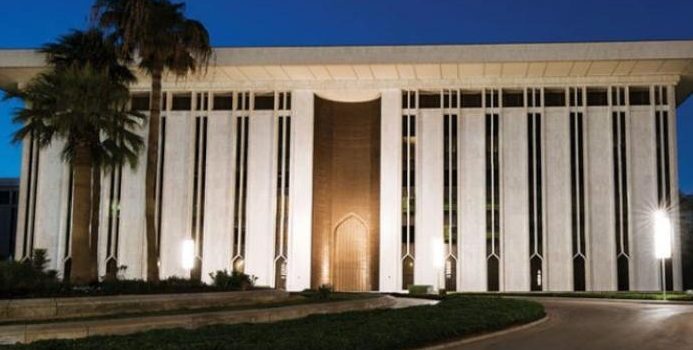

The Saudi Central Bank, Saudi Capital Market, and Financial sector Development Programme (FSDP) will be hosting 24 Fintech conference and exhibition in Riyadh KSA. The co organizer Fintech Saudi and Tahaluf aim to elevate Riyadh’s fintech ambitions. The event will be held at Riyadh Front exhibition and Conference center from September 3-5 2024.

Tahaluf, the strategic collaborative venture between Informa PLC, the Saudi Federation for Cybersecurity, Programming and Drones (SAFCSP), and the Events Investment Fund (EIF), created 24 Fintech to showcase a collective commitment towards unlocking business and networking opportunities, embracing change, and leading innovation. The three-day event will combine an exhibition and summit – featuring 175 hours of expert-led content – with a host of satellite events, including industry gatherings and brand activations, running throughout the week, from September 1-6.

With the goal of establishing the Kingdom as a tech-driven global financial powerhouse, and Riyadh as an international fintech hub, Tahaluf has set ambitious objectives for 24 Fintech. The event aims to become the most influential, and impactful fintech business event, platform, and community anywhere in Asia, Europe, Middle East and North Africa.

Bolstered by an international summit that will unite regulators, financial services professionals, policy makers, investors, technologists, and academics, 24 Fintech will provide a platform for global industry stakeholders to shape, foster, and spur a collaborative fintech transformation.

Initial Tahaluf estimations project the inaugural 24 Fintech will attract upwards of 25,000 attendees, 300 exhibitors, 200 investors and 80 fintech startups. The show will host more than 200 expert speakers to address pressing finance industry issues as the show looks to navigate the immense technological changes impacting operations, from infrastructure provision to client servicing. Targeted attendees include central bank governors, regulators, policy makers, financial and non-financial institutions, big tech providers, investors and venture capitalists, academics, researchers, as well as professional and industry associations.

“Our vision is to drive forward finance by bringing together essential stakeholders and propelling practical, worldwide transformation in alignment with the economic development agenda laid out in Saudi Arabia’s Vision 2030,” said Annabelle Mander, Senior Vice President of Tahaluf.

The inaugural edition of 24 Fintech will feature four stages hosting three days of programming including keynotes, panel discussions, and industry announcements, with dedicated areas for investment and startups, technology, and academia. Across the various stages, experts will probe a host of themes including governance, regulations, interoperability, investment and reimagining the financial services landscape.

In addition to the main and feature stages, the show will host special initiatives – including the Regulators’ Village, a dedicated zone connecting regulators and fintech who aspire to set up in the Kingdom. The inaugural 24 Fintech will also offer a dedicated investor program with an exclusive stage and lounge, as well as Venturescape, pre-show initiative that will bring together 200+ global investors and 100+ fintech for a series of workshops, mentorship and pitch practice.

A specific startup zone will spotlight 80 of the top global fintech companies, across all major fintech verticals including, but not limited to, payments, lending, insurtech, regtech, capital markets, compliance and open banking. Aspiring startups can take advantage of tailored mentorship and matchmaking sessions as well as a 24 Fintech pitch competition. The top startups will battle it out in timed pitch heats, culminating in a grand finale with more than SAR 900,000 (US$250,000+) in equity free awards.