Bahrain based BENEFIT, aFintech and electronic financial transactions service, has partnered with haifin, an e& enterprise company (part of e&) formerly known as UAE Trade Connect offering Blockchain enabled trade financing platform,to revolutionize Bahrain’s banking sector by fostering innovation, and enhancing financial resilience across the industry.

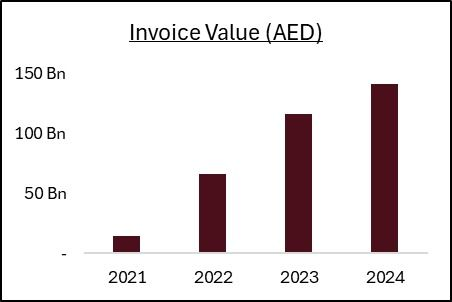

With a proven track record in de-risking trade finance lending, haifin—live in UAE since 2021—has leveraged cutting-edge technologies such as blockchain and advanced analytics to prevent fraud in real-time, saving over $150 million for its consortium members.

As per the press release, the partnership is set to enhance the ability of Bahrain’s banking industry to mitigate risks and prevent fraud, particularly in trade finance. By improving risk management, the collaboration is expected to boost banks’ lending confidence, increase revenues, and improve access to liquidity for SMEs and corporate borrowers.

Abdulwahed AlJanahi, Chief Executive of BENEFIT, commented that this partnership marks a significant step in strengthening Bahrain’s financial ecosystem through advanced technology. He added, “By equipping banks with cutting-edge tools to proactively combat fraud and streamline trade finance, we are empowering the sector to operate with unparalleled efficiency and confidence. By uniting our expertise, we are reinforcing trust, security, and innovation at the heart of the industry’s future, setting the stage for a more resilient and digitally advanced banking landscape in Bahrain.”

Zul Javaid, Chief Executive of haifin, highlighted the importance of this partnership added, “After our success in the UAE and our ambition to address similar challenges across the MEA region this collaboration with BENEFIT marks a major milestone. Together, we aim to deliver advanced technology solutions that enhance risk management which ultimately drives growth for banks.”

The members of Haifin platform include UAE Banks Federation, Al Masraf, Abu Dhabi Islamic Bank, Abu Dhabi Commercial Bank, Commercial Bank International, Commercial Bank of Dubai, Dubai Islamic Bank, First Abu Dhabi Bank (FAB), Habib Bank AG Zurich, Invest Bank, Mashreq Corporate & Investment Banking Group, National Bank of Fujairah, RAKBANK, Sharjah Islamic Bank, United Arab Bank, Beehive Fintech, CredibleX, DP World, and Finneva.

Prior to the recent agreement with Bahrain’s BENEFIT, Zul Javaid expressed his interest in expanding Haifan offering to countries across the GCC and MENA regions, including KSA hiring Wissam Massud to lead their international expansion in 2023.