Qatar backed London based Qan platform is taking the Blockchain conference scene by storm. the QAN platform will be attending both the Paris Blockchain Week, from April 9th-11th and then will be off to Dubai UAE for Blockchain Life 2024 on April 15th and 16th, followed by Token 2049 on April 18th and 19th.

UK QANplatform, the quantum-resistant Layer 1 blockchain, received $15 million investment from Qatar investment company MBK Holding. In September 2023, MBK holding publicly expressed their support for QANplatform.

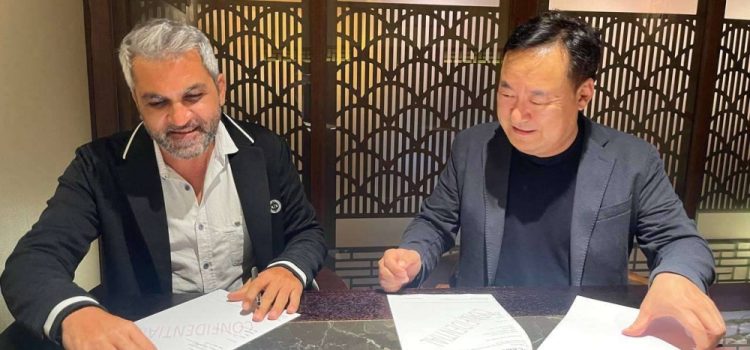

The Qan platform is one of the blockchain platforms being supported by Qatari investors and enterprises. Maxya Blockchain platform developed by Genesis technologies has been supported by Qatar University as well as QFC ( Qatar Financial Center). Recently the Qatar Blockchain startup, Genesis Technologies partnered with South Korean Blockchain company CP Labs.

The Qatar Central Bank( QCB) sets to attract Big Tech and Fintech entities in the fields of Blockchain, AI, Tokenization, Digital assets and crypto to the country.

As per its third financial sector strategy launched by HE Prime Minister Sheikh Mohamed Bin Abdulrahman Bin Jassim Al Thani, the Qatar Central Bank recommended enhancing financial inclusion, measures to facilitate building a world-class shared market infrastructure and establishing a financial technology talent center of excellence.