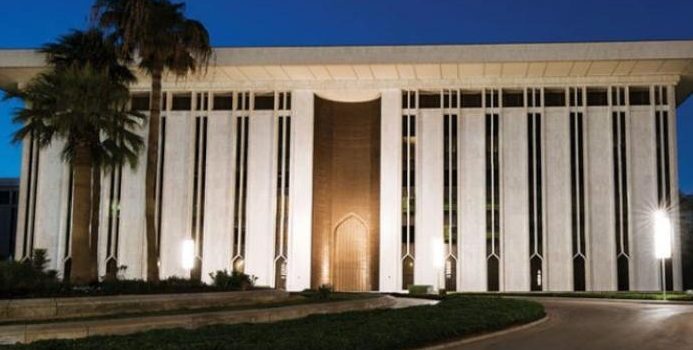

As the BIS (Bank for International Settlements) announced that it had reached a minimum viable product stage, Saleh Algrayan, AI Advisor at Bank for International Settlements and an employee of Saudi Central Bank, announced that Saudi Central Bank had now joined mBridge. Saudi Arabia’s Central Bank becomes the second Arab central bank to join after the UAE Central Bank.

Saleh Algrayan noted on LinkedIn, “I am immensely proud to announce that the Saudi Central Bank – SAMA has joined Project mBridge as a full participant, coinciding with the project reaching its minimum viable product (MVP) stage! As a dedicated SAMA employee and Advisor at the Bank for International Settlements – BIS Innovation Hub (BISIH) – Hong Kong Centre, I am honoured to be part of this revolutionary journey.”

He adds, “Project mBridge, leveraging advanced distributed ledger technology (DLT), aims to transform cross-border payments by addressing high costs, slow speeds, and operational complexities. This collaborative effort, starting in 2021 with partners like the Bank of Thailand, UAE Central Bank, Digital Currency Institute of the People’s Bank of China, and the Hong Kong Monetary Authority, now includes over 26 observers.”

He added, that SAMA’s participation marks a significant step forward, demonstrating the kingdom’s leadership in global financial innovation. He concluded, “We are paving the way for efficient, cost-effective, and instant cross-border transactions, addressing financial inclusion and making payments universally accessible.”

The Saudi Central Bank had previously participated in a CBDC project with the UAE under the name of ABER.

The announcement followed BIS press release where it invited private sector participants to propose value-added solutions that can be connected to the mBridge MVP platform.

The press release noted, “Project mBridge is the result of extensive collaboration starting in 2021 between the BIS Innovation Hub, the Bank of Thailand, the Central Bank of the United Arab Emirates, the Digital Currency Institute of the People’s Bank of China and the Hong Kong Monetary Authority. The Saudi Central Bank is joining mBridge as a full participant. There are also now more than 26 observing members. More central banks and commercial banks can join the platform through the mBridge MVP legal framework and perform real transactions on it. Project expands international cooperation with a new full member and observers.”

The project aims to explore a multi-central bank digital currency (CBDC) platform shared among participating central banks and commercial banks, built on distributed ledger technology (DLT) to enable instant cross-border payments and settlement.

Project mBridge was the result of extensive collaboration starting in 2021 between the BIS Innovation Hub, the Bank of Thailand, the Central Bank of the United Arab Emirates, the Digital Currency Institute of the People’s Bank of China and the Hong Kong Monetary Authority. The Saudi Central Bank is joining mBridge as a full participant. There are also now more than 26 observing members.

The project aims to tackle some of the key inefficiencies in cross-border payments, including high costs, low speed and operational complexities. It also addresses financial inclusion concerns, particularly in jurisdictions where correspondent banking (which connects countries to the global financial system) has been in retreat, causing additional costs and delays. Multi-CBDC arrangements that connect different jurisdictions in a single common technical infrastructure offer significant potential to improve the current system and allow cross-border payments to be immediate, cheap and universally accessible with final settlement.

A platform based on a new blockchain – the mBridge Ledger – was built to support real-time, peer-to-peer, cross-border payments and foreign exchange transactions. In 2022, a pilot with real-value transactions was conducted. Since then, the mBridge project team has been exploring whether the prototype platform could evolve to become an MVP – a stage now reached.

Four-founding participant central banks and monetary authorities have each deployed a validating node, while commercial banks have conducted more real-value transactions in preparation for the MVP release. In tandem, the project steering committee has created a bespoke governance and legal framework, including a rulebook, tailored to match the platform’s unique decentralized nature.

The MVP platform is enabled to undertake real-value transactions (subject to jurisdictional preparedness) and is also compatible with the Ethereum Virtual Machine. This allows it to be a testbed for add-on technology solutions, new use cases and interoperability with other platforms.

It is noteworthy that Qatar Central Bank recently launched its CBDC project for settling large payments with local and international banks.