The engine that will ignite a sustainable future starts with Web3, its associated technologies, and UAE based Enjinstarter. Enjinstarter, launched in 2021 is a Launchpad, incubator, crowd funding, and advisory platform for Web3 metaverse, gaming, entertainment and impact and sustainable projects.

At the beginning of 2023, Enjinstarter appointed Vasseh Ahmed as the new Managing Director to lead the Web3 efforts in the MENA region. Vasseh spoke with LaraontheBlock to discuss Enjinstarter’s plans to help companies reach their Web3 ambitions while positioning Enjinstarter as the go to provider for impact and sustainability projects.

Ahmed, speaking with Lara on the Block, stated, “Before I joined Enjinstarter I was working in the UAE for four years on a digital bank project. I had been in the blockchain and crypto space for over 6 years, so when I met Prakash Somosundram, [Enjinstarter’s] CEO and Co-Founder, and we discussed the launch of an impact and sustainability track, I was all in.”

Enjinstarter in MENA

According to Ahmed, “We have supported 70 projects since inception, helping them raise a total of $10 million. Since the middle of 2022 we have focused on investing in founders who can demonstrate clear utility in their projects. This has worked really well so far, and we continue to onboard more projects each month.”

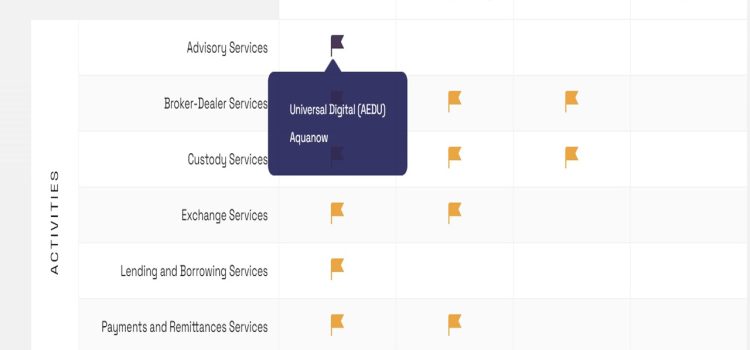

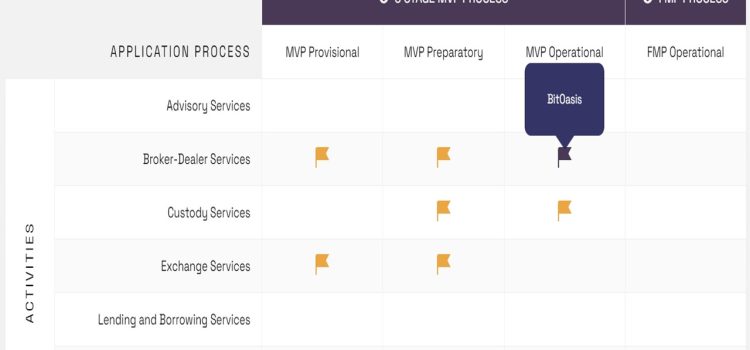

As for the MENA region, Ahmed believes that UAE has its allure not just because of the investments and capital being deployed in Web3, but also because of its very good regulatory environment and its strategy to build an innovative infrastructure. He explains, “The UAE has become a hotbed for Web3 projects. We are seeing an increasing number of start-ups and companies moving to the region. Enjinstarter is one of them, and we are the first Launchpad globally to apply for the appropriate license in Dubai. We have already received initial approval from Dubai’s Virtual Asset Regulatory Authority (VARA) and are now in the process of obtaining a full license to operate.”

He explains, “We appreciate VARA’s progressive approach to regulation. It has been instrumental in helping us at every step of the licensing process. We have a few more steps to complete in order to obtain the full license, then we can begin operations. Singapore has not shown the same commitment to virtual asset regulation, whichis one of the reasons we chose to expand to MENA and run Enjinstarter in a regulated manner.”

Enjinstarter and a Sustainable Future

The climate emergency is becoming a pressing issue. Temperatures are expected to rise 1.5 degrees Celsius by 2050 which will raise sea levels and lead to huge climate changes and extinctions of many animals, and plants.

Yet to date nothing has seemed to incentivize people to do something about it even with the creation of carbon credits. The challenge with carbon credits is that they are only available to corporations and governments. Individuals don’t have much access other than through carbon offset schemes.

For this reason, Enjinstarter is looking to add more projects that focus on impact and sustainability replicating the success of their existing launchpad while complementing it with UAE’s outlook towards building a sustainable future.

Ahmed states, “Web3 has a major role to play in addressing the climate crisis. Carbon credits, in particular, can benefit from Web3’s underlying technology to increase transparency and accessibility. We want to support projects that are looking for ways to shift incentives away from exploitation and toward preservation and regeneration.”

He adds, “Corporate demand for emission reduction strategies is clear. Microsoft, for example, has taken the lead in offsetting its carbon footprint by buying carbon credits. The UAE government has also signalled its desire to be the first carbon-neutral country in MENA. What we need are more initiatives looking to fulfill this demand. Our climate launchpad is designed to scale these initiatives and, ultimately, climate impact.”

Enjinstarter is already working with large scale projects that will be announced in due time, but also wants to focus on grassroots projects. Ahmed explains, “Major projects aren’t the only way to effectively combat climate change. If there is a project making demonstrable climate impact, we want to incubate, accelerate, and match them with interested investors.”

Ahmed also believes AI (Artificial Intelligence) will be part of Web3 climate solutions. He explains, “As a scuba diver I have seen firsthand how ocean species are either extinct or very close to extinction. Putting these species in the metaverse and allowing users to interact with them can help us build awareness around the importance of preserving them. We can work directly with marine conservations to build the kind of metaverse experiences that maximize engagement with people. Today’s youth, for example, already spend a lot of time gaming. Why not give them the opportunity to play for a good cause?”

Web3 is changing Business models

Enjinstarter has been working with corporations to help them transition seamlessly from their Web2 past to a Web3 future. Web3 is changing business models and inevitable outcome of digitization and the metaverse sits at the center of it all.

The company is a strong partner with Web3 giant Animoca Brands, the holding company of The Sandbox metaverse. Enjinstarter and Animoca not only have in common their belief in the metaverse but they also have common investors. True Global Ventures 4 Plus has invested both entities. Enjinstarter raised US$5 million in their Series-A round from True Global Ventures 4 Plus.

According to Ahmed, ”True Global Ventures is a very hands-on VC and we love having them as our only VC investor so far. They were instrumental in developing our UAE expansion strategy.”

Both Enjinstarter and Animoca Brands believe that the future of the metaverse hinges on interoperability. The two partnered together for OMA3™, a collaboration of Web3 metaverse platform creators whose goal is to ensure virtual land, digital assets, ideas, and services are highly interoperable between platforms and transparent to all communities. OMA3™ is open to all Web3 metaverse builders.

With this in mind Enjinstarter has developed its Web3 Innovation consulting practice that works with brands, large corporations, and Web2 companies to help them develop Web3 strategies.

Ahmed explains, “In the UAE and GCC there is a lot of excitement towards and experimentation with Web3.. Part of our mission is to help clients jump into Web3 and the metaverse. We’ve developed a playbook for success comprising 30 core skills and actvities. The most important is to take a community-first approach, meaning that you build your community first, then your product. ”

Utilizing a holistic multi-disciplinary approach and a portfolio of partners, Enjinstarter has been able to help replicate its successes with previous projects and build loyalty based metaverse experiences, NFTs, and more.

This is just the beginning; Ahmed believes that there is a lot happening in the region on a government and corporate level and that the future will see AI and Web3 come together as the masses adopt Web3 and metaverse experiences.