US blockchain deposit token infrastructure provider which ues Corda by R3 to bring CBC deposit token infrastructure , Fluent Finance has expanded into the MENA region with the opening of its operations in Abu Dhabi, UAE under the new name, Fluent Economic Bridge. Fluent Finance will offer trade finance and cross border payments with the support of UAE Ministry of Economy.

Fluent Finance’s new UAE entity, named Fluent Economic Bridge, will be focused on deposit token infrastructure, promoting cost-effective and borderless trade finance between Abu Dhabi banks and global markets. The company is currently procuring a trade license from Abu Dhabi Global Market (ADGM), an integral part of Fluent’s mission to offer dependable digital asset services to its UAE partners and the global trade community.

On twitter, Fluent Finance stated, “ We’ve expanded into the MEA region, setting the stage for the next chapter in UAE’s FinTech innovation, delivering our leading-edge deposit token infrastructure to Abu Dhabi.”

They add, “ The newly formed Fluent Economic Bridge in the UAE is central to this initiative. We’re set to enable cost-effective, borderless trade finance between Abu Dhabi banks and global markets, contributing to the UAE’s global trade expansion. Deposit Tokens will herald the next chapter of UAE’s Fintech Innovation, transforming trade finance and improving cross-border settlements.”

Fluent Finance is a US-based blockchain development and fintech company that is building deposit token infrastructure to help bring trade finance on-chain. Fluent’s primary product is Plus, a stablecoin backed by a consortium of banks to ensure reliable and verifiable liquidity. Fluent aims to connect DeFi and TradFi without sacrificing the core tenets of Web3.

Fluent Finance’s CEO, Bradley Allgood, has meticulously evaluated jurisdictions worldwide before deciding on UAE as the prime location for Fluent’s expansion. He has offered his insights across multiple roundtable discussions organized by Hub71 to optimize the regulatory sandbox for global trade finance and payment infrastructure.

“The UAE has positioned itself as a global leader for digital assets through their special economic zone initiatives, regulation foresight, and global trade expansion with strategic Memorandums of Understanding (MoUs)”, says Allgood. “We use Corda by R3 as our enterprise layer to bring CBDC-compatible deposit token infrastructure for borderless payments, complementing the UAE as they lead the charge on digital transformation.”

He adds, “I am very much looking forward to seeing deposit tokens improve trade throughout developing regions. With transparent and borderless settlement available to any wallet in the world, those most affected by war or climate change with soul bound tokens could get immediate delivery of aid around the clock, any day of the year.”

Deposit tokens, a novel form of digital assets, offer an innovative alternative to conventional stablecoins. Unlike stablecoins, which are pegged to traditional fiat currencies, deposit tokens are backed by actual deposits and issued by banks, offering more transparency, security, and stability to users.

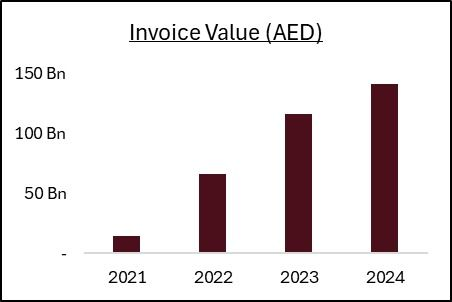

The recent Memorandums of Understanding (MoU) between the UAE and other global partners like India and China marks a significant milestone in fostering a closer financial relationship between the nations. These MoUs account for more than $100 billion in bilateral trade, with a focus on strengthening the use of new technologies and settlement with digital currency. Deposit tokens issued by commercial banks are poised to offer a borderless missing link to accelerate trade settlement to CDBC.