Holon Global Investments Limited (Holon), a technology company aimed at creating a greener Web3 ecosystem, has signed partnership agreement with ArcLive Limited to deliver a solution to enhance energy performance and sustainable data management for both domestic and commercial premises.

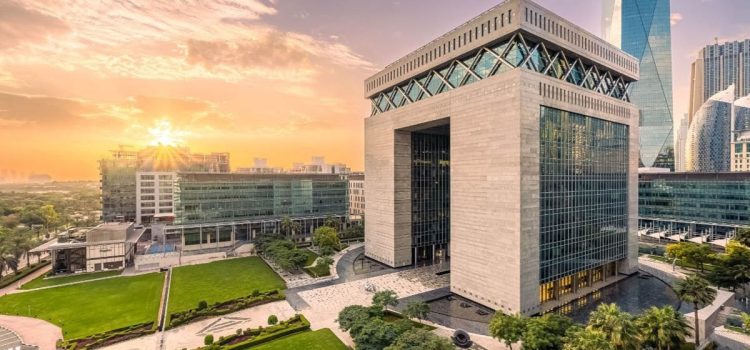

Launching this strategic and promising collaboration, Holon and ArcLive signed a Memorandum of Understanding (MoU) on the first day of the Dubai AI & Web3 Festival. Holon’s Managing Director Heath Behcncke and ArcLive’s Co-founder Nicholas Edwards were present to sign the agreement.

Holon, is a green, verifiable distributed data storage and computing company that operates energy-efficient, immersion-cooled edge data centers powered by renewable energy sources utilizing blockchain technology, Holon provides robust governance over the data stored in its systems, ensuring security and sustainability.

ArcLive specializes in the collection, storage, collation, analysis, and presentation of real-time data from various premises and buildings. By leveraging sensors and other hardware, ArcLive collects performance data to help customers analyze and improve the energy efficiency of their buildings.

This joint solution enables regulatory compliance with sustainable finance objectives and helps property owners and their lending banks achieve their decarbonization targets, all while being powered by green energy.

In addition Holon also entered into a partnership with Magma ,a platform that integrates 3D modeling with blockchain technology to enhance collaboration in real estate by exploring opportunities in decentralized data storage, tokenization of real estate assets, and the integration of blockchain technologies.

Holon and Magma aim to develop new solutions that enhance data privacy, ownership, and energy efficiency in building management. By combining their expertise, both companies will focus on creating secure, sustainable, and efficient data management options for residential and commercial properties.

Holon Global Investments Limited (Holon) officially appointed Michael Clark as its Global Holon Evangelist at the highly anticipated Dubai AI & Web3 Festival.

Michael, a renowned data scholar and industry advisor, will work closely with Heath Behncke, Holon’s Managing Director, to advance Holon’s pioneering roadmap for data custodianship, decentralized sustainable storage, and tokenization.

These partnership agreements comes weeks after Holon announced its presence with an office in the UAE.