As the popularity of crypto rises not only globally but in the UAE, a recent DIFC Innovation Hub, Julius Baer, and Euroclear report entitled “Navigating the Future of Inheritance” found that one of the most problematic assets to transfer as part of inheritance is crypto assets.

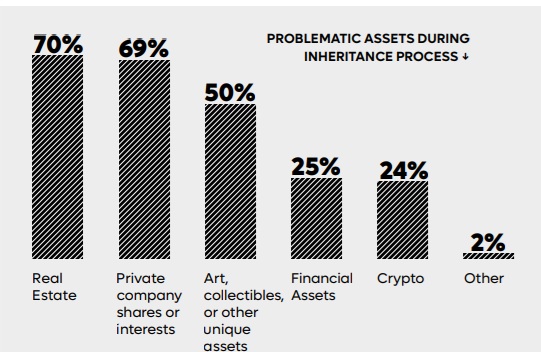

According to the report 24% of global wealth owner respondents cited crypto assets as problematic during the transfer process, while in the Middle East region, it was higher at 29%. The typical HNWI’s ( High Net Worth Individuals), estate is spread across more accounts and more documents globally than ever, many of which lie outside of the core responsibilities of the region’s wealth managers.

This is interesting especially given that The United Arab Emirates ranked fifth for crypto adoption worldwide, with the largest percentage of the population holding crypto at 30.4% (The average across all countries is 3%).

The Navigating the Future of Inheritance report addressed the complexities of inheritance at a time when the region stands on the verge of a historic transition of USD 1trn (AED 3.67trn) in wealth to heirs and extended family members. This includes High Net Worth individuals in the United Arab Emirates who have seen their assets grow by 20 percent to reach USD 700bn in value since 2022.

The report discussed how smart contracts can automate trust deeds administration with streamlined client onboarding at trigger events such as birthdays or deaths. In addition by tokenizing assets wealth holders could standardize and streamline the administration of all their holdings into a single digital portfolio with safe custody and better access to financing.

It would also ensure the HNWI’s had control over their data which was also something important to them, improving their data privacy and confidentiality. Tokenization could allow each individual’s data item to be separately permissioned – so that any one organization can see only what the original wealth holder wants them to see.

Smart Contracts for example would allow wealth holders to define their own administration and reporting rules especially with high complexity of tax and jurisdictional rules which is an issue for 81% of respondents in the survey. The use of smart contracts can be used to drive greater programmability of data and processes – and therefore reduce costs and complexity for investors and their wealth

managers.

In addition with 14% of respondents in the report struggling to define and document asset ownership, digital identity and tokenization would be able to create digital records with information on history, ownership and updates. The report notes that recent pilots in Europe have demonstrated that permissioned tokens can directly link Know Your Customer (KYC) information to securities investments, creating self-contained units of information that facilitate streamlined processing and verification.

Another issue that needs to be address is security. According to the report tokenized security records are both immutable and traceable which is a requirements for 14% of respondents who are struggling to verify the authenticity of assets.

Instant transfers for example is a requirement of 50% of respondents and 62% of non shariah wealth holders who usually have to wait over 6 months to transfer their assets today.

Finally, the report notes the potential benefits of tokenization appear equally apparent. In removing obstacles to proper estate planning and in smoothing the execution of wealth transfers, a new, industry platform could reduce costs and improve transparency, thereby delivering a range of social benefits that extend for generations.

More transparent wills would mean less pressure on existing family decision structures. Lower costs would mean greater access to inheritance beyond only HNWIs. Most of all, a tokenized ecosystem for inheritance could avoid unnecessary stress on family structures and ensure that more wealth is preserved for generations to come.

This will need more clarity on the rules that govern how digital assets can be recognized, and used, the the legal validity of electronic wills, stored as smart contracts; and how the rights of investors using tokens can be protected – across multiple jurisdictions where assets may be held and / or transferred.