UAE based Allo.xyz, a blockchain platform for AI Agent Funds and Real World Assets with $2 billion+ in tokenized assets, which received a $100M credit facility backed by Bitcoin has been accepted into Qatar’s Digital Assets Lab, bolstering its presence in the crypto lending sector.

Allo xyz has participated in Binance Labs and BNB Chain’s MVB Accelerator program and tokenized $2.2B in assets on BNB Chain. The company seeks to tokenize $1 trillion assets by 2030.

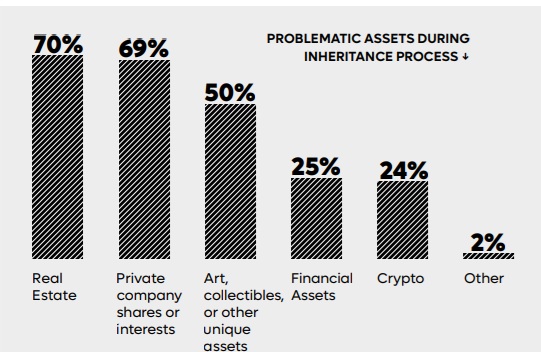

RWA tokenization is the process of converting rights to a real-world asset into a digital token on a blockchain. These assets can include real estate, art, commodities, or even intellectual property. By tokenizing these assets, we bridge the physical world and the digital realm, enabling fractional ownership, increased liquidity, and more efficient trading.

In 2025, the concept of tokenization has seen remarkable growth, the growth trajectory suggests that the RWA tokenization market could potentially reach a staggering $30.1 trillion by 2034.

“We’re projecting a very strong Q4 this year. Stablecoins are about $200 billion. In TVL, we have treasuries at about a few billion dollars. Private credit at about $10 billion. Treasuries, stablecoins, and private credit are early movers in the space, and we’ll see a continuation of that,” said Kingsley Advani, Founder and CEO of Allo XYZ told BeInCrypto in a recent article.

So far the Qatar Digital Assets Labs has accepted, Accelerated Sustainable Materials Discovery, Alt DRX a Digital Real Estate Exchange, ArcaX, Asset Share, Audteye, Blade Labs, BlockStead, FinRock, DMZ, evergon, FalconNest Labs, iTOO technologies, mintus, oori, partier, Polygon, Proptech, Scie NFT, SettleMint, SeedraChain, Skarguard Taurus, xALTs, Verity, SurferMonkey, Ryzer Doha Digits, Hacken, Root VX, DAVID and Stobox.