LaraontheBlock interviewed the CEO of recently UAE licensed crypto exchange M2, Stefan Kimmel who had a lot to say on the future plans of M2, their product growth, partnerships, acquisition appetite, Bitcoin ETFs and license plans.

Why Abu Dhabi

According to Kimmel, launching a fully regulated, transparent clean startup from Abu Dhabi ADGM ( Abu Dhabi Global Market) was because the FSRA ( Financial Services and Regulatory Authority) in ADGM is one of the oldest most respected and esteemed regulatory authorities when it comes to virtual assets and crypto. FSRA as Kimmel explains has been around for five years and has a comprehensive solid framework. He stated, “ After all that has happened in crypto over the past few years, everyone is looking for a safe protected transparent exchange, and this is what we are offering from ADGM.”

M2 Strong liquidity

Another strong feature that M2 has is its strong liquidity which is essential for the success of any crypto exchange. As Kimmel explains, “ Liquidity is super important for successful crypto exchanges, and this is why we have partnered with global leading market makers, have tight spreads, and in terms of depth of key markets we are right up there with all the top players. Liquidity is key for good trading experience for investors and that is why we are connected with the largest global market makers and have deep liquidity especially on large crypto asset pairs.”

M2 investors

Speaking on M2 investors and whether the company will be seeking further investment, Kimmel replies that M2 is not seeking to raise capital any time soon. According to Kimmel, M2 is lucky to have an equity investment of $300 million which will give them a long run rate. According to Kimmel, “Our strategic key investor is Phoenix Group but we also have investment from several Abu Dhabi family offices.”

However for those who have asked or been interested in investing in M2, Kimmel states they have the option of investing in Phoenix Group which is now trading publicly on the ADX exchange in Abu Dhabi or they can buy the M2 MMX token on the M2 exchange and Uniswap.”

Noteworthy is that while Phoenix Group is a strategic investor in M2 it also partners with M2 on Bitcoin mining and Hashrate mining.

Acquisition appetite

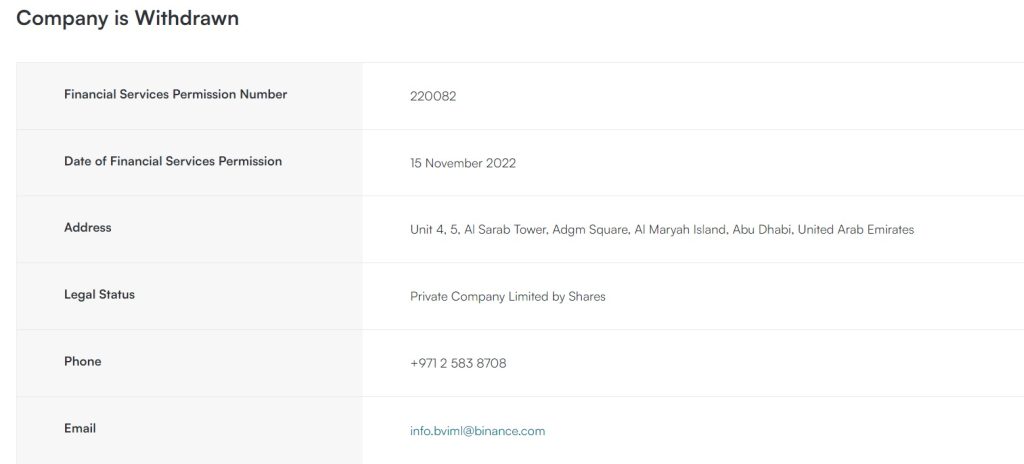

As for M2’s acquisition appetite, Kimmel admits that if they find well regulated transparent crypto exchanges in countries of interest they would seek to acquire them. On whether M2 would be interested in Binance, he replies, “First Binance is not up for sale, and secondly we are on the lookout for fully regulated exchanges, as we want to be regulated, transparent and clean in everything we do. So we would have to choose an exchange that is in the same direction.”

The U.S. market

At the moment M2 is not interested in the U.S. market given the unclear regulatory situation. Kimmel states, “We will be staying outside of the USA unfortunately, given its current regulatory state. There are no rules we can apply or abide by currently in the USA only enforcement.”

However M2 is very keen on Europe given that Europe has come out with its MICA regulations for crypto service providers. He states, “Our next intention after receiving several regulatory licenses from ADGM and a license from the Bahamas is to acquire a license in Europe and we have filed for one in Spain.”

After Spain, M2 plans to apply for a license in the United Kingdom.

Bitcoin Earn Yield Product

The first product launched by M2 was Bitcoin Earn product. The product was launched in partnership with Phoenix crypto mining group and offers yields that reach up to 10.5%.

The pair designed a product that utilizes Bitcoin mining to offer genuine returns for investors. Most investment platforms that offer yield returns on crypto provide it through one of two routes. M2 are generating returns predominantly with Bitcoin mining, which underpins the M2 Earn product

Kimmel admits that the appetite for the M2 Bitcoin Earn product has been fantastic. He states, “This has been one of the most debated topics inside the M2 because a large share of deposits goes to the Bitcoin Earn product. 10.5% is amazing given that it is hard to earn decent returns on Bitcoin.”

According to Kimmel it is not that difficult to offer 10.5% returns because as he notes, “Given that we are partially owned by Phoenix Group, we reinvest in Bitcoin mining which offers higher returns than 10%, the other two angles is on platform lending which is over collateralized and fully on platform, and a small percentage goes into Proprietary Trading (Prop Trading) market making and basic arbitrage, but no big exposures, as we are not trying to take on risks.”

According to Kimmel even if the crypto markets are not doing well since the investment is in Bitcoin and the interest return is in Bitcoin, then there is no FX market exposure.

Future product offerings partnerships

Kimmel is excited about the future of M2 after going live and ensuring that the processes in place are scalable and robust. Next up are more product offerings, partnerships, and maybe an ETF.

Kimmel explained, “In Q1 of 2024 we will be coming out with a crypto payment card. We will also be offering fiat on and off ramp with one of the banks in the UAE. In addition we have partnerships coming up with big retail names in the country to reach a bigger customer base.”

When asked about the potential of a Bitcoin ETF product, Kimmel confesses that this is absolutely on the radar. He says, “We are already having initial exploratory discussions on it.”

Outlook on crypto exchanges and DeFi

In terms of the bigger global situation when it comes to crypto exchanges, competition and DeFi, Kimmel believes that given that today there are around 600 crypto exchanges globally, we will definitely see some closing down because of the regulatory requirements, others being bought because the market cannot accommodate so many crypto exchanges. He explains, “ We will not only see consolidations in the UAE as crypto exchanges struggle to meet tighter regulatory environment, but there will also be eliminations as market gravitate towards the stronger players.”

In terms of centralized crypto exchanges versus decentralized using DeFi, Kimmel believes that for mass adoption to take place, centralized exchanges are a must. Kimmel, “As we drive for mass adoption the vast majority will struggle with decentralized user experiences, such as managing wallets, on and off ramp, which is hard, in addition we also have governments and regulators who struggle in DeFi, where it is anonymous and users as well may not subscribe to that ethos. For institutional adoption this can only happen in centralized platforms.”