Zero Hash, a global crypto and stablecoin infrastructure provider, in partnership with Lightspark, commissioned a study and surveyed 2,500 freelancers and contractors from the US, Brazil, Argentina, Mexico and UAE with 80% of UAE freelancers saying they would prefer to receive payments in stablecoins. The survey findings also noted that 69% of those surveyed agree that receiving crypto or stablecoin payments would allow them to work with clients globally, with 95% of them wanting to receive a portion of their income in crypto or stablecoins.

According to the survey the main challenges facing freelancers is slow payments, currency volatility, payment delays and high fees. 48% of those surveyed noted that it takes too long to get paid, with 75% desiring payment within 24 hours.

Moreover, 49% felt the fees charged by payment platforms are too high, and 30% cited currency volatility as an issue.

Cryptocurrencies and stablecoins emerge as viable solutions to these challenges. A significant 93% of freelancers express interest in receiving at least a portion of their income in cryptocurrency or stablecoins.

According to 58% of freelancers and gig workers surveyed the current local banking and payment systems don’t work for them.

Globally 65% of freelancers say that they have lost money or left money on the table because they couldn’t accept work across borders due to a non-compatible currency that could not be easily exchanged. 69% agree or strongly agree that receiving crypto or stablecoin payouts would allow them to work with clients globally.

Interestingly 93% would like to receive a portion of their income in crypto or stablecoins, with 80% of UAE and Argentinian respondents preferring stablecoin payouts.

Edward Woodford, Founder and CEO of Zero Hash, commented, “We have long held the belief that fiat, crypto and stables cannot individually solve all of the world’s payment’s requirements by themselves. We believe Zero Hash will play a pivotal role in the future of payments with our ability to connect fiat, crypto and stables in one unified platform. This will enable freelancers and gig workers to move seamlessly between these rails for different use cases and needs”

Christian Catalini, Co-Founder and Chief Strategy Officer at Lightspark, says, “We live in an increasingly connected world, but our payment infrastructure has not kept pace with the requirements that entrepreneurial and hard-working freelancers are looking for today. This survey shows that change is wanted and needed – we are pleased to be working with Zero Hash to provide solutions for their customers, and freelancers, everywhere!”

Zero Hash, in partnership with Lightspark, leveraged Centiment (the survey platform trusted by Fortune 100 companies) to survey 2,500 freelancers and gig workers in the US, Brazil, Argentina, Mexico and UAE. The survey participants comprised 500 freelancers & gig workers across each jurisdiction. The majority of participants were full-time self-employed 66%, and 34% were part-time self-employed. 65% knew about cryptocurrencies, and 42% used freelance/gig platforms like Fiverr, Upwork, or Catch for at least 50% of their sourced work.

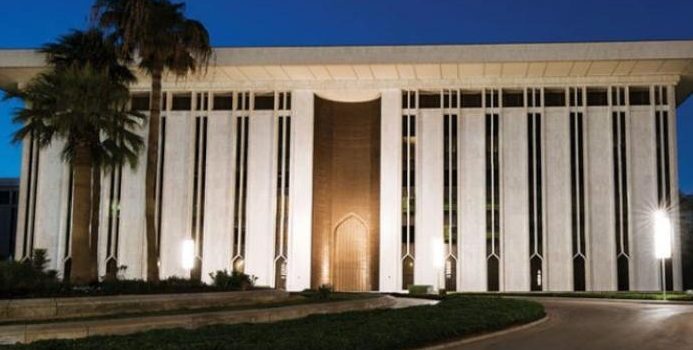

The survey comes at an interesting time given the recent announcement by UAE central Bank approved the issuance of a regulation for licensing and overseeing stablecoins and a series of policies aimed at supporting the banking, insurance, and financial services sectors.