UAE Aya licensed under Web3 Innovations FZE, an entity of Enjinstarter, a Web3 Launchpad and advisory that it has been granted a virtual asset services provider license pending fulfillment of pre-operating conditions and qualifying for operational approval.

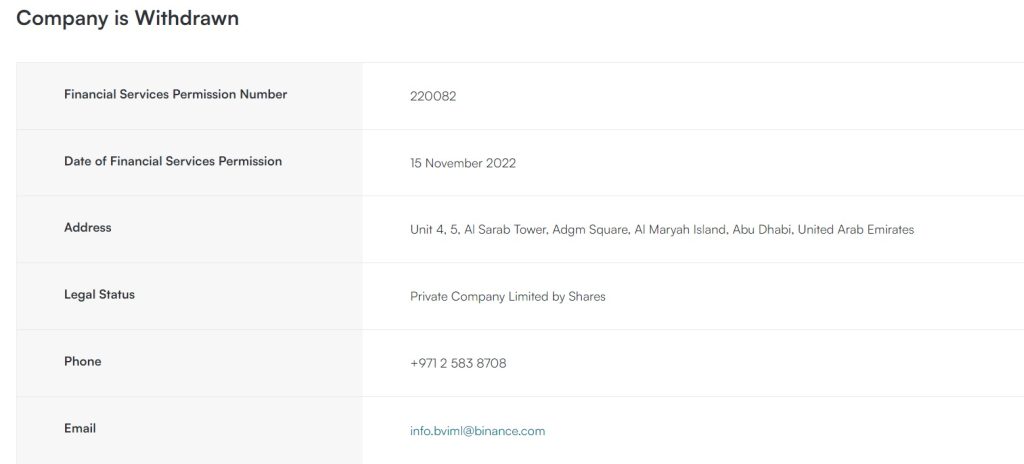

The license one fully received will allow Aya to provider Virtual asset Management and investment services. VARA has listed Aya on its registry but states it is still pending full license.

As per AYA press release, the license remains non-operational until the company fully satisfies all remaining conditions and select localization requirements defined by VARA, following which it will be able to commence operations, subject to regulatory re-verification and approval.

Prakash Somosundram, co-founder and CEO of Enjinstarter and AYA Foundation stated, “It’s an honor to be participating at the world’s most influential climate conference and adding our voice to the collective climate change conversation. “This is a great day for AYA and a huge milestone for us. The VASP license process demonstrates our compliance with the VARA process as we leverage Web3 to help bridge the climate financing gap. We are thankful to VARA for taking a collaborative approach towards understanding our business and working closely with us throughout the application process. We are now poised to leverage the license approval and accelerate operational set-up to deliver impact as soon as we conclude the outstanding regulatory pre-requisites.”

Ayay a climate focused launchedpad aims to support the next generation of sustainability innovation. Acting as a green financing bridge, AYA will connect retail investors, high-net-worth individuals, and institutional investors with startups working in areas such as reforestation, nature credits, mangrove conservation, and sustainable agriculture. It will also provide startups with access to innovative technologies and incubation services. AYA’s pipeline already includes UCO Network, a platform to optimize the collection, processing, and trading of used cooking oil while rewarding responsible actions, and other nature-based projects looking to leverage blockchain and Web3 for climate action.

As one of its first initiatives, AYA is collaborating with UAE-based The Storey Group on a campaign to plant mangroves in Dubai. Everyone who joins the AYA community will have a mangrove tree planted in their name and will receive a digital certificate with the exact coordinates of the tree.

“AYA’s main contribution to the fight against climate change is as a platform to scale the pace of climate innovation and action,” said Vasseh Ahmed, managing director of Enjinstarter MENA. “We are looking to work with founders and projects that have a unique proposition within our key focus areas by helping them build their product narrative, raise capital, and launch their projects. We already have projects in the pipeline and look forward to working with them.”

Updated November 12th with link to pending status on VARA website.