Saudi Central Bank better known as SAMA in a recent SEC ( Securities and Commodities Exchange) 13F filing has disclosed that it has invested and holds 25,656 shares in MicroStrategy Inc. For those not familiar with MicroStrategy, now known as Strategy, it is an award-winning AI (Artificial Intelligence) and Business Intelligence platform trusted to deliver intelligence everywhere, on any cloud, at enterprise scale.

It is also one of the biggest buyers of Bitcoin. Its strategy has been to issue equity, debt and preferred stock to acquire the digital currency, and it has been on a buying spree. Its Bitcoin holdings have more than doubled since Sept 2024, when it held 252,200 coins. It had about 447,000 coins at the end of 2024. Now, MicroStrategy owns 568,840 bitcoins as of May 12, 2025.

Its CEO Michael Saylor in an interview on Al Arabiya encouraged countries like Saudi Arabia, Qatar, UAE, and Kuwait to purchase Bitcoin as well. In the Al Arabiya English interview with Hadley Gamble, he works to convince the globe on why Bitcoin is the center of the AI economy, and why countries including KSA, Kuwait, Qatar, and UAE as well as the rest of the world should buy Bitcoin. He then states that GCC region with its low taxation, its digital asset regulations, and its trusted banking sector could become the trusted digital asset custodians for the digital economy.

MicroStrategy states the average purchase price as $66,384.56 USD per bitcoin with a total cost of $33.139 billion USD.

Now, Saudi Central Bank, has indirectly become an investor in Bitcoin with its 25,656 Shares in MicroStrategy.

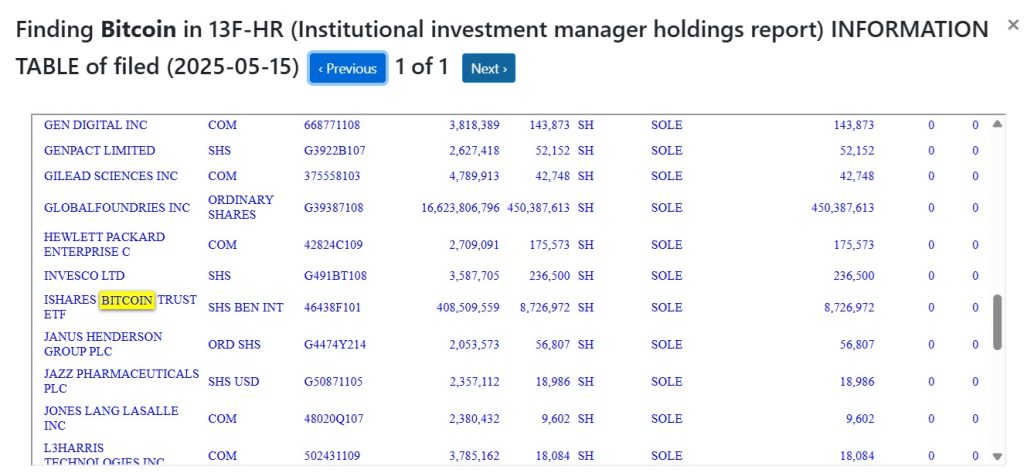

The Saudi Central Bank is not the first with exposure to Bitcoin. Prior to this Mubadala Fund of UAE invested in Bitcoin ETF with BlackRock. More recently Mubadala increased its investment in Black Rock’s Bitcoin ETF. It now holds a $408.5 million stake in IShare Bitcoin Trust (IBIT). While MGX, UAE sovereign Fund and a big investor in AI, recently invested $2 billion into Binance.

Even Bahrain based Al Abraaj Restaurants Group B.S.C. (Ticker: ABRAAJ) (“Company”), a public listed company on the Bahrain Bourse, has announced that it put Bitcoin on its balance sheet. The Group has purchased Bitcoin in partnership with U.S. based 10X Capital, becoming the first publicly traded company in the Kingdom of Bahrain, the Gulf Cooperation Council (“GCC”), and the Middle East to acquire Bitcoin as a treasury asset.

While Saudi Arabia has yet to come out with its crypto regulation, it has been investing heavily in Web3 technologies, including AI, Blockchain and others. Could this be the beginning of an opening up to crypto after the United States seems to have changed its stance on the asset, or just another AI investment? It just might be both!