On Sunday October 29th, Qatar announced one of the biggest digital assets initiatives in the country and the GCC region, the Qatar Innovation Dome for digital assets. As per the live event keynotes, the digital assets lab will develop tokenization platforms and ecosystems for everything that has value whether tangible assets or intangible assets including real estate assets, securities, Sukuk, bonds and others in the future utilizing DLT ( distributed ledger technologies), blockchain, and smart contracts.

Present at the launch was His Excellency Sheikh Bandar bin Mohammed bin Saoud Al-Thani, Governor, Qatar Central Bank, and His Excellency Sheikh Mohammed Bin Hamad Bin Qassim Al-Abdullah Al-Thani, Minister of Commerce and Industry.

Bandar bin Mohamed bin Saud Al-Thani, The Governor and Chairman of the Board of Directors of Qatar Central Bank noted in his speech, “ It is my pleasure to be at the launch of the Digital Assets Lab where as a country we are working to discover new tools to increase, enhance our competencies and capabilities in the digital sector. We have achieved strides in digital technology through a number of initiatives chief among them is electronic KYC ( Know your Customers) ad are working to develop and establish an ecosystem for startups and new companies to enhance the role of KYC.”

He added, “We are encouraging entrepreneurship as part and parcel of new financial technology strategy with local, regional and international customers with initiatives such as blockchain and digital assets. These are steps in the direction with initial modules for digital assets, modern databases, and increased internet speed as such as welcome collaboration for the sustainable development of the state of Qatar.”

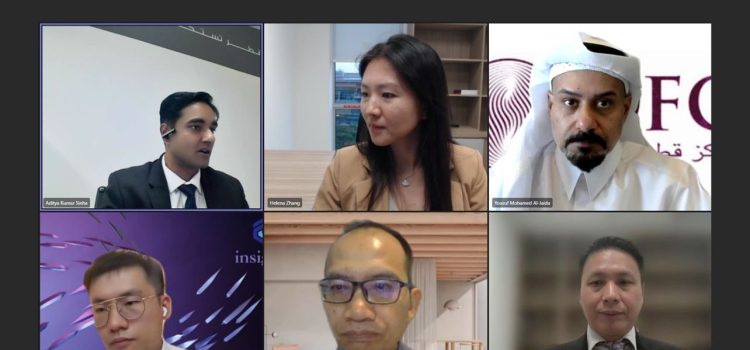

Yousuf Mohamed Al-Jaida Board Member and Chief Executive Officer of Qatar Financial Centre in his speech offered a detailed explanation on the technology relevant to this lab, the benefits, pillars and the coding system and tokenization process. He explained, “The digital assets projects leans on three Qatar National strategies, the Qatar National Vision 2030, the Qatar Financial Center strategy and the fintech strategy of the state of Qatar, which aims to make the country a financial commercial hub 2030.”

He explained, “Tokenization is the process of creating tokens that represent tangible and intangible assets using DLT. The tokens could represent tangible assets such as real-estate or intangible assets such as securities. We will also work on fractionalization of assets, and will allow property to be part of those tokenized assets democratizing the process of investment.”

He added, “Smart contract, which are self-implementing contracts built on cryptographic programming systems, will allow the transfer of property, in distributed format.”

He discussed how DLT is an innovative technology that registers transactions, and can be expanded to include investment opportunities. As per Al Jaida, in the first phase tokenization will verify property, second will entail economy of tokens, third will entail development of smart contracts and the application which will manage these digitized tokens after which they will be offered on secondary markets.

As per the objectives of the digital assets lab, it will reinforce innovation and research as well as the establishment of DLT enabled startups, and companies, helping participants transform their ideas into tangible reality. Al Jaida states, “Participants in the digital assets lab will have three to six months to test their ideas, where they will have to meet feasibility requirements, benefits towards fintech ecosystem in Qatar before they graduate.”

The Digital asset lab will offer technology support, operational support, where startups and companies can cooperate with experts, regulators, test their use cases and register their businesses and receive licenses, offering the support from pilot to company formation allowing them to operate in Qatar’s fintech ecosystem.

Al Jaida announced that one of the first use cases to be explored within the digital assets lab will be tokenized carbon assets. He goes on to state, “Secondly will be tokenizing private company shares to facilitate trading and management of these shares, as well as transforming Sukuk bonds into digital assets in addition to tokenized real estate to facilitate the buying and selling of real estate assets.”

He called for continuous suggestions on what else can be tokenized moving forward as well as input into the regulations for digital asset ecosystem.

He then announced the name of the lab, which is the “QFC Innovation Dome”

Michael G. Ryan, the Chief Executive Officer at Qatar Financial Center Regulatory Authority, believes that the digital asset economy has a transformative nature and cooperation will be essential because as promising as it is, it also faces challenges.

He believes that with the equilibrium between innovation and regulatory oversight, confidence and trust will prevail among investors and firms. This is why the digital assets framework that QFCR has developed requires the engagement of all participants. He called for feedback on the digital assets public consultation paper announced in early October 2023, which will be open until January 2nd 2024, as these feedback will play a strong role in their policy decisions.

One of the Blockchain entities participating in QFC Innovation dome is R3. Bryan D’Souza Strategic Alliances & Partner Ecosystem Lead for EMEA at R3 stated in a comment made on the live LinkedIn event, “R3 is proud to be partnering with the QFC for this exciting Digital Assets Lab initiative.” Settlemint Blockchain is also one of the participants.

Prior to this The Qatar, Ministry of Finance, signed an agreement with the World Economic Forum (WEF) to establish a “Centre of Excellence for the Fourth Industrial Revolution” in Qatar that will help to foster an environment for research and development in technologies that include AI ( artificial intelligence), blockchain, IoT (Internet of Things), renewable energy and others.