In a recent press release published by Marathon Digital Holdings, Bitcoin mining entity, the company showcased its unaudited Bitcoin production stating that in January 2024 their Abu Dhabi facilities will have a total of 7.1 exahashes online.

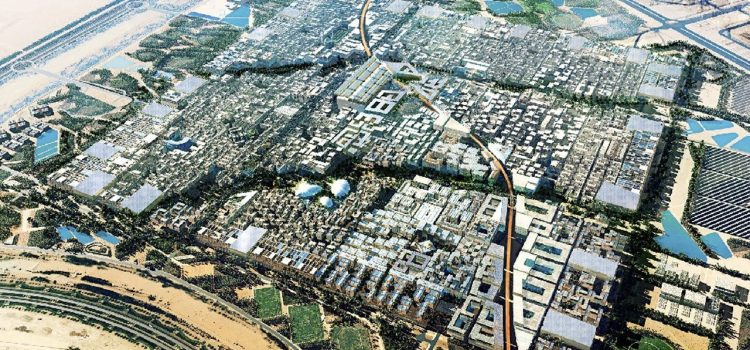

According to the CEO of Marathon Digital Fred Thiel, the operations in Abu Dhabi UAE currently has 2.7 exahashes online and includes over 13,000 rigs energized at their second larger facility in Masdar City. As he stated, “the remaining 4.4 exahashes are still expected to be online in January 2024.”

In November Marathon Digital had reported that 7.5 exahashes would be online by the end of 2023.

Marathon Digital by December had increased their energized hash rate 4% to 24.7 exahashes and extended their lead as the largest publicly traded Bitcoin miner in North America. As per Thiel, “We continue to target 30% growth in energized hash rate in 2024 and with the recently announced acquisition of the two sites from Generate Capital, which is expected to close in January 2024, we expect to reach 50 exahashes in the next 18 to 24 months.”

In addition their new joint venture in Paraguay also continued to energize, reaching 0.3 exahashes with 2,110 miners now online and the company expect the total 1.1 exahashes to be online by early Q2 2024.

Bitcoin production grew, as Marathon mined 1,853 BTC in December, up 56% from November, and 290% year-over-year.

Thiel explained, “Significantly higher transaction fees helped December’s Bitcoin production grow much faster than average operational hash rate. For the month, MaraPool collected more than 380 BTC in transaction fees or 22% of BTC production, up from 12% of production last month. Our success in capturing the sizable transaction fees currently available to miners is directly related to owning and operating our own pool and represents a key competitive advantage of our vertically integrated tech stack.”

As of December 31, the Company holds a total of 15,174 unrestricted BTC. Marathon opted to sell 704 BTC or 38% of monthly production to cover operating expenses. The Company intends to sell a portion of its bitcoin holdings in future periods to support monthly operations, manage its treasury, and for general corporate purposes.

Marathon held $356.8 million in cash and cash equivalents on its balance sheet at month end, all of which was unrestricted. During December, the combined balance of unrestricted cash and cash equivalents and bitcoin increased from $802.3 million to $998.5 million at December 31, 2023. In anticipation of the next Bitcoin network halving, the Company continues to build liquidity on the balance sheet to capitalize on strategic opportunities, including industry consolidation. The transaction to acquire two operating sites from Generate Capital is expected to close in January 2024 for approximately $178.6 million in cash to be paid from the Company’s balance sheet.