R3 announced on LinkedIn that it was thrilled about the success of UAE RAKBANK in their first cross border CBDC transaction using mBridge in which R3’s issuance layer technology solution played an instrumental role.

David E Rutter, CEO of R3 said: “The first cross-border CBDC transaction by a UAE local bank, RAKBANK, is a groundbreaking development for the UAE, and the region more broadly.

He added, “R3’s issuance layer technology and CBDC integration solutions have been instrumental in supporting RAKBANK to achieve this exciting milestone in production. R3’s ambition is to continue to deliver interoperable distributed ledger solutions, using Corda, our open, permissioned tokenization platform to the UAE and beyond.”

Rutter adds that R3 is committed to working with UAE domestic banks like R3 to build their digital ecosystem.

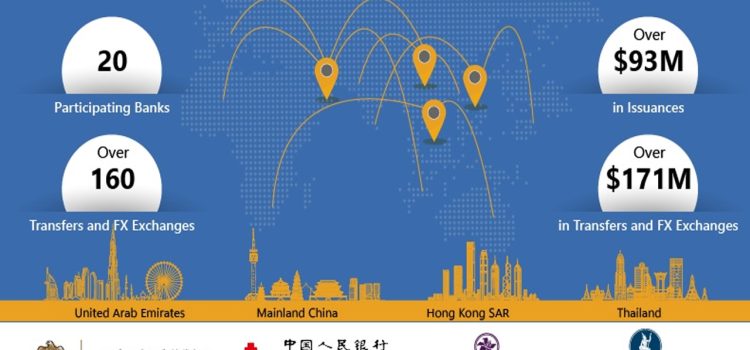

The National Bank of Ras Al Khaimah (“RAKBANK”) recently became one of the first banks in the United Arab Emirates to execute an international remittance using mbridge CBDC. The Bank utilized China’s digital Yuan (eCNY) in exchange for the Digital Dirham, the UAE’s CBDC.

Vikas Suri, Co-Head of Wholesale Banking Group at RAKBANK, added, “The successful transfer of eCNY to our correspondent in China is a game-changer in several respects. It’s one of the first UAE-led foreign currency transfers executed in local currencies without involving a third currency to China and without using conventional payment rails. This is a gamechanger that paves the way for instant blockchain based CBDC exchanges with payment versus payment, fundamentally altering how we approach international payments. Our next steps will focus on supporting the China and UAE business corridor for our clients, by leveraging mBridge to reduce costs and improve the speed of remittances.”

In an IMF blog, the International Monetary Fund noted that almost two-thirds of countries in the Middle East and Central Asia are exploring adopting a central bank digital currency with Bahrain, Saudi Arabia and UAE in the more advanced proof of concept stages. The countries in MENA and Central Asia are studying CBDCs as a way to promote financial inclusion and improve the efficiency of cross-border payments.

The IMF Blog noted however that CBDCs require careful consideration, with each weighing their own unique set of circumstances.

Many of the 19 countries currently exploring a CBDC are at the research stage. Bahrain, Georgia, Saudi Arabia, and the United Arab Emirates have moved to the more advanced “proof-of-concept” stage. Kazakhstan is the most advanced after two pilot programs for the digital tenge.