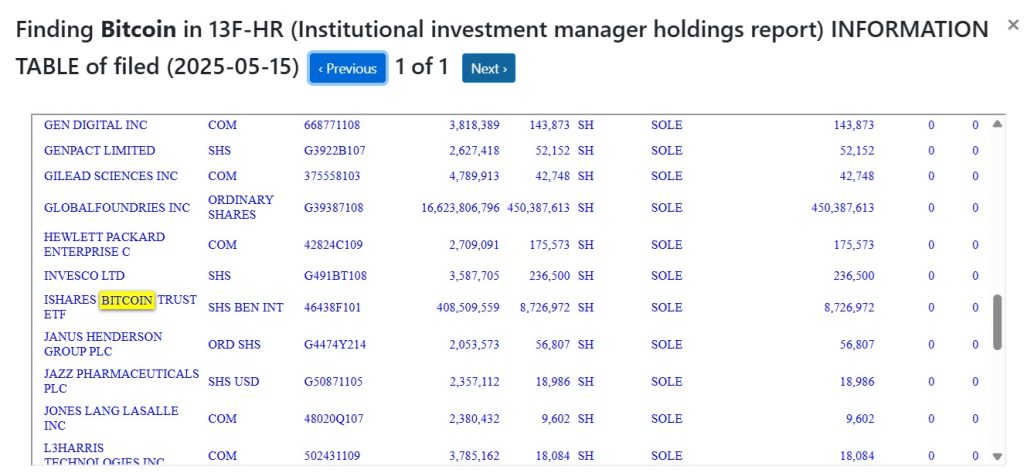

While the rumor mill across the crypto ecosystem over the past days speculated that countries such as Qatar, UAE, and Saudi Arabia were investing in Bitcoin, Mubadala, Abu Dhabi’s sovereign wealth fund, disclosed a $408.5 million stake in IShare Bitcoin Trust (IBIT) in a 13F filing released on My 15th 2025.

The fund reported holding 8,726,972 shares as of March 31, 2025, an increase from 8,235,533 shares reported at the end of 2024. This increased exposure showcases the perception change regarding Bitcoin and crypto in general after President Trump has taken office.

Back at the end of 2024, UAE Mubadala, a sovereign investment fund, revealed in an SEC Filing that in late 2024 it invested $436 million worth in BlackRock’s Ishares Bitcoin Trust ETF. The disclosure was made through a 13F filing with the U.S. Securities and Exchange Commission (SEC).

At the time while Mubadala’s investment in Bitcoin while not directly but through an ETF is a significant departure from the usual investments made by Sovereign funds in the Middle East and GCC region.

The UAE in particular has been showcased as having 30% of its population owning crypto. Prior to this announcement another UAE sovereign wealth fund, through one of its subsidiaries FSI ( FS Innovation) agreed with US based Marathon digital holdings, a digital asset mining company establishing and operating facilities for digital asset mining in Abu Dhabi. The initial phase consisted of two digital asset mining sites comprising 250 MW (megawatts) in Abu Dhabi UAE. Marathon Holdings will own 20% of the joint company in UAE only. The cost of the project being $406 million.

Bahrain Restaurant Group also announced investment in Bitcoin

Bahrain based Al Abraaj Restaurants Group B.S.C. (Ticker: ABRAAJ) (“Company”), a public listed company on the Bahrain Bourse, announced that it has put Bitcoin on its balance sheet. As per the news on Zawya, the Group has purchased Bitcoin in partnership with U.S. based 10X Capital, becoming the first publicly traded company in the Kingdom of Bahrain, the Gulf Cooperation Council (“GCC”), and the Middle East to acquire Bitcoin as a treasury asset.

Al Abraaj has acquired an initial amount of 5 Bitcoin with plans to build on this initial purchase and begin allocating a significant portion of its corporate treasury into Bitcoin.

As per the announcement, Al Abraaj considers Bitcoin to be its reserve treasury asset. Al Abraaj is a profitable company, with 2024 EBITDA of USD $12.5 million.