The ClearWorld 2025 MENA Early Stage Handbook has come out showcasing that there are 480 crypto startups in MENA with one in every 20 startups in MENA being a crypto one, and one in every 10 startups being a crypto one if you filter out non-tech startups. As such within the tech startup ecosystem, one in every 10 tech startup is a crypto startup. As of April 2025 15% of active ventures in MENA are crypto startups.

Of the total of 3,600 startups in MENA, half of them are in the UAE, with 65% of the 3,600 startups in pre-seed phase. There has been a multi-year downtrend in new startup formation, coupled with increased investment activity, which is aging the structure of the market.

With less new startups coming to the market, and investor demand remaining high, older startups are getting a better chance for a “second look” from the investors.

The ClearWorld Handbook also notes that by 2026, 21% of pre-seed startups will be written off and join the pool of zombie startups. This means 209 pre seed startups who would have spend significant time without funding that is becomes extremely unlikely for them to get new VC Funding.

The report also adds that MENA Venture Market’s Middle of the Funnel Seems Stuck. The number of Series A startups in MENA

remained unchanged since 2024. In fact, it dropped everywhere outside Saudi. In Saudi, Series A showed the smallest growth out of all stages. Only 26% of startups make it to seed stage with Saudi startups enjoy funding coverage much higher than MENA (41% vs 29%)

Egypt’s high survival rate at Pre-seed stage is in large due to accelerators who are affiliated with VCs and corporations, though it would

come back to hurt Egypt’s survival rates when time is due for these startups to raise Series A as per the report.

However if nothing moves, 30% of MENA’s Viable Series A Startups Will Be Written Off By 2026. As more Series A startups spend more

years stuck in the system, their prospects of raising growth capital diminish. At the current rate, a sizable move affecting 10-27 Series A startups might be expected soon, either progressing to Growth Stage or being written off in relatively ‘large’ quantities.

MENA now has more active investors than it has new startups. MENA is going through a critical and unique phase. The report states that this could be resolved if there is an easing of classic conditions placed on tech founder such as stop requesting founders quit their day job and take immense risk during a global macro economic challenge. Another solution is utilizing AI for more efficient early stage cutting short prototype development time and combining Seed stage with Series A stage in a single step. The report states, “For this, accelerators and incubators can take the lead and train a new wave of founder-friendly AI-empowered entrepreneurship.”

Currently 80 percent of AI startups are in UAE and KSA, 150 in UAE, and 110 in KSA. AI startups grew between 2024 and 2025 because according to report, many startups rebranded to AI startups with 12% of Egypt’s AI startups relocating to UAE and Saudi Arabia.

Seed round raises are usually between 500K to $3M with only 15% of seed companies getting funding between $3M to $7M. The report goes into more detail on each round and the funding offered in each.

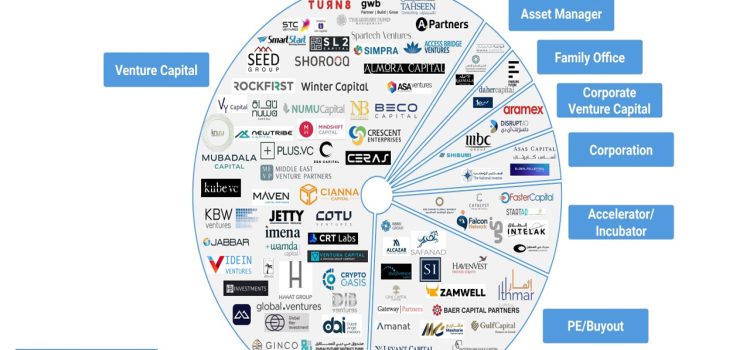

In conclusion, while the MENA region has grown in terms of investors, startups are still small in numbers in comparison. Yet we are seeing more incentives for startups to build in the region with deep tech studioss being launched, governmental investment in AI, Blockchain, digital assets and more.