In Ripple’s latest report entitled “ 2023 New Value report, Crypto Trends in Business and Beyond” which covered topics such as cryptocurrencies, tokenization, DeFi, and crypto custody, financial decision makers from MENA ( Middle East and North Africa) are more bullish than their counterparts in other regions when it comes to cryptocurrencies, digital assets, and Blockchain.

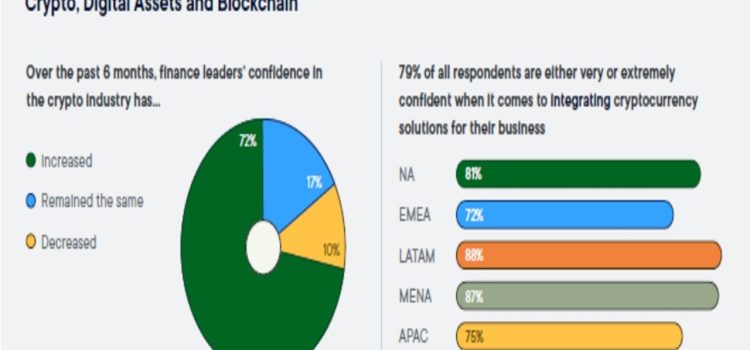

As per the report findings, 72% of finance leaders surveyed expressed increased confidence in the crypto industry over the last 6 months, the number is even higher for those in the MENA region, reaching 87%.

90% of global finance leaders anticipate big impacts on business from blockchain and digital assets in the next three years. In terms of tokenization,they see the most massive impact in public stock trading and private share trading. This was especially expressed by finance decision makers with cryptocurrency experience in MENA.

In addition, global finance decision makers predict CBDCs and stablecoins will have a massive impact across business, finance and society. This sentiment is particularly strong among those with cryptocurrency experience, and those based in the LATAM and MENA regions.

When the Ripple report compared these results to last year’s survey, they saw that no only do more respondents expect significant or massive impact of digital currency on business, finance and society,but they expect this to happen within a shorter period of time.

In other words, impact from these digital currency technologies is and will continue to accelerate at a faster clip. Specifically, respondents appear particularly bullish on the overall impact of digital currencies on payments. Nearly half (46%) of all respondents think stablecoins will have the largest impact on cross-border payments, and anticipate the largest impact of CBDCs to be on consumer-to-business payments (39% of financial institutions) and cross-border payments (41% of enterprises).

Many are either somewhat or very likely to begin using cryptocurrencies, CBDCs or stablecoins in their business in the next three years, and are confident that the technologies can meet their business needs. Once again, Ripple saw that respondents in LATAM and MENA ranked slightly higher than those in other regions, and particularly those decision makers at financial institutions who work in roles related to digital transformation, blockchain/cryptocurrency, and innovation.

Overall, Latin America (LATAM) is more bullish on enterprise and institutional use of crypto for business followed by the Middle East and North Africa (MENA), then North America (NA), Asia Pacific (APAC) and Europe, Middle East and Africa (EMEA).

The report also noted that more financial institutions are interested in instituational DeFi due to pain points around borrowing, raising capital which many see that DeFi can help solve. In addition high interest rates currently outweight other borrowing related pain points by a pretty significant margin everywhere except in MENA, where credit approval requirements were ranked as the primary pain point.

According to the report, these findings are reflective of the current state of the global economy, and that’s reinforced when one compares these results to last year’s data when interest rates were lower, and thus ranked lower on the list at that time.

Another significant technology being looked into by financial decision makers is Decentralized digital identity (DID). The vast majority (90%) think DiD will have a significant or massive impact on Banking, Financial Services and Insurance in the next three years, especially finance leaders in LATAM and MENA.

Even those in treasury, capital markets, payments, and institutional banking are bullish on the technology as it pertains to Banking and Financial Services, falling within the 90% response rate and above for significant or massive impact. Surprisingly, finance leaders in those more traditional roles ranked slightly higher than those in innovation, which is somewhat counterintuitive.

When it came to crypto custody the report found that while a greater proportion of respondents at financial institutions (compared to their enterprise counterparts) currently use crypto custody in their business, in general across all respondents it was found that a total of 35% are currently using a custody solution and 54% plan to within the next three years. Additionally, most companies currently or planning to use crypto custody will do so via a managed custody approach outsourced to a third party.

The vast majority of global finance decision makers (upwards of 88%) believe that crypto and blockchain will have either a significant or massive impact on business, finance, and society over the next three years.

Over half of global respondents cited that they already have a cryptocurrency solution in place at their company, or are in the process of implementing one. Upwards of three-quarters indicate an openness to using or exploring other crypto technologies over the next few years (e.g. CBDCs, stablecoins,NFTs, etc.)

Despite the general positivity, uncertainty and barriers to adoption like privacy concerns, lack of clear regulation, risk management and price volatility are still present.

Cross-border payments and consumer-to-business payments are the top two most highly ranked use cases for both CBDCs and stablecoins.

Enterprises are particularly bullish on the use of NFTs for business in the metaverse and events/ticketing. Over 80% of global finance leaders are somewhat or very likely to use cryptocurrencies, CBDCs and/or stablecoins in their business in the next three years.

Ease of use is far and away the most important requirement for organizations to enable customers to pay with crypto. Faster payments/settlement times and cost savings are the biggest value propositions for incorporating crypto into cross-border payments for enterprises and payments/treasury professionals at financial institutions—regardless of region and level of familiarity with crypto.

Top reasons to hold a cryptocurrency are for use as a currency for making payments, and for use as a hedge against inflation. Interest rates and cost-related concerns are key blockers for borrowing, raising capital, and making cross-border payments.

According to a survey of global institutional clients commissioned by BNY Mellon and conducted by Celent, 97% agree that tokenization will revolutionize asset management and be good for the industry. They also found that 88% of investors are comfortable utilizing a digital representation of currency like stablecoins or tokens.

The majority (72%) of finance decision makers expect to explore tokenization as a way to drive innovation over the next three years, especially those at financial institutions who currently have or are in the process of implementing a cryptocurrency solution at their organization.

In terms of assets that would benefit the most from tokenization 63% of respondents said online security of data, 50% said stocks.