UK QANplatform, the quantum-resistant Layer 1 blockchain, receives $15 million investment from Qatar investment company MBK Holding. In September 2023, MBK holding publicly expressed their support for QANplatform.

The QANplatform unveiled its private blockchain on September 12th 2023. The platform which is both quantum resistant and compatible with Ethereum’s EVM received support from Qatar ruling family member H.E. Sheikh Mansoor Bin Khalifa Al Thani. In a privately held partner event prior to the public launch of QANplatform, H.E. Sheikh Mansoor Bin Khalifa Al-Thani, Member of the Qatari Ruling Family, Chairman of MBK Holding, and former ICT Director for The Council of The Qatar Ruling Family Affairs stated, “We always evolve but not everyone leads the way. I’m proud to support the introduction of a cutting-edge deep tech project, such as QANplatform, in the Gulf region and on the global market.”

Today MBK holding has gone a step further and announced their $15 million investment in QANplatform days before the launch of its testnet.

MBK Holding, an investment holding company with its main office in Qatar and a subsidiary in the United Kingdom, focuses on investing in technology startups. The Founder and Chairman, H.E. Sheikh Mansoor Bin Khalifa Al-Thani, member of the Qatari ruling family, formerly served for a decade as the director of information technology for The Council of The Qatar Ruling Family Affairs.

In addition MBK Holding will offer growth services to facilitate global market access and expansion for QANplatform. MBK Holding’s focus extends to various regional markets, including Qatar, Saudi Arabia, United Arab Emirates, Turkey, and United Kingdom while also encompassing other global opportunities.

H.E. Sheikh Mansoor Bin Khalifa Al-Thani, Founder and Chairman of MBK Holding commented, “MBK Holding proudly backs QANplatform, the game-changing quantum-resistant blockchain platform and nominates Johann Polecsak as the Director of Blockchain of MBK Holding. Blockchain technology in general, is still an untapped area with many opportunities and potential to transform entire value chains, sectors, and business processes. As a deep tech startup, QANplatform can lead the next wave of blockchain platforms with its remarkable features, including multi-language smart contracts and quantum-resistant security. QANplatform is a great fit for our portfolio and partner companies to discover and benefit from the potential of its technology.”

Johann Polecsak, Co-Founder and CTO of QANplatform added, “Working alongside MBK Holding and their team is truly an honor. QANplatform is driven by the vision of creating the safest and most user-friendly blockchain platform, enabling the development of numerous real-world robust applications that bring tangible value to various industries.”

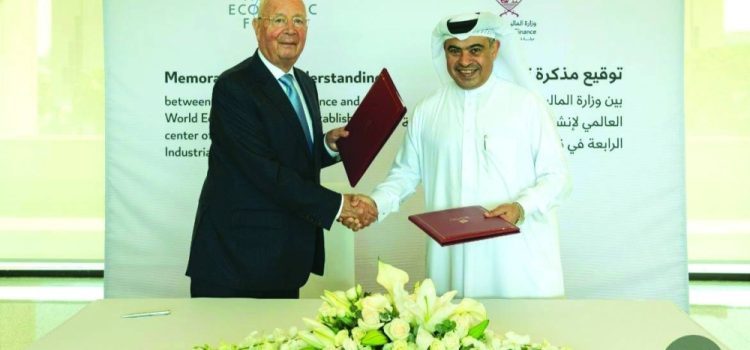

MBK Holding recently signed a strategic partnership with the Ministry of Investment of Saudi Arabia to support entrepreneurial growth and innovation in Saudi Arabia by developing growth services that seek to create market-leading investment opportunities.

QANplatform will be the first EVM-compatible, quantum-resistant Layer 1 hybrid blockchain platform where developers can code smart contract, DApp, DeFi, DAO, token, NFT, Metaverse, CBDC, tokenized asset, and robust Web3 solutions on top of the QAN blockchain platform in any programming language.

As a hybrid blockchain, QANplatform will have a private and public blockchain as well. In September 2023, QANplatform marked a new era of Web3 OS (Operating System) with the launch of the QAN Private Blockchain. QANplatform has unveiled the world’s first private blockchain that is both quantum-resistant (using NIST primary recommended post-quantum algorithm), and compatible with Ethereum’s EVM, while also enabling developers to code smart contracts in any programming language.

QANplatform’s ecosystem is building up with renowned companies such as Hacken, Beosin, or Alpine Esports. In February 2023, Alpine Esports, a Group Renault brand, and inter alia in the Formula 1® Esports Series signed QANplatform as its Official Blockchain Partner. In September 2023, QANplatform was selected to the Ernst & Young Startup Program as one of the nine selected promising startups in the technology and finance sectors, chosen from among hundreds of applicants globally.

This announcement comes as Qatar enters the blockchain era, with the launch of its digital assets lab, as well as partnerships with R3, Settlemint and others.