Virtual asset trading and cusotial service platform M2 has been granted a Financial Services Permission (FSP) license in the Abu Dhabi Global Market (ADGM) from the Financial Services Regulatory Authority (FSRA). M2 is approved to operate a multilateral trading facility and offer custody services to UAE residents.

M2 will be able to offer institutional and retail clients in the UAE the ability to buy, sell and custodies virtual assets. The platform has been developed over the past year with a long-term vision to establish the highest levels of trust, security, and integrity in the emerging virtual asset class.

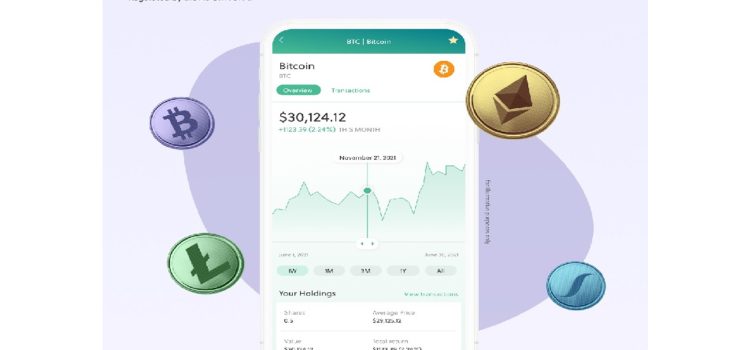

Subject to regulatory approval, the M2 platform is scheduled to launch later this year, offering UAE virtual asset investors the opportunity to purchase market-leading virtual assets (BTC and ETH), and benefit from institutional grade trading features in addition to having a secure on and off-ramp for fiat payments.

Stefan Kimmel, M2 CEO, said, “The M2 team is delighted to have received confirmation of the ADGM FSRA license as it represents the approval of one of the most sophisticated and respected regulators in the world. The process of obtaining the license is the first step on our journey and we will remain in close dialogue with ADGM to ensure transparency around the custody of client assets.

He added, “Over the past five years the ADGM regulatory framework has established clear rules for those operating in the virtual assets sector and M2 will uphold the highest standards to reflect their vision as the UAE continues to affirm its reputation as a global leader in this space.”

Salem Al Darei, Chief Executive Officer of ADGM Authority, commented, “We are delighted to welcome M2 to ADGM’s international virtual asset community, further solidifying ADGM’s position as a leading International Financial Centre and a catalyst for business expansion. At ADGM, our mission has always been centered around unlocking new growth opportunities and fostering investments in the virtual assets sector. This has been possible through the establishment of a robust and forward-looking regulatory framework for digital assets. By integrating companies like M2 into our ecosystem, we remain committed to enhancing Abu Dhabi’s digital asset landscape and actively supporting the diversification of our thriving economy.”