the development of data centers in the UAE and their influence on the local energy sector.

According to a recent Research and Markets report, the United Arab Emirates Data Center Market was valued at USD 1.26 billion in 2024, and is expected to reach USD 3.33 billion by 2030, rising at a CAGR of 17.58%.

Global cloud providers such as Microsoft, Amazon Web Services (AWS), Oracle, and Alibaba are establishing and expanding their operations in the UAE data center market. AWS continues to grow its cloud footprint, capitalizing on the expanding digital economy of the country, while Microsoft has expanded its cloud operations in both Abu Dhabi and Dubai. The UAE data center market is primarily dominated by regional operators, including Khazna Data Centers, Gulf Data Hub, Moro Hub, and du. The global operator Equinix also has a significant presence in the market. The UAE data center market is also witnessing several new entrants which include Quantum Switch Tamasuk and Pure Data Centres, with Khazna Data Centers holds the highest market share of over 59% in the UAE as of H1 2024.

Given the oncoming growth in datacenter market in the UAE, the UAE National team meeting, highlighted the challenges facing data centers and ways to make them more sustainable, in addition to the importance of adopting global best practices to ensure the efficient operation of these centers.

Attending the meeting was His Excellency Eng Sharif Al Olama, Undersecretary for Energy and Petroleum Affairs at MoEI, His Excellency Eng Saif Ghubash, Assistant Undersecretary for Petroleum, Gas, and Mineral Resources at MoEI, in addition to members of the team which comprises representatives of MoEI, the Ministry of Industry and Advanced Technology, the Ministry of Climate Change and Environment, the Telecommunications and Digital Government Regulatory Authority, the Artificial Intelligence, Digital Economy, and Remote Work Applications Office, Abu Dhabi Digital Authority, Digital Dubai Authority, Digital Sharjah Authority, Sharjah Digital Department, Department of Digital Ajman, the Electronic Government Authority of Ras Al Khaimah, Smart Umm Al Quwain Department, and Fujairah Digital Government.

The team will be responsible for analyzing and reviewing the impact of data centers on energy demand, evaluating the local market and projected economic return for this key sector as well as, identifying all data centers in the country and classifying them according to specific standards. The team will also be conducting a geographical study of the distribution of current and future data centers in the country to ensure optimal infrastructure distribution, performing benchmark comparisons to review global best practices in data centers, and working on developing a federal policy aimed at regulating the operation of local data centers.

During the meeting, His Excellency Eng Sherif Al Olama said, “The formation of the UAE National Team for Reviewing the Impact of Data Centers on the Energy Sector comes as part of the country’s strategic directions towards digital transformation and enhancing sustainability in the energy sector. It is expected to contribute to the development of policies and regulations that support the sustainability of the sector and maintain the competitiveness of the UAE in the field of digital infrastructure.

He noted the need to develop innovative solutions to ensure a balance between the demands of technological development and the sustainability of energy resources, in alignment with the national goals in the field of energy and sustainability.

He also highlighted the importance of establishing a comprehensive framework that includes analytical studies and clear recommendations based on accurate data, which will contribute to making strategic decisions capable of achieving the country’s energy goals, particularly in clean and renewable energy.

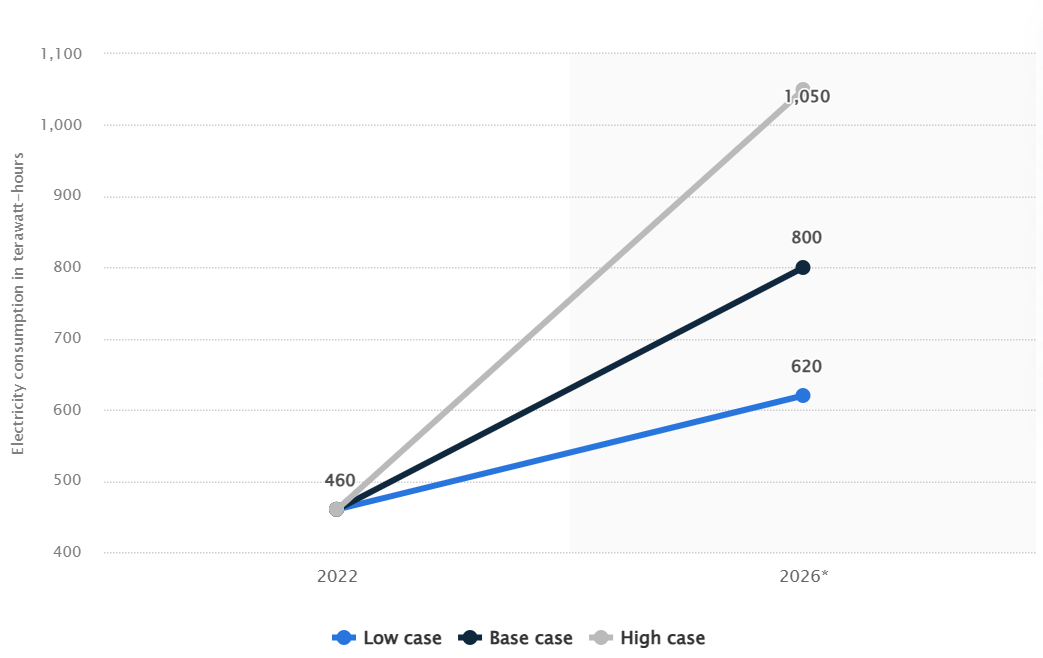

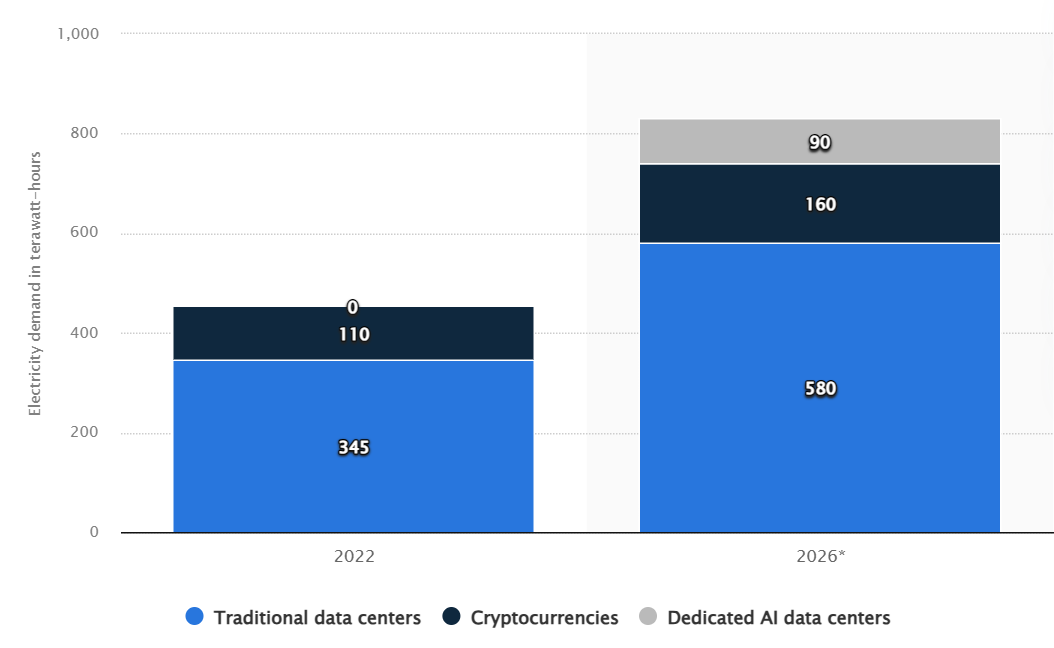

This comes as Roland Berger’s recent report ” Who Pays For Tech” discusses the fact that addressing the energy challenge requires regulatory measures, technological innovation, and appropriate cloud processing pricing. Enforcing energy efficiency regulations, deploying new cooling and computing technologies, and leveraging AI to optimize data center operations will be crucial in balancing technological progress with environmental sustainability, ensuring that digital services do not impose unsustainable costs on the planet.

UAE set to launch XRG energy investment company

The UAE government is also working on its energy needs with the launch of XRG, an international energy investment company that will focus on projects across the spectrum, from gas to chemicals to low carbon fuels to energy infrastructure. The energy investment company was launched by ADNOC in November 2025 with the aim to have $80 billion in assets under management by 2035.

XRG was launched by Dr. Sultan bin Ahmed Al Jaber, UAE Minister of Industry and Advanced Technology, Chairman of Masdar and ADNOC. He noted at the time that global energy demand is set to rise dramatically, increasing from 9,000 GW to 15,000 GW by 2035 and potentially reaching 35,000 GW by 2050—a staggering 250% increase. The rise of AI applications like ChatGPT, which consumes ten times the energy of a single Google search, is accelerating this trajectory.

Without diversified energy solutions, meeting this demand sustainably will be nearly impossible. XRG hopes to address this by optimizing energy production and usage across the spectrum—from traditional fuels to low-carbon alternatives and advanced infrastructure.

It is estimated that global spending on construction of new data centers is expected to surpass US$49 billion by 2030 (source: MicKinsey & Company). With over US$1.0 trillion funding gap in renewable energy, it is believed to be an opportune time to lay the groundwork to power the advancement of compute infrastructure for a vibrant digital economy.

HODLER Investments and EHC Investment create NEXGEN to supply critical energy infrastructure

HODLER INVESTMENTS, a UAE based investment company, headquartered in the Dubai, which includes in its portfolio energy, AI, and digital asset mining startups such as PermianChain, Brox Equity and others; and Abu Dhabi’s EHC Investment which leads multiple businesses with operations and investments across the energy, infrastructure, firefighting technology and system integration services signed a strategic partnership to launch NEXGEN.

NEXGEN aims to support the creation of a compliant digital energy market to supply critical energy infrastructure that will monetize wasted energy such as flared gas in the UAE, KSA, and Egypt for hosting global data center operators, reducing carbon emissions and contributing the Digital Energy Infrastructure (DEI) Fund, a local decarbonization innovation fund.

The strategic partnership with EHC Investment comes after HODLER announced its ongoing plans for a $500 million Digital Energy Infrastructure (DEI) Fund with the participation of UAE based GEWAN holding. The DEI will be established as a closed-ended Fund, subject to compliance and regulatory approvals. The DEI Fund has already secured soft commitments from lead investors and in-kind contributions in addition to offtake partners seeking energy and connectivity for A.I. and digital asset mining operations.