IOTA utilized the expertise of Zokyo, a blockchain security solutions provider to carry an assessment of IOTA’s white paper and Token economy paper in alignment to industry benchmarks and ADGM regulatory requirements for IOTA’s registration as the first DLT Foundation in ADGM.

Zokyo Econ Lab a new division of Zokyo is dedicated to assisting blockchain companies in optimizing their token economics, aligning them with both industry and regulatory standards across various jurisdictions. Zokyo Econ Lab specializes in driving exceptional growth at the forefront of blockchain innovation, including ecosystems, protocols, foundations, and DAOs.

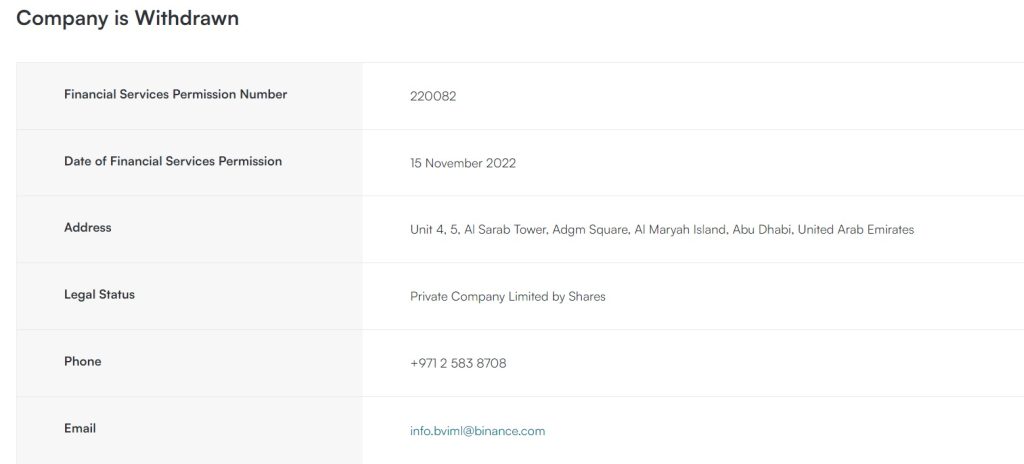

Zokyo Econ Lab’s first major undertaking in regulatory compliance involved the successful registration of IOTA, a renowned blockchain protocol, under the Abu Dhabi Global Market DLT Foundations 2023 regulations.

The IOTA audit assessed the alignment of IOTA’s White Paper and Token Economy paper with regulatory requirements and recognized industry benchmarks for their content. This included a proper market, product, and business overview; identification of target users and services provided; explaining reasons for tokenization; token utilities; tokenized ecosystem participants breakdown; usage of the token and it’s value for users; incentive policy, and more.

With expertise in mathematical analysis, Zokyo Econ Lab designs comprehensive token models to maximize value and ensure sustainable growth. By scrutinizing distribution, utility, governance, and incentives, Zokyo Econ Lab identifies and capitalizes on optimization opportunities. It aims to craft robust ecosystems that drive stakeholder engagement and project resilience. This proactive approach positions blockchain projects at the forefront of the industry, ready to adapt and thrive in a rapidly evolving digital economy.

The audit process was structured in two phases: an initial report to identify areas of concern and recommend improvements, followed by a collaborative workshop with the IOTA team. The final report, post-remediation, confirmed IOTA’s compliance with the ADGM DLT Foundations 2023 regulations.

Dominik Schiener, Co-Founder and Chairman of the IOTA Foundation, said: “Zokyo was an instrumental partner in helping to navigate the new regulatory framework of the Abu Dhabi Global Market (ADGM) in the United Arab Emirates. Zokyo’s expertise and thorough processes helped a great deal in successfully getting the IOTA Ecosystem DLT Foundation registered as the first foundation under the new DLT Foundations Regulations, enabling us to start our next chapter of global expansion.”

Hartej Sawhney, Founder and CEO of Zokyo, added, “The inauguration of Zokyo Econ Lab marks a pivotal moment in demystifying the complex realm of both blockchain regulation and token modeling. Our commitment to offering bespoke compliance solutions extends beyond ADGM, as we support blockchain enterprises in dozens of jurisdictions.”

Zokyo’s collaboration with VAF Compliance, a consultancy company specializing in regulatory compliance within the blockchain and virtual asset sector, further underscores the lab’s dedication to providing superior compliance services.