In a recent X post by HE Dr Thani bin Ahmed Al Zeyoudi, UAE Minister of State for Foreign Trade, he noted that the UAE government will be accelerating the adoption of technologies such as AI (Artificial Intelligence) and Blockchain into the global trading system.

The Initiative called Regulation 5.0 for the Future of TradeTech and the Trade-Sustain-AI Initiative will identify key trends in trade technology and provide a blueprint for a harmonized global regulatory system to oversee their deployment.

According to Al Zeyoudi this is especially important for developing countries to avoid widening the technology gap.

Al Zeyoudi stated on X platform, “At the inaugural TradeTech Global Forum today, we launched two important initiatives that will accelerate the adoption of technologies like AI and Blockchain into the global trading system: Regulation 5.0 for the Future of TradeTech and the Trade-Sustain-AI Initiative.

He added, “Our Trade-Sustain-AI initiative will create global partnerships to oversee the development of AI-powered trade solutions that will advance sustainable practices throughout supply chains – and help promote a smarter, cleaner trading system.

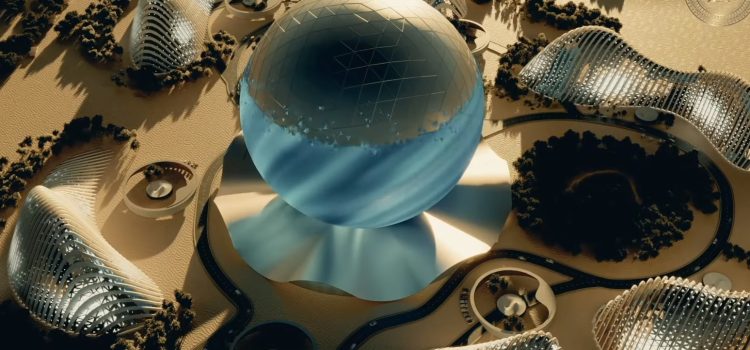

The comments were made during the Abu Dhabi World Trade Organization Conference being held in Abu Dhabi between Feb 26th and 29th. The conference had metioned that decentralization of global supply chains would be on the table for the first time.

The conference witnessed that attendance of 165 nations and trading blocs. WTO Director-General Ngozi Okonjo-Iweala noted in an interview with WAM, “We will initiate new dialogues, called deliberative sessions, where, for the first time, the ministers will engage on issues crucial to the contemporary world, including trade and environment, trade and climate change, trade and sustainability, and trade and inclusion.”

She advocated the decentralization of supply chains, expanding them to developing countries.

Moreover during the conference, Blockchain Foundation, IOTA announced its partnership with the World Economic Forum, Trademark Africa, the Tony Blair Institute for Global Change, the Institute of Export and International Trade, and the Global Alliance for Trade Facilitation.

As per their press release, “Together, we are embarking on a transformative journey to revolutionize international trade through the creation of the Trade Logistics Information Pipeline (TLIP). International trade has long been burdened by inefficiencies, bureaucracy, and lack of transparency. The cumbersome process of trading goods across borders involving numerous documents, multiple actors, and intricate regulations often leads to delays, errors, and even fraudulent activities. Recognizing the urgent need for a reliable and transparent digital trade infrastructure, our coalition is committed to fostering a neutral governance framework for TLIP.”

TLIP aims to streamline information exchange and promote collaboration across borders. It builds on IOTA’s distributed ledger technology (DLT) to provide data immutability and security. It performs the same function as a government stamp on a trade certificate to prove authenticity – just made digital.

Customs in destination markets will not need a stamped physical Certificate of Origin when using TLIP. However, while physical documents are subject to fraudulent risks, the TLIP system ensures transparency and immutability of the relevant details of uploaded documents.

TLIP ensures that a digital certificate is authentic and prevents it from being tampered with. IOTA also provides distributed controls, so each trade actor can manage their data and give access permission without outsourcing the permission controls to a centralized entity enabling a digital-based collaboration much like how the free market of trade works manually today.

Furthermore, using IOTA’s DLT enables parties to interact securely online without requiring a centralized platform that stores all information and is vulnerable to hacking or manipulation.