Deep Knowledge Group, pioneers of big data analytics system and dashboard solutions have published a report on the top 100 tech investors in the UAE of which 4.6% of their investments are in blockchain technology while 2.9% are in Artificial Intelligence and machine learning.

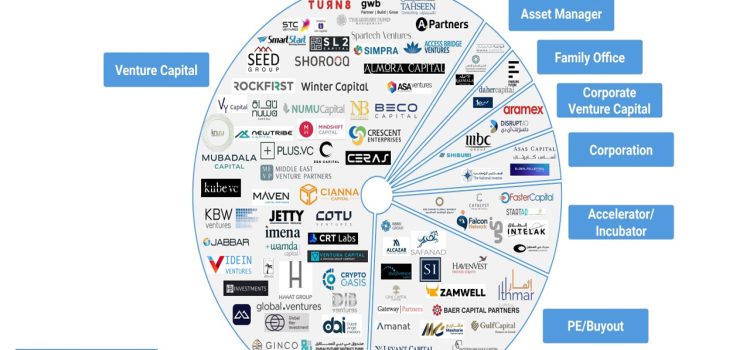

The report makes several findings which include that 50% of the top 100 tech investors are venture capital entities with some of the well known blockchain investors including Crypto Oasis, Shurooq Partners, Seed Group, DisruptAD, Ghad Capital Parners, Mubadala and Ceras Ventures.

More than 50% of the top Tech investors are based out of Dubai UAE with 29% of their investments going to the Middle East startups, 17% going to GCC based entities and 18% in Africa.

74% of the top 100 tech investors have invested less than $10 million per deal, while only 11% have invested over $50 million.

In the last 12 months, Kube VC was the most active in terms of investments which totaled 48, followed closely by Maven Capital with 47 investments, and UAE Ghaf Capital making 20 investments.

The data from the report was gathered from all types of funding rounds, non-equity assistance, investors performance and characteristics were collected and analyzed according to various parameters set forth in Deep Knowledge Group evaluation criteria methodology.

The top 100 Tech investors in UAE have been selected based primarily upon the following criteria, ● number of investments made in DeepTech Companies; potential for equity and non-equity financing (lead investors in seed/venture rounds); Investors overall background, intangible assets and philosophy; investor investment activity; % of successful investments; and Investment impact on the company.

Within the framework of the given research, data related to over 3,000 investment deals, concluded by top 100 UAE tech investors, were collected. The share of deals concluded in 2022 constituted circa 20% of the total number of investment deals.

Data related to 2,600 portfolio companies, 77% of which are among active portfolio companies, has been gather and evaluated according to the ranking framework as well.

Prior to this report, LaraontheBlock issued a survey in early January 2023 entitled “MENA Investor Survey 2022-2023 for crypto Blockchain sector” found that 50% of those surveyed stated they will be allocating more funds to blockchain and crypto projects and entities in 2023. 19% of those surveyed stated in 2022 they had invested more than 50% of allocated capital and funds into crypto and Blockchain projects.

In June 2023 GCC (Gulf Cooperation Council) and MENA based Investcorp, a global alternative investment firm has led a $15 million investment round for BitMe a Spanish crypto exchange. Included in the list of investors was Telefonica Ventures, Stratminds VC, Cardano, and YGG Fund.While just this week, UAE based Global Millennial Capital Ltd (“Global”), an emerging technology and digital assets investment manager, and venture capital firm launched its Global Millennial Web3 Investment Program, out of UAE which aims to accelerate emerging companies to their full potential in the realm of Web3, DeFi, and Blockchain.