In celebration of the UAE’s 53rd National Day, UAE based Mbank (Al Maryah Community Bank) , a digital bank, launched Jaywan Cards, the UAE’s first National Debit Card, on its blockchain enabled Mbank Wallet platform.

As per the press release, the national debit card is powered by advanced blockchain technology. It empowers customers with the ability to pay seamlessly at all POS terminals across the UAE, transfer money internationally with ease, and enjoy zero fees for cash withdrawals. By leveraging the security and efficiency of blockchain, Mbank sets a new benchmark in financial convenience and inclusivity, reinforcing its commitment to innovation and serving the diverse needs of its customers.

The press release added, that the launch of Jaywan Cards reflects Mbank’s commitment to fostering financial inclusion, serving the local community, and enhancing its position in the UAE’s financial ecosystem.

This initiative aligns with the Central Bank of the UAE and Al Etihad Payments’ strategic timeline, supporting the introduction of over 10 million new debit cards into the UAE market over the next two years. Mbank extends its gratitude to Al Etihad Payments for their unwavering support and collaboration, which has been instrumental in bringing this transformative initiative to life and advancing the UAE’s payment infrastructure.

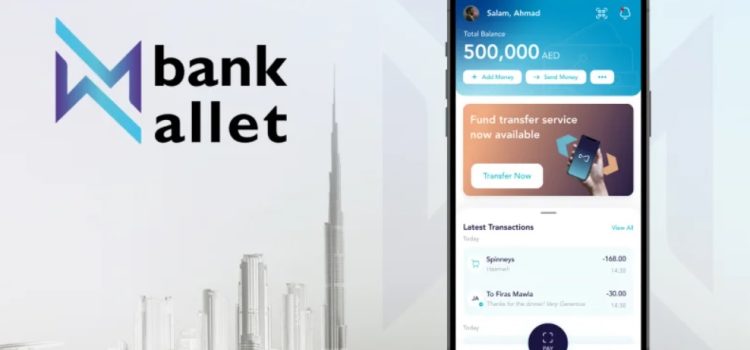

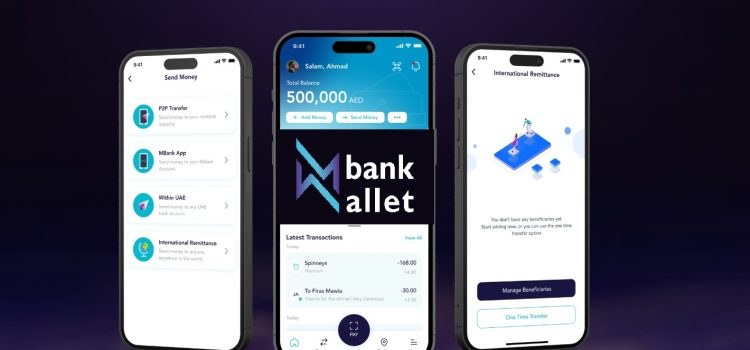

The Mbank Wallet offers a full suite of payment solutions, giving users the ability to manage their finances on the app while using Jaywan Cards for in-person transactions.

The Mbank Wallet is the UAE’s first national digital wallet built on decentralized blockchain technology, offering:

- Payments Through All POS Terminals in the UAE: Jaywan Cards are widely accepted across the country for seamless transactions.

- Instant Payments with QR Technology: Secure and quick payments for in-store and online purchases.

- Cross-Border Transactions: International transfers facilitated through Lulu Exchange.

- No Bank Account Needed: Customers can send, receive, and request payments using an IBAN, eliminating the need for a bank account.

- Zero Fees for Cash Withdrawals: A fee-free experience at ATMs, ensuring greater financial accessibility.

- Digital E-Vouchers: Simplify the process of purchasing gift vouchers from a wide range of top merchants

“As we celebrate the UAE’s 53rd National Day, we take immense pride in introducing a transformative step forward with the launch of Jaywan Cards through the Mbank Wallet,” said Mr. Mohammed Wassim Khayata, CEO of Al Maryah Community Bank. “This groundbreaking initiative is a testament to our unwavering commitment to empowering the nation’s financial landscape, enhancing customer experiences, and driving the UAE’s vision of becoming a leader in financial inclusion and digital innovation.”

He added, “With Jaywan Cards and the Mbank Wallet, we are not just redefining the banking experience but also reinforcing the UAE’s position as a hub for cutting-edge financial solutions. Our focus is on creating meaningful impacts that bring convenience and accessibility to every customer, reflecting the spirit of progress and innovation that defines our nation.”

This announcement comes after AED Stablecoin LLC stated that the Central Bank of UAE provided it with in principle approval to launch and establish its own stablecoin, AE Coin.