As the United States President Donald Trump overhauls USAID with a new name as well as a proposed integration with Blockchain, Lebanon whose USAID funds were semi frozen might need to integrate Blockchain into its digitization strategy if it wants to be able to get USAID in the future.

President Donald Trump in a recent speech at the Digital Asset Summit in New York, plans to restructure USAID and rebrand it as U.S. International Humanitarian Assistant placing it under the Secretary of State’s authority.

This is in line with Elon Musk’s call to put the U.S. Treasury department on the blockchain as well, considering it would create efficiency and help to decrease costs in government. His view is that the transparency and immutability of the blockchain technology, which ensures all transactions are visible for everyone to see for the rest of time, would eradicate alleged fraud.

Blockchain to be incorporated into USAID

As per a memo circulating among State Department staff, Trump wants to integrate blockchain technology into USAID’s procurement system to enhance security, transparency, and traceability in aid distributions.

It would leverage a blockchain to trace aid distributions and enforce payment models based on outcomes rather than inputs. “All distributions would also be secured and traced via blockchain technology to radically increase security, transparency, and traceability,” the memo reportedly reads, adding that such an approach would encourage innovation and efficiency.

The President also reportedly wants cryptocurrency and blockchain technology to feature heavily in its operations. USAID has been under scrutiny from the Trump administration since the establishment of the Department of Government Efficiency (DOGE), led by Elon Musk.

Lebanese USAID grants semi frozen

The U.S. president froze USAID payments in a January 20th under an executive order. The freezing also effected Lebanon which in 2024 alone received a total of $219 million in assistance from USAID of those $17 million came from the U.S. State Department with military aid accounting for 4% of the total funding and with remaining funds primarily supported humanitarian relief ($91 million) and education ($71 million).

The news of the freeze has had a negative effect on NGOs and their employees in Lebanon even though it was temporarily lifted in February 2025.

There are two major issues that will challenge Lebanon’s ability to received USAID, the first is level of historic corruption in Lebanese government and even claims of corruption within the NGO community, as well as lack of transparency, while the second is the lack of a digital infrastructure that can integrate Blockchain, AI, and other technologies such as digital payments into the web of aid or investment funds to the country.

If USAID will utilize blockchain and crypto, it will need to add the entities that funds are provided with to the blockchain as nodes to be able to track where money has been spent and if it has been spent correctly leading to results.

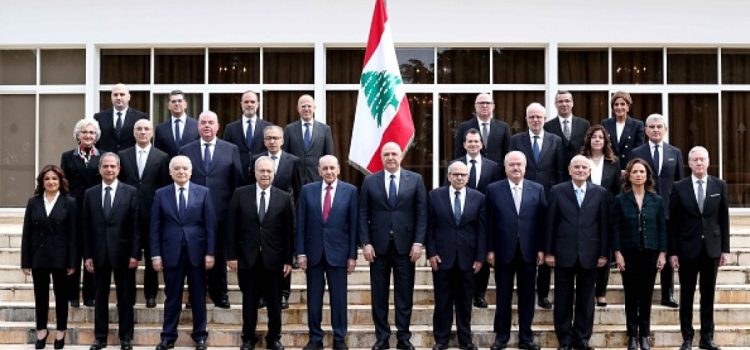

New Lebanese Cabinet under Salam discusses digital transformation

The new Lebanese Cabinet, under Prime Minister Nawaf Salam is discussing digital transformation in the public sector, after enacting the first Ministry of AI in Lebanese government.

As per news reports, a committee will be formed to oversee coordination between Lebanese Ministries, even though the digitization theme has been in discussion for years. Several previous sessions addressed this issue, dating back to the government’s adoption of the Lebanon Digital Transformation Strategy 2020-2030.

Lebanon’s Prime Minister Nawaf Salam emphasized the government’s commitment to establishing a neutral, transparent, and efficient state administration as a cornerstone of governance. He stressed that “there is no state without an administration,” as it serves as the backbone of governance and a key tool for serving citizens.

He announced that the government formed a ministerial committee to study and modernize the public sector, along with another committee to examine digital transformation in public administration.

Lebanon still has one of the most outdated governmental services sector, where almost everything needs paperwork and in person visits.

Despite this, some ministries have taken independent steps to integrate technology into their services. In 2021, the Ministry of Labor launched an online platform for work permit applications for foreign nationals. The Interior Ministry introduced an electronic criminal record service, allowing citizens to request and receive documents through OMT centers across Lebanon. The Ministry of Justice has also advanced its digital services, enabling lawyers and citizens to create online accounts on the official judicial services platform for easier access to information and remote application submissions. Most recently, the Ministry of Economy introduced an online licensing system for market and exhibition organizers in Lebanon.

Yet all these are remnants of what other governments in the region and globally were doing in the early 2000s. Previous discussions on a CBDC launch and regulation of crypto have never seen the light.

Lebanese Ministry of Health dabbles with Blockchain

The only Ministry that has dabbled with Blockchain has been the Lebanese Ministry of Health which launched MediTrack back in December 2021. The first phase was used to track medicine for Cancer and chronic illness patients whose treatment is costly. Twenty hospitals from across Lebanon attended the training at Rafic Harriri International Hospital.

Minister Abyad in a statement at the time,” The MediTrack Solution will first be utilized for medicine related to high cost treatments such as cancer and other chronic diseases. It is essential in tracing the movement of medicine and will decrease the effects of the financial crisis that Lebanon is going through because it will stop the smuggling of medicine across the border as well as stop the storage and monopolization of these medicines ensuring it gets to the patient and only the patient.”

The Minister noted that this was carried with support of World Health Organization and European Union. In September of 2021, The Lebanese Ministry of Public Health signed a five year agreement with rfxcel, part of Antares Vision Group a solution provider in digital supply chain traceability solutions, to provide a Blockchain enabled GS1-compliant traceability hub to protect the entire pharmaceutical supply chain in the country. The Blockchain enabled solution will be implemented by rfxcel’s partner Medical Value Chain (MVC), the Bahrain subsidiary of US-based AVC Global. MVC

The Future of Lebanon will depend on Blockchain, AI, and datacenters

Future of Lebanon depends on receiving investments from around the globe and the region, and for this to happen, the Lebanese government has to show not only an appetite for reforms, but also a platform that brings transparency and trust. Once again Blockchain, AI, datacenters, become the only relevant solution to bureaucracy corruption and favoritism.

Smart contracts, public access to information on the blockchain, digital asset payments either in CBDCs or stablecoins will eliminate the waste, bureaucracy and corruption that has crippled the Lebanese state for decades, as well as restore trust and confidence in the political and governmental operation of the country.

Anything less than that will not be accepted as the United States and countries in the GCC and Arab world embrace blockchain, AI, digital assets, and the future.