Zero Two, and Marathon Digital Holdings, Joint entity based out of ADGM Abu Dhabi for crypto mining has inaugurated the state of the art 200 MW Bitcoin mining facility at Masdar Abu Dhabi. The announcement was made in a LinkedIn post by Pierre Sematies, Partner at Roland Berger and Global Head of Digital assets.

He stated, “Today Zero Two inaugurated a state-of-the-art 200MW Bitcoin Mining Facility with Marathon Digital Holdings at Masdar. The quality of the facility and the pace at which it was built and energized are very impressive.” He congratulated the teams of both Zero Two and Marathon Digital, as well as Roland Berger Digital asset team who were part of this journey in the early days.

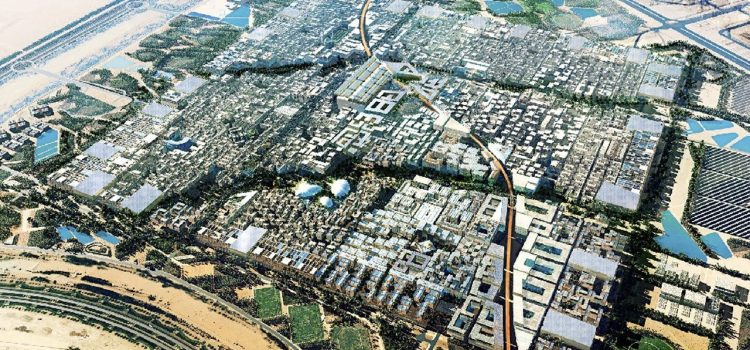

Prior to this Marathon Digital Holdings had confirmed that the company along with Abu Dhabi based Zero Two (Registered name FS Innovation), an emerging blockchain and digital assets infrastructure development company, will be launching the two digital asset mining sites with a combined capacity of 250 Megawatts in the sustainability hub of Abu Dhabi Masdar City and the port zone of Mina Zayed by the end of 2023.

The joint entity registered in ADGM will work to accelerate the global digital economy while supporting the power grid of Abu Dhabi, JV) with the first large-scale immersion Bitcoin mining operations in the Middle East. To power the sites, Marathon and Zero Two intend to leverage excess energy in Abu Dhabi, increasing the base load and sustainability of the Abu Dhabi grid. Marathon and Zero Two will offset any non-sustainably produced electricity with clean energy certificates.

The equity ownership in the ADGM Entity will be 80% for Zero Two and 20% for Marathon.

This announcement comes as Oman moves strongly forward with its crypto mining projects.